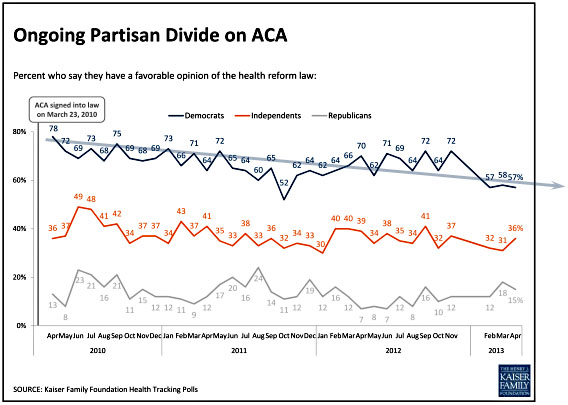

You may have heard that after receiving mountains of criticism for its 21-page first draft, HHS released a new, streamlined application form for Obamacare today. So, hooray, right? Sort of. Here’s my take on the original form:

In fairness, there’s a single 2-page section you have to fill out, and then there are five more 2-page sections for other members of your family. So sure, it might be long if you have a big family, but a lot of it is repetition. And if you’re just a single earner? Then aside from instructions, there’s really only about four pages (five if you’re an American Indian or Alaska Native): one page of basic contact information, two pages of income information, and one page of current insurance information.

And here is Ezra Klein’s description of the new form:

Where the draft form was a hefty 21 pages, the new form is a svelte 5 pages….The new form is short because it’s only for a single adult. But if you head to the HHS Web site, you can find the new form for family coverage. It, too, is shorter: A mere 12 pages rather than 21. But it only includes the forms for two people. If your family includes more than two people, the form advises you to “make a copy of Step 2: Person 2 (pages 4 and 5) and complete.”

The result is that the new form for a family of six is 20 pages long and includes a substantial amount of time spent in front of a copier.

In other words, the new form is actually about the same as the old form. The fact that it seems shorter is merely an example of the power of framing. The default for the old form was 21 pages, which could be reduced to four if you were a single earner. The default for the new form is five pages, which can be expanded to 20 if you have a big family. Which one sounds better?

able to do what’s going to be best for the country. But it’s going to take some time.

able to do what’s going to be best for the country. But it’s going to take some time. Simon said, human imagination is the ultimate resource.

Simon said, human imagination is the ultimate resource.

up the whole world trading system we’ve spent almost 80 years building.

up the whole world trading system we’ve spent almost 80 years building. quickly. That being the case, Congressional Democrats are increasingly looking to hold the line and say “No Mas” to further near-term deficit reduction.

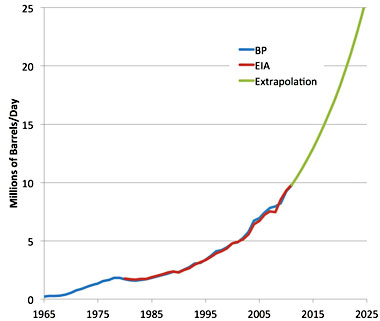

quickly. That being the case, Congressional Democrats are increasingly looking to hold the line and say “No Mas” to further near-term deficit reduction. Stuart Staniford extrapolates China’s demand for oil and comes up with the chart on the right.

Stuart Staniford extrapolates China’s demand for oil and comes up with the chart on the right.