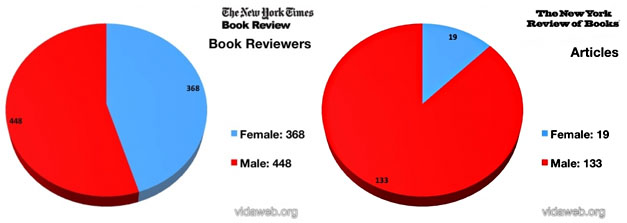

VIDA has once again counted up the bylines in a variety of literary and political magazines in order to compare the contributions of men and women, and the news remains pretty bleak. Among the mainstream magazines (as opposed to the purely literary journals), the most and least egalitarian are the New York Times Review of Books, where 45% of the contributors are women, and the New York Review of Books, where a dismal 13% of all articles are written by women:

This comes via E.J. Graff, who asks:

Why is this important? Because the news purports to be objective, to tell it like it is. The media help create our image of the world, our internal picture of what’s normal and true. And when the news is being written by men about men, a significant part of reality is missing from view.

….We’ve all had plenty of fun mocking [Darrell] Issa’s all-male panel on contraception—er, religious freedom. But you know what? That wasn’t an outlier. The fact that Issa’s panel was about lady business made it particularly egregious. But check out the world around you. All-male and 90-percent male panels convene every day. Sometimes they’re called “Congress.” Sometimes they’re called your newspaper. And they’re giving you a false picture of your world.

More at the link. Here’s a complete list of the mainstream magazines covered by the VIDA project, from best to worst. Sadly, Mother Jones wasn’t part of the project. Perhaps some enterprising intern can leaf through our 2011 issues and come up with a count.

- 45% — New York Times Book Review

- 40% — The Nation

- 31% — Boston Review

- 26% — New Yorker

- 26% — Atlantic

- 25% — New Republic

- 17% — Harper’s

- 14% — London Review of Books

- 13% — New York Review of Books

UPDATE: Ask and ye shall receive. Samantha Oltman checked through MoJo’s 2011 archives and discovered that we ran 41 pieces bylined by men and 41 pieces bylined by women. Not bad! Click the link for more details.

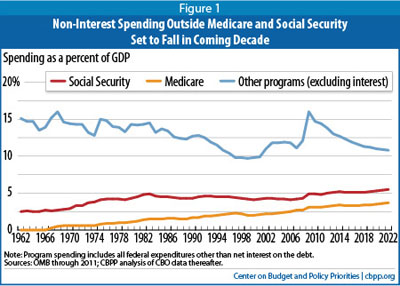

steadily. Basically, “everything else” is in good shape. We should direct our attention a little bit toward Social Security and a lot toward healthcare costs, and stop obsessing about the rest.

steadily. Basically, “everything else” is in good shape. We should direct our attention a little bit toward Social Security and a lot toward healthcare costs, and stop obsessing about the rest. Back in 2008, after the passage of Proposition 8 banned gay marriage in California, there was a lot of talk about putting a pro-marriage initiative on the ballot in 2010. That didn’t happen, and my read of public opinion at the time suggested we’d be better off waiting a little bit to ensure victory. Time was on our side, after all.

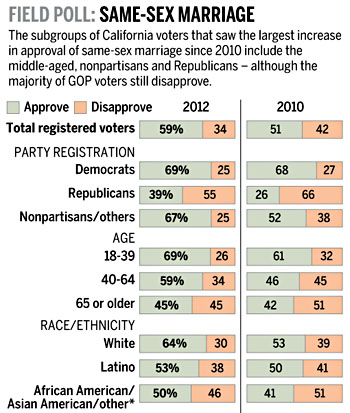

Back in 2008, after the passage of Proposition 8 banned gay marriage in California, there was a lot of talk about putting a pro-marriage initiative on the ballot in 2010. That didn’t happen, and my read of public opinion at the time suggested we’d be better off waiting a little bit to ensure victory. Time was on our side, after all.

between winning and losing, still waiting for the Republican base to look at him just a little bit harder and collapse him into one or the other.

between winning and losing, still waiting for the Republican base to look at him just a little bit harder and collapse him into one or the other.