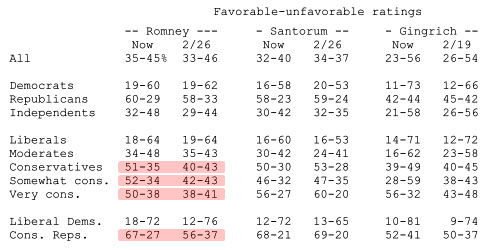

The latest ABC/Washington Post poll is in, and it demonstrates an eternal truth: maybe money can’t buy you happiness, but it can buy you the Republican nomination for president. Compared to a week ago, Mitt Romney has made huge strides among conservatives of all stripes, including those who describe themselves as very conservative. His favorability ratings are up about ten points among conservatives, compared to no change for Santorum and no change for Gingrich except among the very conservative.

Oddly, although Romney’s favorables are up a lot among conservatives, and flat among moderates, this hasn’t translated into much improvement among Republicans. I’m not sure how the math works out there. Maybe there’s a mistake in the calculations somewhere.