Old CW: Drudge rules their world. New CW: Breitbart rules their world. Jim DeMint gets it: “We don’t need The Washington Post to cover things anymore. Something can get on a conservative blog, then on Fox News, then it’s everywhere.”

Old CW: Drudge rules their world. New CW: Breitbart rules their world. Jim DeMint gets it: “We don’t need The Washington Post to cover things anymore. Something can get on a conservative blog, then on Fox News, then it’s everywhere.”

Good news! The Washington Post  has picked the ten finalists in its “America’s Next Great Pundit” contest. I know you don’t have time to read them all, so I’ll summarize:

has picked the ten finalists in its “America’s Next Great Pundit” contest. I know you don’t have time to read them all, so I’ll summarize:

Richter: Bring back the Office of Technology Assessment.

Haber: Where I come from, five plus one equals eight. What’s more, Nevada will both lose and gain a congressional seat after the 2010 census.

Martin: These days, everybody wants it all. Also: my dad is driving my mother crazy.

Jackson: Barack Obama needs to stop whining. Bush 43 wasn’t so bad.

Gyamfi: Cable news is stupid.

Huffman: I want to be the next Dave Barry.

Esper: Healthcare is an important issue.

Khalil: Surprise! Arab-Americans watch Fox News.

Khan: Women like to yak, and Obama should capitalize on this.

I know what you’re thinking: this is only nine columnists. What’s the deal? Answer: there’s a tenth, but for some reason her column isn’t up yet. Not sure why.

By the way, the ten winners include a Nobel Prize winner, a Bush 43 assistant secretary of commerce (guess which one), a senior correspondent for the American Prospect, an analyst at the Council on Foreign Relations, a former researcher at the Kennedy School of Government, an Atlantic Media fellow, and a small-town newspaper editor. Not exactly a crowd of just plain folks. It might have been more fun to read the other 4,790 entries.

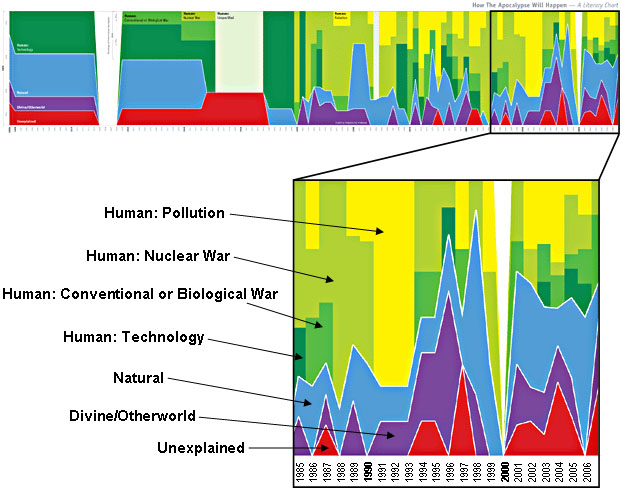

Via the mysterious Will, io9 has a guest post this week from Chanda Phelan, a graduate of Pomona College who recently completed a thesis on post-apocalyptic literature. Basically, she looked at 423 books, poems, and short stories about the apocalypse (full list here) in order to try and divine trends on just what the fictional causes of fictional apocalypses are. Fun!

Anyway, the result is a gigantic chart, partly excerpted below. And some discussion:

I wanted to see if there were patterns in how writers saw the monster. As it turned out, the patterns were clearer than I imagined. Nuclear holocaust was really popular after 1945; that’s to be expected. But the precipitous and permanent drop in nuclear war’s popularity after the dissolution of the U.S.S.R. in 1991 (see chart)? That surprised me.

….The easily spotted trends make the patterns’ total collapse in the mid-1990s even weirder. Human-created apocalypses shrink dramatically, and there’s a sudden spike of unexplained apocalypse scenarios at the turn of the century. What happened? One possibility is that every End started to feel clichéd. The terror of a possible nuclear war faded, and no new extravagant ways to kill ourselves appeared to replace it.

My theory: most the explained apocalypses hightailed it to the movie theater, where practically the whole point of apocalyptic storytelling is to show you exactly how the planet is destroyed in loving IMAX/Technicolor/Dolby CGI detail. This wouldn’t really be on my mind except that I’ve now seen the trailer for 2012 about a hundred times — it feels like a hundred times, anyway — and apparently the purpose of the movie is to make the entire genre obsolete by rolling up every disaster movie trope ever invented into one ultimate 2-hour extravaganza never to be surpassed. Everything will be destroyed. Every manner of destroying things will be used. Every cliche will be exploited. When you’re done, you will never need to see another disaster movie ever again!

