After admiring an old Kalashnikov rifle that’s still in active use, C.J. Chivers asks:

After admiring an old Kalashnikov rifle that’s still in active use, C.J. Chivers asks:

Can you think of tools that last this long, or that you expect to? Your pickup truck? Cell phone? Refrigerator? Television? Laptop? Do you own anything that was manufactured in the 1950s and still is in regular, active use in your life?

Yes! My beloved reading chair. Unfortunately, it’s out being recovered right now, which means I don’t have a reading chair at the moment. And this in turn means that I’m not reading as much as usual, because I really don’t have any other place in the house that I find comfortable for extended loafing. Buying a new chair probably would have been cheaper than recovering the old one, and I thought about it, but then Marian reminded me that (a) I really like this chair and (b) I always hate new stuff because it’s made like crap and doesn’t last. She was right! Almost without exception, every time I buy something new, the workmanship of the new item is annoyingly shoddy (and she has to listen to me gripe about it). It doesn’t really seem to matter how much I paid, either, which is why I don’t bother buying expensive things. It’s almost all junky, so why bother?

But this chair? Built like a rock and it has spring cushions. It’ll probably collapse about the same time as the heat death of the universe.

Anything else that old? Not really. My grandfather’s wristwatch still works, but I don’t actually wear it on a regular basis. Maybe a few old tools that we inherited. Nothing else I can think of. How about you?

contain Iran’s nuclear ambitions, he will have made the world safer and may be regarded as one of the most successful presidents in history.

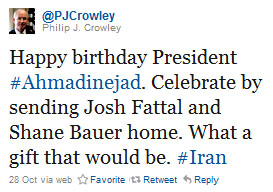

contain Iran’s nuclear ambitions, he will have made the world safer and may be regarded as one of the most successful presidents in history. So here’s a good question. Thursday was Iranian President Mahmoud Ahmadinejad’s birthday, so Assistant Secretary of State for Public Affairs Philip Crowley tweeted the message on the right. Shane Bauer, of course, has written for Mother Jones in the past,

So here’s a good question. Thursday was Iranian President Mahmoud Ahmadinejad’s birthday, so Assistant Secretary of State for Public Affairs Philip Crowley tweeted the message on the right. Shane Bauer, of course, has written for Mother Jones in the past,  labor law with impunity. But they presumably don’t want to see the economy fall into a depression and Speaker Boehner may be “responsible” in their eyes.

labor law with impunity. But they presumably don’t want to see the economy fall into a depression and Speaker Boehner may be “responsible” in their eyes.