NGDP stands for nominal GDP, and it’s the level of GDP without adjusting for inflation. It’s become much talked about lately because of proposals that this is what the Federal Reserve should target. Not interest rates, not inflation, and not unemployment. Just make sure that NGDP rises steadily (say, 5% per year) and the economy will prosper. In some years, that might mean 4% real growth and 1% inflation, and in  others it might mean 1% real growth and 4% inflation. Doesn’t matter. It’s all good.

others it might mean 1% real growth and 4% inflation. Doesn’t matter. It’s all good.

Matt Yglesias explains how this works using an example of a company trying to decide whether to expand production:

You look to your left and you see a stack of dollars. You look to your right and you see a bunch of machines. Do you want to trade the dollars for the machines? It’s a close call.

Now a little birdie from the Bureau of Labor Statistics shows up and tells you that the price level is going to surge over the next three years. Suddenly your decision is made for you. That stack of dollars isn’t as valuable as you thought it was. Buy the machines!

But no, a second little birdie arrives this time from the Bureau of Economic Analysis and it’s here to tell you that the level of real output is going to surge over the next three years. Suddenly your decision is made for you. That pile of machines is more valuable than you thought it was. So go buy them!

The point is that any information pointing toward higher NGDP at the margin points in the direction of marginally more investment.

It’s worth adding a piece that got left out here. If this explanation were literally true, then all we’d need to spur economic growth is high inflation all the time. Weimar Germany would be an economic miracle instead of a millstone that continues to hang around Angela Merkel’s neck a century after the fact.

But the missing piece is interest rates. Interest rates generally vary with inflation, so in the first example our befuddled CEO will stay befuddled. Sure, he figures, inflation will be up, but so will the returns his CFO can make by investing the corporate cash hoard. The knife edge between keeping money in the bank and spending it on increased production is still a knife edge.

The way this calculus changes is if the Federal Reserve keeps interest rates low and promises to keep them low for a good long time. This is the “expectations channel.” If the Fed does this, and if you believe that they’re dead serious no matter what, then you might as well buy the machines. Cash sitting in the bank is going to lose value, and if the decision was a close call in the first place, this will be enough to make plant expansion look like a better deal.1

Note that if it’s not a close call, none of this matters. But the whole point of policies like this isn’t to get everyone in the country to change their preferences. It’s to change things on the margin. If 10% of the companies in America are on the fence about increasing production, and the promise/threat of low interest rates is enough to push them over the edge into increasing production by 10%, then that’s 1% more overall production. And that’s great for the economy.

The key here is credibility. Investors have to believe that the Fed is absolutely committed to its NGDP goal and won’t back down even if inflation rises. And this, of course, is the problem with NGDP targeting: investors aren’t idiots, and they know perfectly well that there’s plenty of opposition to any policy that tolerates higher inflation. This makes it nearly impossible for a central bank to convince the markets that there’s absolutely no chance that it will change its mind. Given the real-world political constraints here, I don’t really see how this is likely to change in the near future.

1Put in different terms, the hurdle rate for the investment has gone down. For all practical purposes, the cost of money is negative, and this makes the financial case for spending money on plant expansion more favorable. It’s really negative real interest rates that are doing most of the heavy lifting here.

lengthy, table-laden posts that often meandered through several thousand words. Liberals loved it. Before long he was, for all practical purposes, the liberal patron saint of polling.

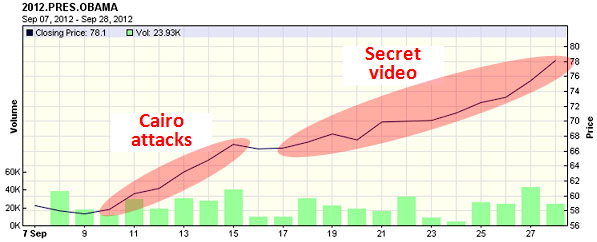

lengthy, table-laden posts that often meandered through several thousand words. Liberals loved it. Before long he was, for all practical purposes, the liberal patron saint of polling. meeting. These kinds of pieces are three-a-penny for decisions made in the White House or on Capitol Hill, but not so common for decisions made in the inner sanctums of the Eccles Building. But as you’ll recall, September’s meeting is the one where the Fed finally decided to implement QE3,

meeting. These kinds of pieces are three-a-penny for decisions made in the White House or on Capitol Hill, but not so common for decisions made in the inner sanctums of the Eccles Building. But as you’ll recall, September’s meeting is the one where the Fed finally decided to implement QE3,