Which is fine with me. I’m just wondering if they’ll even pretend to tell a story while all this mayhem is going on. Or is that too old school these days?

POSTSCRIPT: I also have a question about the chart: what happened in 2000? Not a single work of planet-ending fiction in the entire year? Really?

From Maria Walter, United Airline’s director of merchandising, on the barrage of innovative, second generation fees coming soon to a flight near you:

[Walter] told conference attendees that the airline wants passengers to see the new offers as “options,” not as fees. “Options are different than fees,” she said.

Walter was speaking at the Ancillary Revenue Airline Conference, an entire event dedicated to brainstorming newer, subtler, and more annoying fees. And then there’s this, from legendary LA talk show host Michael Jackson, on what the triumph of “vitriolic, unsympathetic, bombastic” talk radio means about America:

That we’re amazing. That we can put up with all of that and more! It’s the best country in the world.

I admire Jackson’s optimism. I don’t really share it, but I admire it.

The New York Times reports that a deal on a federal shield law is near:

The New York Times reports that a deal on a federal shield law is near:

The Obama administration, leading Senate Democrats and a coalition of news organizations have reached tentative agreement on legislation providing greater protections against fine or imprisonment to reporters who refuse to identify confidential sources.

….Protection under the so-called shield law would also be extended to unpaid bloggers engaged in gathering and disseminating news.

….In civil cases, the litigants seeking to force reporters to testify would first have to exhaust all other means of obtaining the information. Even then, the judge would apply a “balancing test,” and the burden would be on the information seekers to show by a “preponderance of the evidence” why their need for the testimony outweighed the public’s interest in news gathering.

Ordinary criminal cases, as in prosecutors’ effort to find out who leaked grand jury information about professional athletes’ steroid use to The San Francisco Chronicle, would work the same way, except that the balancing test would be heavily tilted in favor of prosecutors….Most cases involving disclosure of classified information would work the same way as criminal cases.

This is….better than nothing, I suppose. But most of the high-profile trials of the past few years that involved confidential sources have been criminal cases, and it doesn’t sound as if this compromise proposal provides very much real-world protection in these cases. But news organizations support it, so maybe it’s better than it sounds. I’ll be curious to hear some media lawyers weigh in on it.

I happen to think that the evils of sugary soft drinks have probably been a wee bit overblown, but even at that it’s a little hard to believe that the American Academy of Family Physicians would create a “corporate partnership” with Coca-Cola that’s designed to “develop consumer education content related to beverages and sweeteners” in return for a six-figure fee. And yet they did.

I’m not surprised they did this, mind you. I’m just surprised they sold out so cheaply. Seems like this ought to be worth at least a million bucks or so.

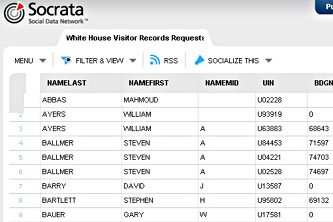

Today, under the headline “Transparency like you’ve never seen before,” the White House released visitor records from January through June. But wait! It’s not all the visitors. It’s only a selective dump of names that people specifically asked about.  Someone submitted a request about Bill Ayers, for example, so all the “William Ayers” records were released. But guess what? There’s more than one guy in the country named William Ayers:

Someone submitted a request about Bill Ayers, for example, so all the “William Ayers” records were released. But guess what? There’s more than one guy in the country named William Ayers:

A lot of people visit the White House, up to 100,000 each month, with many of those folks coming to tour the buildings. Given this large amount of data, the records we are publishing today include a few “false positives” — names that make you think of a well-known person, but are actually someone else. In September, requests were submitted for the names of some famous or controversial figures (for example Michael Jordan, William Ayers, Michael Moore, Jeremiah Wright, Robert Kelly (“R. Kelly”), and Malik Shabazz). The well-known individuals with those names never actually came to the White House. Nevertheless, we were asked for those names and so we have included records for those individuals who were here and share the same names.

Hold on there. This data dump includes everyone who’s been on a public tour of the White House? Everyone who’s been invited to some kind of White House ceremony? Seriously?

Yes, seriously. Max Doebler, for example, is the White House ceremonies coordinator, and sure enough, there are 29 visitor records linked to luncheons and receptions where he’s listed as the official host. Bill Ayers is one of the many people who were there for public tours. (Plus a second mystery Bill Ayers who was there for some other reason.)

This is kind of ridiculous, isn’t it? I suppose it’s easy enough to filter out the dross once you figure out the right codes, but it almost seems like the White House is deliberately trying to inundate everyone in useless mountains of data by including this stuff. In particular, when the end of the year rolls around and we get the full dump, do we really need the names of all 500,000 people who have been on a tour of the residence? Is it even right to make all these names public? Is the White House staff playing a quiet little joke hoping for a few reactions like this? What’s going on?

