<a href="http://www.flickr.com/photos/ryanh/2253015543/">Ryan Harvey</a>/Flickr

The Occupy Wall Street protests grew out of anger at the outsized power of banks. But as they’ve expanded nationwide, the uprisings have evolved into a kind of running challenge to the way power is concentrated in all aspects of our economy—concentrated into the hands of people with an interest in maintaining the status quo.

No doubt, the financial sector is a stunning example. This MoJo chart shows how the 10 largest banks came to hold 54 percent of US financial assets, up from 20 percent in 1990. As big banks gobbled smaller banks and became megabanks, they managed to extract more and more wealth out of the economy. Even after the epochal meltdown and bailout, the financial sector now claims fully a third of US corporate profits. They’ve invested a chunk of that windfall in what is probably Washington’s most formidable lobbying machine—which is precisely how they managed to slither away unscathed despite the economic carnage they caused.

But other economic sectors are similarly concentrated, and have a comparable grip on public policy. Consider the industry I cover. Our national food policy is both in desperate need of reform and utterly trapped under the heel of industry influence. So, as Occupy Wall Street evolves, food policy should be on the plate. Here are four reasons why:

1. The food industry is a big fat monopoly.

Agribusiness is concentrated to a point that would make a Wall Street master of the universe blush. Vast globe-spanning corporations, many of them US-based, dominate the industry.

Let’s start with “inputs,” the stuff farmers buy before they plant their crops. As of 2007, six companies owned 75 percent of the global pesticide market, and four companies sold half of the globe’s seeds, ETC Group reckons. Here’s the kicker: Three of them—Monsanto, Syngenta, and Dupont—are on both lists. The agrichemical makers have transitioned into seed barons, genetically engineering their major seed lines to resist their own herbicides.

Monsanto is an interesting case. In addition to being the planet’s largest seed vendor, with 23 percent of the market, it licenses its patented genetically modified traits to other companies. Think of the physical seed as the hardware and traits as the software. In the trait market, Monsanto holds a near monopoly: By 2007, according to ETC Group, 87 percent of the acreage dedicated to genetically engineered crops contained crops bearing Monsanto traits.

Okay, so farmers rely on a small handful of firms for their inputs. But it turns out the same thing holds true when they harvest and sell their crops. Just four companies—Cargill, Archer Daniels Midland, Bunge, and Louis Dreyfus—control up to 90 percent of the global trade in grain. In the United States, three of those firms process 70 percent of the soybeans and 40 percent of the wheat milled into flour. The bulk of corn and soy grown by US farmers ends up feeding animals in vast factories, and here, too, the consolidation is dramatic: Three companies now process more than 70 percent of all beef, and just four firms slaughter and pack upwards of 58 percent of all pork and chicken.

Finally, let’s look at the supermarkets. Walmart opened its first grocery-selling “superstore” in 1988. Today, it controls 2,750 superstores and more than a quarter of the US grocery market. As a result, the combined market share of the four largest grocery players has doubled, from less than 20 percent in 1992 to nearly 40 percent today.

And, despite acres of shelves groaning with thousands of products, only a few large companies stock supermarkets. By 2002, the USDA reported, four companies churned out 75 percent of breakfast cereal, 75 percent of snacks, 60 percent of cookies, and 50 percent of ice cream.

2. The food industry screws farmers, its own employees, and the environment.

In antitrust theory, when four players control more than 40 percent of a market, they’re said to wield “market power”—that is, they can manipulate the prices they charge consumers and the terms on which they deal with their suppliers. So, rather than raise prices, the food industry has slashed costs—at the expense of workers, farmers, and the environment.

The meat industry provides a stark example. Today, you can grab a McDonald’s McDouble burger or a McChicken sandwich for a dollar. As I noted above, just a few companies process the great bulk of meat consumed in the United States. How can they do that profitably, when McDonald’s is practically giving burgers away? Simple: screw the workers.

From 1976 to 2009, according to USDA figures, the inflation-adjusted average hourly wage of meatpacking workers plunged, as did union membership among meatpacking employees. Predictably, working conditions deteriorated. (See our recent Hormel Foods exposé: “The Spam Factory’s Dirty Secrets.”) In 2005, Human Rights Watch issued a damning report titled “Blood, Sweat, and Fear,” which concluded:

Employers put workers at predictable risk of serious physical injury even though the means to avoid such injury are known and feasible. They frustrate workers’ efforts to obtain compensation for workplace injuries when they occur. They crush workers’ self-organizing efforts and rights of association. They exploit the perceived vulnerability of a predominantly immigrant labor force in many of their work sites. These are not occasional lapses by employers paying insufficient attention to modern human resources management policies. These are systematic human rights violations embedded in meat and poultry industry employment. [Emphasis added.]

