The individual mandate may be an essential part of healthcare reform, but it’s also the part that’s easiest to hate. After all, the government is forcing you to spend money to buy something that you might not want. Andy  Sabl suggests some better framing:

Sabl suggests some better framing:

Here is another way of describing ACA that’s completely accurate but explains the point much better:

“If you or your family aren’t getting health insurance through your job, the government will pay to get you private insurance coverage, just as an employer would. You’ll have to contribute something — but the law guarantees, with specific numbers, that it will be no more than you can afford. It’ll be less than three percent of your paycheck if your family makes $33,000 a year, less than ten percent if you make as much as $88,000. Pre-existing conditions won’t matter. The government will still pay for your insurance, with the same affordable contribution from you.”

That sounds fine. Unfortunately, I have (as usual) some doubts about whether there’s any chance of this working. A few comments:

- For better or worse, the term “individual mandate” has been commonly accepted for years. Trying to change it now isn’t likely to be any more successful than Republican attempts to cynically change “private accounts” to “personal accounts” when the former started polling badly.

- We still have a problem: what do we actually call the policy formerly known as an individual mandate? Andy has provided an explanation for how the overall program works, but not a name for that specific piece of the puzzle. People are going to write about the fact that everyone is required to get coverage whether we like it or not, so there has to be something to call it.

- In real life, how would this work? Once we reel off Andy’s paragraph, the next question from the Fox News anchor interviewing you is still going to be, “But it’s not voluntary, is it? You have to get insurance whether you like it or not, right?” What’s the answer?

Am I being too gloomy here? It just seems like these attempts at precision framing don’t usually survive contact with the real world. Comments?

Some facts for your consideration:

Some facts for your consideration:

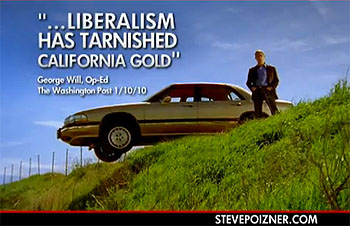

As you may know, eBay zillionaire Meg Whitman is running for governor in California. She’s been pretty assiduously avoiding reporters who might ask real questions,

As you may know, eBay zillionaire Meg Whitman is running for governor in California. She’s been pretty assiduously avoiding reporters who might ask real questions,

Nice piece by Esther Kaplan in The Nation about how Hilda Solis and her team are

Nice piece by Esther Kaplan in The Nation about how Hilda Solis and her team are