So far my only comment about Tyler Cowen’s e-booklet “The Great Stagnation” has been a whine about the Kindle format it’s offered in. I promised a more substantive review for Monday, but now that Monday is here I’m almost reluctant to weigh in because TGS has gotten so much attention already. At this point, I’m not sure I have anything original to say about it.

But perhaps I do. The primary argument of TGS is that the United States has been growing strongly for the past two centuries by relying on lots of low-hanging fruit, but now the days of easy growth are over. In particular, Tyler identifies three sources of easy growth that are no longer open to us:

-

Land. The United States used to have lots of open land and now we don’t anymore. I find this argument unpersuasive. Europe ran out of land a long time ago and its economic growth over the past two centuries has been great.

Conversely, Brazil has lots of open land, but until recently its growth was poor. So I’m just not convinced that land is a big issue here.

Conversely, Brazil has lots of open land, but until recently its growth was poor. So I’m just not convinced that land is a big issue here.

-

Education. Starting a century ago we dramatically increased the number of kids who went to high school. More importantly — much more importantly, I’d say — after World War II we dramatically increased the number of kids who graduated from college. But you can only do that once. We can still make incremental improvements on this score, but we can’t double or triple the number of college grads anymore. That avenue of growth is closed to us.

-

Technology. Tyler argues that technological growth was high between 1900-1950, but it’s slowed since then. We spent several decades exploiting all the new inventions of the early 20th century, but a few decades ago we ran out of steam and we haven’t invented enough truly fundamental new stuff since then to keep growth going. Longtime readers know that I basically agree with this, so I don’t need much convincing on this score.

But there’s a tension here that Tyler doesn’t address. Technology grew like gangbusters in the first half of the 20th century, but it wasn’t until the second half that education took off. So apparently it’s not higher education that’s really responsible for dramatic technological growth. But if that’s the case, who cares about education?

The answer, I think, is that having lots of college grads doesn’t really help push technological boundaries forward. What it does is produce a population that can effectively manage and direct large organizations that depend on advanced technology. And that helps produce economic growth nearly as much as fundamental new inventions do.

So here’s what I think Tyler missed: it’s true that we’ve already made our big improvements in access to education, and we can’t do that again. But even if the number of college grads stays about the same as it is now, and even if the quality of their education stays about the same as it is now, the effectiveness of their management skills is multiplied tremendously by the computerization of the workplace. The human beings who are managing our country might be about the same as the ones who managed it 30 years ago, but they’re managing it with steadily improving software and networking. They’ll keep doing that for a long time, and that will keep GDP growing in the same way that better and better exploitation of electricity did during most of the 20th century.

In other words, computerization isn’t just about the internet, and it’s not just about whether Facebook generates a lot of utility without generating a lot of traditional GDP. That’s the sexy stuff, but for the next 30 years it’s continuous improvements in the computerization of industry and the computerization of management that will be the big GDP driver. Providing well-educated humans with better computers is every bit as important as simply churning out more well-educated humans.

(And after that? I’m a true believer in artificial intelligence, and I figure that 30 or 40 years from now computers are literally going to put humans out of business. They’ll dig ditches better than us, they’ll blog better than us, and they’ll make better CEOs than us. This is going to cause massive dislocations and huge social problems while it’s happening, but eventually it will produce a world in which today’s GDP looks like a tinker toy.)

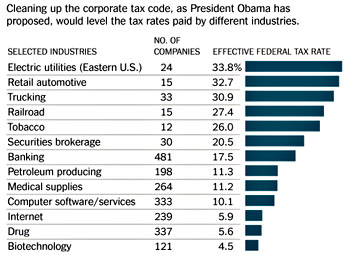

Tyler makes a bunch of other arguments in “The Great Stagnation” too, some more persuasive than others. Like some other critics, I’m not sure why he uses median wage growth as a proxy for economic growth. It’s important, but it’s just not the same thing. Besides, median wage growth in the United States slowed very suddenly in 1973, and it’s really not plausible that our supply of low hanging fruit just suddenly dropped by half over the space of a few years. I also had a lot of problems with his arguments about whether GDP generated by government, education, and healthcare is as “real” as other GDP. For example, he suggests that as government grows, its consumption is less efficient, but that’s as true of the private sector as it is of the public sector. A dollar of GDP spent on an apple is surely more “real” than a dollar spent on a pet rock, but there’s simply no way to judge that. So we just call a dollar a dollar, and figure that people are able to decide for themselves whether they’re getting the same utility from one dollar as they do from the next.

The healthcare front is harder to judge. I agree with Tyler that we waste a lot of money on healthcare, but at the same time, I think a lot of people seriously underrate the value of modern improvements in healthcare. It’s not just vaccines, antibiotics, sterilization and anesthesia. Hip replacements really, truly improve your life quality, far more than a better car does. Ditto for antidepressants, blood pressure meds, cancer treatments, arthritis medication, and much more. The fact that we waste lots of money on useless end-of-life treatments doesn’t make this other stuff any less real.

To summarize, then: I agree that the pace of fundamental technological improvements has slowed, and I agree with Tyler’s basic point that this is likely to usher in an era of slower economic growth in advanced countries. At the same time, improvements in managerial and organizational efficiency thanks to computerization shouldn’t be underestimated. Neither should the fact that other countries still have quantum leaps in education to make, and that’s going to help us, not just the countries trying to catch up to us. After all, an invention is an invention, no matter where it comes from. And finally, try to keep an even keel about healthcare. It’s easy to point out its inefficiencies, but it’s also easy to miss its advances if they happen to be in areas that don’t affect you personally.

boys might favor, like, toy soldiers or baseball cards, whose voluminous entry includes a detailed chronological history of the subject.

boys might favor, like, toy soldiers or baseball cards, whose voluminous entry includes a detailed chronological history of the subject. out ahead of time, it’s cheaper to simply parachute in to cover them. And hard news began to soften, including more human interest stories and politics-as-sports coverage.

out ahead of time, it’s cheaper to simply parachute in to cover them. And hard news began to soften, including more human interest stories and politics-as-sports coverage.

The New York Times has a

The New York Times has a  the small-government movement, has said he’s unsure if he’ll join. Sen. Pat Toomey (R-Pa.) showed up to address the group of activists, but then hustled out of the room, ignoring reporters’ questions about whether he was in or out.

the small-government movement, has said he’s unsure if he’ll join. Sen. Pat Toomey (R-Pa.) showed up to address the group of activists, but then hustled out of the room, ignoring reporters’ questions about whether he was in or out.