Farmers, too, got the shaft. As a few big hog processors like Smithfield gobbled market share and began raising millions of their own pigs, pork prices tanked and tens of thousands of farms went belly up, despite an increase in the total number of hogs being slaughtered. In 1992, America had 240,000 hog farms, the USDA reports, but only 60,000 of them remained by 2007. Similar trends have hit the poultry industry.

Meanwhile, shunting livestock production into huge factory-style facilities has led to a massive concentration of toxic animal waste. Using data collected by the EPA, the Environmental Integrity Project recently showed that animal factories routinely emit levels of particulate matter, ammonia, and hydrogen sulfide that are well above acceptable health limits. A good deal of that manure ends up in groundwater, too, fouling drinking water supplies and fish habitat.

Finally, to keep their animals alive and growing fast under dire conditions, the meat industry laces feed rations with antibiotics. The FDA recently revealed that 80 percent of the antibiotics sold in the United States go to livestock facilities. Nearly every US public health and farm oversight agency has acknowledged that the practice contributes heavily to the rise of antibiotic-resistant human pathogens—vicious superbugs like MRSA, a resistant form of staphylococcus that kills now more Americans than AIDS does.

3. Wall Street’s greed leaves millions to starve—literally.

One obvious reason that Occupy Wall Street should focus on food is that Wall Street itself focuses on food.

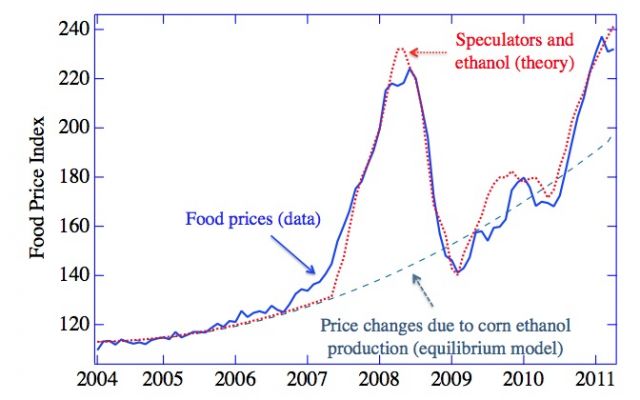

As I reported last month, two recent UN reports directly implicate commodities speculators for driving up the price of key food staples like rice and wheat—leaving tens of millions of people around the world hungry in order to make a buck. A new study (PDF) reaching the same conclusion has emerged from the New England Complex Systems Institute—and was reviewed by two Harvard economists and an official from the Federal Reserve Bank of Boston.

Sure, these analyses note, US and European biofuel programs have played a role in all this by (foolishly) diverting key food staples into car fuel. But Wall Street took the biofuel craze to a whole new level. Olivier de Schutter, the UN’s Special Rapporteur on the Right to Food, puts it bluntly:

The promotion of biofuels and other supply shocks were relatively minor catalysts, but they set off a giant speculative bubble in a strained and desperate global financial environment. These factors were then blown out of all proportion by large institutional investors who, faced with the drying up of other financial markets, entered commodity futures markets on a massive scale.

And here’s what the New England Complex Systems Institute team had to say:

The two sharp peaks in 2007/2008 and 2010/2011 are specifically due to investor speculation, while an underlying upward trend is due to increasing demand from ethanol conversion.

They illustrated this with the following chart.

From: “The Food Crises: A quantitative model of food prices including speculators and ethanol conversion,” New England Complex Systems Institute, 2011.

From: “The Food Crises: A quantitative model of food prices including speculators and ethanol conversion,” New England Complex Systems Institute, 2011.

When the first speculative shock hit food markets in 2007, “at least 40 million people around the world were driven into hunger and deprivation as a result,” de Schutter writes. The bubble burst with the 2008 Wall Street meltdown but has since reinflated as Wall Street returned to profitability and its speculative ways. In real terms, global food prices are now hovering above their former peak in 2008, meaning misery for millions of people globally.