Today’s picture is life imitating art. Or is it art imitating life? Hard to say. Is Windows wallpaper art? Is Inkblot life as we know it? Questions, questions, questions.

(Note: I’m talking about the picture below, not the one on the left.)

And here’s another question: who’s the cutest cat of them all? Inkblot knows the answer, but as an employee-by-concatenation of the Foundation for National Progress, aka the publisher of Mother Jones magazine, he’s ineligible for our upcoming cat contest. But your cat isn’t! Go here and register a first-round vote in our contest to find the cutest cat made into a Mother Jones cover.  If you think you can do better, make a cover out of your cat and submit it for the cat-off to be held in two weeks. May the best cat win.

If you think you can do better, make a cover out of your cat and submit it for the cat-off to be held in two weeks. May the best cat win.

As for Inkblot, the powers-that-be tell me that he’ll be appearing in costume on our home page over the weekend. An e-costume, of course. Check it out tomorrow.

UPDATE: No, it turns out that it’s Domino who gets the e-costume. Which is appropriate since she’s the black cat in the house. So everyone gets a picture this week!

I was on vacation and not watching the news back in June when Honduran President Manuel Zelaya was ousted in a coup. Ever since then  I’ve used this as an excuse not to blog about it, since I hadn’t really kept up with the twists and turns that got it all started. But today, both sides signed a deal that restored Zelaya to office for the remainder of his term and allowed the scheduled November election to proceed with everyone’s blessing. Tim Fernholz comments:

I’ve used this as an excuse not to blog about it, since I hadn’t really kept up with the twists and turns that got it all started. But today, both sides signed a deal that restored Zelaya to office for the remainder of his term and allowed the scheduled November election to proceed with everyone’s blessing. Tim Fernholz comments:

If the election in Honduras goes smoothly — doesn’t every foreign-policy article these days include the sentence, “If the election in ________ goes smoothly”? — then Honduras’ democratic system will have been reinforced without harsh sanctions, which would mainly affect the people of the state, or military conflict. Affirming democracy in Latin America is a positive step, especially coming from the United States, which does not have a particularly good history in that department. While the White House’s domestic opposition will no doubt call this deal a sham or attack the president for helping restore a controversial leader to power, this outcome will likely improve inter-American relations, and that is a win for a relatively green foreign-policy team.

The truth is that I still don’t know all the ins and outs of what happened in Honduras and whose side I’m supposed to take. But what I do know is that conservatives came out of the chute almost instantly with demands that the Obama administration adopt the hardest line possible in favor of the coup leaders. This appeared to be for no special reason except that Zelaya was friendly with Venezuela’s Hugo Chávez, and to call this idiotic would be an insult to idiots everywhere. Tim is right: the Obama administration’s calmer approach was the right one, and messy or not, it helped get the job done in a region where the U.S. is not exactly known for subtlety and respect for local customs. Not bad.

Rich Yeselson says, “We are living through the Californiafication of America — a country in which the combination of a determined minority and a procedural supermajority legislative requirement makes it impossible to rationally address public policy challenges.” Ezra Klein agrees.

Me too! Here’s what I wrote a couple of weeks ago, back when the Dodgers and Angels still had a chance of getting to the World Series:

Unfortunately, a local championship or two are about all the good news we’re likely to get anytime soon in the Golden State. We have structural deficits as far as the eye can see.

A Republican governor took over a few years ago and cut taxes, making things even worse. Healthcare costs have gone through the roof.1 Unemployment is over 12%. And a rabid Republican minority in Sacramento can — and does — prevent any of these things from being seriously addressed because the state constitution requires a two-thirds majority to pass a budget or raise taxes.

But no schadenfreude, please. In Washington DC, federal deficits have become enormous, Republican tax cuts have made them even worse, healthcare costs are skyrocketing, unemployment is about to break double digits, and it’s nearly impossible to seriously address these problems because the Republican Party has adopted a policy of making the filibuster a routine tool of state. If you can’t get 60 votes in the Senate, you can’t pass anything of consequence these days.

In the past, California has been a bellwether for the nation, and that’s been no bad thing. But this time? Fasten your seatbelts, gang. It’s going to be a very bumpy ride indeed if it happens again.

Don’t remember reading this? That’s because I wrote it for our weekly email newsletter, which you can subscribe to here. All I can say is this: for years I was basically uninterested in Sacramento politics because it was such a cesspool. It made Washington DC look like a model of good government. But no longer: Sacramento is still a cesspool, but DC is catching up fast. If we keep it up much longer, the entire country may end up in the same mess we’ve made for ourselves here. That would be decidedly not a good thing.

1And prison costs!