Tyler Cowen links to a pair of papers that conclude that only 42 percent of the workers hired using stimulus funds came from the ranks of the unemployed. The rest came from other organizations or were hired straight out of school. Tyler concludes that this means the stimulus worked poorly:

Tyler Cowen links to a pair of papers that conclude that only 42 percent of the workers hired using stimulus funds came from the ranks of the unemployed. The rest came from other organizations or were hired straight out of school. Tyler concludes that this means the stimulus worked poorly:

One major problem with ARRA was not the crowding out of financial capital but rather the crowding out of labor.…You can tell a story about how hiring the already employed opened up other jobs for the unemployed, but it’s just that—a story. I don’t think it is what happened in most cases, rather firms ended up getting by with fewer workers.

There’s also evidence of government funds chasing after the same set of skilled and already busy firms. For at least a third of the surveyed firms receiving stimulus funds, their experience failed to fit important aspects of the Keynesian model.

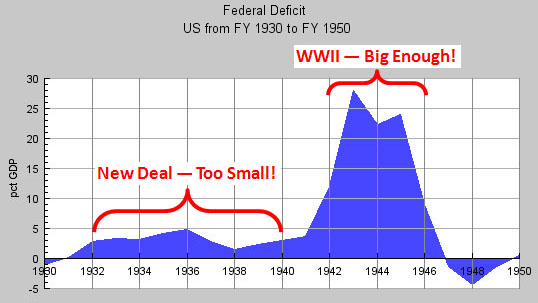

This paper goes a long way toward explaining why fiscal stimulus usually doesn’t have such a great “bang for the buck.” It raises the question of whether as “twice as big” stimulus really would have been enough. Must it now be four times as big?

Maybe this is just my priors speaking, but I’d draw the exact opposite conclusion from this. First of all, a lot of stimulus spending went to states, where it was explicitly used to avoid laying off workers. That doesn’t take anyone off the unemployment rolls, but it certainly keeps unemployment from getting worse. Second, no one expected ARRA to hire solely from the ranks of the unemployed. That’s just not feasible, so these results hardly seem like a surprise to me. In fact, they seem pretty good. Third, yes, it’s “just a story” that firms whose workers were hired away filled some of those new openings with the unemployed. But far from being some kind of weird fairy tale, it seems almost inevitable that this is partly true. And if even a third of those jobs were filled this way, it means nearly two-thirds of ARRA’s total hiring (direct and indirect) was among the unemployed. And that’s not even counting the effect of the increased spending from these newly hired workers that drives hiring in other firms

And fourth, my intuition says this result is an excellent argument that the stimulus should have been twice as big. Think of it this way. If the stimulus had been very small—say, $50,000—what would have happened? Well, if you could hire only one person, you’d almost certainly hire someone who was already working. There’d be lots of people to choose from, and it’s a safer bet. At some point, though, you start to run out of good choices, and the currently employed are too expensive. So as the stimulus gets bigger you start to hire some of the best of the unemployed. Now make the stimulus super big, and cherry picking from the ranks of workers has played out almost completely. If 40 percent of the direct hires from the original ARRA spending were unemployed, I’d expect that something like 70 to 80 percent of the hires from a second trillion dollars of ARRA to be unemployed. What’s more, all the newly employed people from that extra trillion would have created enough additional demand to benefit the rest of the economy as well.

Obviously, my intuition could be wrong. But overall, these results actually seem pretty positive to me. Probably at least half of ARRA’s spending ended up in the hands of the unemployed, and if it had been bigger the vast bulk would have ended up in the hands of the unemployed. It’s too bad we’re not willing to try this out in real life to find out who’s right.

Then again, maybe having three or four companies really does provide more competition, stronger price pressure, and increased innovation. I just haven’t studied this enough to know. Still, Felix Salmon

Then again, maybe having three or four companies really does provide more competition, stronger price pressure, and increased innovation. I just haven’t studied this enough to know. Still, Felix Salmon  welfare edifice “from housing to public television, from the environment to art, from education to medical care, from public transportation to food, and beyond.”

welfare edifice “from housing to public television, from the environment to art, from education to medical care, from public transportation to food, and beyond.”

Tyler Cowen links to a pair of papers that conclude that only 42 percent of the workers hired using stimulus funds came from the ranks of the unemployed. The rest came from other organizations or were hired straight out of school.

Tyler Cowen links to a pair of papers that conclude that only 42 percent of the workers hired using stimulus funds came from the ranks of the unemployed. The rest came from other organizations or were hired straight out of school.  election formula has correctly called every president since Ronald Reagan’s 1984 re-election,”

election formula has correctly called every president since Ronald Reagan’s 1984 re-election,”

The numbers seem destined to tumble. Recently developed hybrids do not need seeded melons for pollination — more on that later — which liberates farmers from growing melons with spit-worthy seeds.

The numbers seem destined to tumble. Recently developed hybrids do not need seeded melons for pollination — more on that later — which liberates farmers from growing melons with spit-worthy seeds.