How did the global food supply become a Wall Street profit center? In a July 2010 Harper’s article called “The Food Bubble: How Wall Street Starved Millions and Got Away With It,” journalist Frederick Kaufman laid out the story (PDF). It all started with a financial instrument Goldman Sachs conjured up in back in 1991 to allow the its clients to invest in the commodities market without having to pick specific winners. Here’s how Kaufman describes it.

[Goldman’s financial engineers] selected eighteen commodifiable ingredients and contrived a financial elixir that included cattle, coffee, cocoa, corn, hogs, and a variety or two of wheat. They weighted the investment value of each element, blended and commingled the parts into sums, then reduced what had been a complicated collection of real things into a mathematical formula that could be expressed as a single manifestation, to be known thenceforward as the Goldman Sachs Commodity Index. Then they began to offer shares.

For years, the Goldman Sachs Commodity Index was a stable, boring instrument that didn’t draw much attention as investors chased flashier instruments like tech stocks and real estate. But it generated enough client fees to inspire other firms, including AIG, JP Morgan, and Bear Stearns, to roll out similar food-centered instruments, Kaufman reported.

By 2005, the tech bubble had long since burst, and real estate had reached dizzying heights. And the Commodity Futures Modernization Act of 2000—the same Clinton-era legislation that “introduced obscure financial derivatives like ‘credit default swaps’ into the American lexicon and ultimately caused the collapse of mortgage and stock markets,” notes blogger Eric Michael Johnson—had deregulated derivatives markets. With this backdrop, President Bush and Congress began to ramp up US corn ethanol production in an absurd attempt to kowtow to the mythical notion of energy independence. This gave Wall Street the story it need to sell investors en masse on commodity crops. Suddenly, billions of dollars were flowing into the food funds, and crop prices soared.

When those prices crashed again in 2008, Kaufman reports, Goldman’s clients who had bet on ever-rising prices lost money, but the firm itself didn’t. It had rigged the instrument so that the bank made money no matter what. The subsequent rebound has left global food prices well above levels justified by supply and demand factors, according to the United Nations.

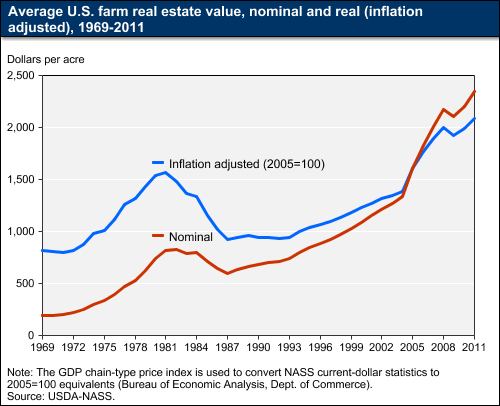

In a sense, the dramatic rise in commodity prices could at least benefit farmers around the world. After all, until 2005, crop prices had been falling or stagnating for 30 years. But the upswing has mainly benefited the agribusiness giants I mentioned above. That’s because, as crop prices rise, the prices for inputs like agrichemicals and genetically modified seeds rise in tandem, keeping farmers squeezed.

The price of farmland has also jumped, as (yes) speculative cash swept into heartland real estate. (See chart.) That means a windfall for farmers who own their land but rising rents for those who lease.

In Africa, rising food prices have inspired hedge funds, institutional investors, and nations like Saudi Arabia and China to gobble up farmland for export crops at a time when domestic populations are going hungry.

What can be done to curb food speculation? The Dodd-Frank financial reform law signed by President Obama required the Commodity Futures Trading Commission to rein in speculation in ag markets. But as the New York Times‘ Gretchen Morgenson reported last month (hat tip, Tom Laskway), the commission has proposed rules that “might actually encourage speculation in the commodities markets.”

This suggests that the political system is so shot through with finance sector cash that it’s incapable of properly regulating Wall Street’s food fetish.

4. Our politicians are in bed with agribusiness.

Like the big banks, the handful of companies that dominate our food system dedicate loads of cash to throwing their weight around in DC.

From 1998 through 2011, the agribusiness sector dropped $1.4 billion on lobbying, reports the Center for Responsive Politics. That’s considerably less than the finance and health sectors, but enough to put it sixth on the CRP’s list of clout-wielding sectors, beating out defense contractors ($1.3 billion) and trial lawyers ($366 million).

