Jonathan Bernstein points me to Jeffrey Toobin, who writes that although Republican obstruction of President Obama’s judicial appointments has been unprecedented, it’s also true that Obama hasn’t nominated many judges in the first place. “The Senate cannot confirm judges who were never nominated in the first place,” he points out. And there’s more:

The President’s lethargy on the matter of judicial nominations is inexplicable. So is his silence on the subject. George W. Bush complained loudly when he felt Democrats in the Senate had delayed or obstructed his judicial nominees. Obama has said little. Indeed, Bush had a public judicial philosophy as President, frequently calling on judges to “strictly apply the Constitution and laws, not legislate from the bench.” As a former president of the Harvard Law Review and long-time lecturer at the University of Chicago Law School, Obama has a great deal of familiarity with legal issues but hardly ever talks about them. His legal philosophy, if he has one, is unknown.

I find many of the liberal complaints about Obama unconvincing, mainly because I viewed him from the very start as a rather cautious, mainstream Democrat. I didn’t expect the second coming of FDR. But there are some areas where I’ve nonetheless found Obama inexplicably disappointing. Housing policy, for example. National security and civil liberties policy. And judicial nominations.

In fact, that last one is the most inexplicable of all. The first two at least have the excuse of considerable political opposition. But judicial nominations don’t. Republicans can be blamed for obstructing, but Obama is solely to blame for not mustering the energy to vet and nominate candidates for every open seat — or being willing to fight for them in the court of public opinion. At a bare minimum, if his legal team had done this in the first half of 2009, he would have had plenty of candidates to muscle through during the few months he commanded a filibuster-proof majority.

So why didn’t he? It’s a helluva mystery.

abstract symbols. Eugene Volokh, however,

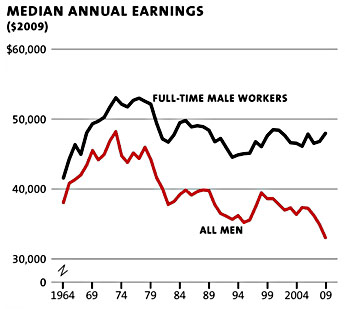

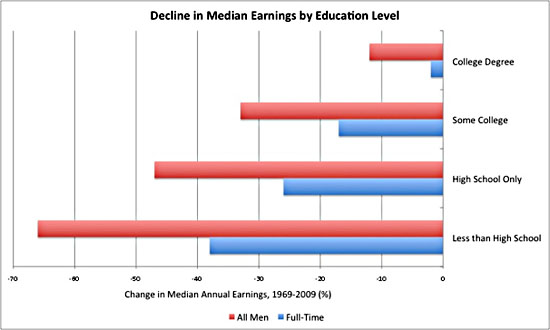

abstract symbols. Eugene Volokh, however,  Dylan Matthews says a bit more today about something I mentioned briefly a couple of weeks ago: among men, wages haven’t just stagnated over the past few decades.

Dylan Matthews says a bit more today about something I mentioned briefly a couple of weeks ago: among men, wages haven’t just stagnated over the past few decades.

televised for — what? 20 years or so now? It’s time to get over it. This particular complaint isn’t cutting edge or original or even very interesting anymore.

televised for — what? 20 years or so now? It’s time to get over it. This particular complaint isn’t cutting edge or original or even very interesting anymore. numbers by a third and turned another third into inert tax cuts designed to appease Republican legislators.

numbers by a third and turned another third into inert tax cuts designed to appease Republican legislators.