So what does the industry get in return? A 2010 study by the Union of Concerned Scientists and Iowa State University gives us a taste. The researchers polled more than 1,700 employers of the USDA and FDA, the two federal agencies overseeing food and ag companies, on the topic of industry influence. The results are chilling:

Hundreds of survey respondents identified undue corporate influence as a major problem. More than 620 respondents (38 percent) agreed or strongly agreed that “public health has been harmed by agency practices that defer to business interests.”…And more than 300 respondents (25 percent) said they personally experienced corporate interests forcing their agency to withdraw or significantly modify a policy or action designed to protect consumers in the past year. When asked that same question about Congress and non-governmental interests, more than 260 respondents (24 percent) and more than 240 respondents (22 percent) said yes, respectively.

One of the respondents, a USDA veterinarian named Dean Wyatt who manages the agency’s slaughterhouse inspectors, spoke bluntly. “Upper level management does not adequately support field inspectors and the actions they take to protect the food supply,” he told the pollsters. “Not only is there lack of support, but there’s outright obstruction, retaliation and abuse of power.”

And evidently, data-fudging to protect industry interests is commonplace:

…190 respondents (16 percent) said they witnessed officials selectively or incompletely using data to justify a specific regulatory outcome. One-hundred-and-five respondents (10 percent) said agency decision makers inappropriately asked them to exclude or alter information or conclusions in an agency scientific document. Ninety-eight respondents (9 percent) said agency managers asked them to provide incomplete, inaccurate or misleading information to the public, regulated industry, media or government officials.

Plenty of observers were hopeful that industry influence over federal watchdog agencies would decrease dramatically with the exit of George W. Bush. But the poll detected only a “very small” reduction of influence-wielding under Obama.

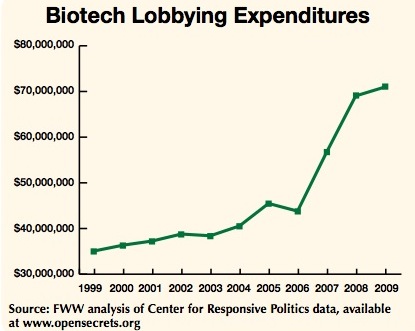

Another way to gauge industry influence is to look at particular cases. Take the genetically modified seed industry dominated by Monsanto, Dupont, and Syngenta. According to a 2010 report (PDF) from Food & Water Watch:

These companies and organizations spent more than half a billion dollars—$547.5 million—lobbying Congress between 1999 and 2009, the most recent full year of available data. The firms employed more than 100 lobbying firms in 2010 alone, as well as their own in-house lobbyists. Lobbying expenditures rose 102.8 percent from $35.0 million in 1999 to $71.0 million in 2009.

That’s money well spent. As I’ve written before, the GM foods industry has enjoyed a rather laissez-faire regulatory environment since it emerged in the 1990s, despite steady public pressure for more oversight.

That tradition continues under President Obama. In January, the USDA green-lighted Monsanto’s genetically modified alfalfa after signaling that it would place restrictions on the crop to protect organic farmers from genetic contamination. The Wall Street Journal later reported that the White House had intervened to force the decision, “as part of the administration’s review of ‘burdensome’ regulation.”

And in July, the USDA declined to regulate genetically modified turf grass, issuing a decision that opens the door for a whole slew of novel crops to avoid even minimal oversight. This, despite the agency’s admission that the novel grass will likely contribute to the herbicide-resistant “superweed” problem and contaminate non-GM grass crops.

The hands-off approach to GM crops evidently extends to other corners of the administration. Indeed, in some agencies, the attitude is downright boosterish. Regarding the labeling of foods containing GM ingredients, a notion with strong public support, a State Department officially has publicly sided with the industry line, the Des Moines Register reports. Speaking at a panel organized by CropLife America, the main agrichemical/GM seed industry trade group, State Department economic specialist Jose Fernandez told the crowd what it wanted to hear: “If you label something there’s an implication there’s something wrong with it.”

The Register adds: “The State Department has been working along with the Agriculture Department to encourage foreign countries to permit the production and use of biotech crops.”

On the potentially scary problem of livestock being pumped with antibiotics, regulation has been practically nonexistent, even though, as I’ve pointed out before, the USDA, FDA, and Centers for Disease Control and Prevention have all acknowledged the dangers of essentially neutering the best weapons we’ve got against outbreaks of bacterial disease in humans.

What we’re left with is a system of government oversight crumbling in the face of industry influence, an election-year atmosphere of anti-regulatory zeal, and a political system polarized to the point where it is incapable of addressing the problem. At times when our leaders have proved unwilling or unable to defend the public interest, a social movement like Occupy Wall Street becomes vitally important.