Erick Erickson, who is pretty clearly the voice of the Tea Party at this point, is unhappy with his fellow Republicans and he’s letting everyone know it via Twitter:

At this point, the House should just go on and pass a clean CR. They’ve already embarrassed themselves and done requisite head pats.

Seriously House GOP, if you’re going to fully fund Obamacare, go on and stop the shiny object dangling and just embrace it.

GOP should either find for defund or just embrace the suck.

And which shiny object is Erickson objecting to here? That’s hard to say since Republicans could furnish a disco hall with all the shiny objects they’ve been dangling in front of their base lately, but most likely he’s talking about the stupidest shiny object of them all: the Vitter Amendment.

In fact, the Vitter Amendment is so stupid that it’s actually a little hard to explain. As you know, the whole point of Obamacare is that it’s for people who don’t get health insurance via their employer. Back in 2009, however, when Republicans were offering up a slew of amendments to try to embarrass Democrats, Chuck Grassley offered an amendment that would require members of Congress and their staffs to buy insurance via the exchanges.

This made no sense since staffers already had a health insurance plan, just like all other federal employees. But Republicans somehow decided that if Grassley’s amendment didn’t pass, it would mean Democrats weren’t willing to use their own program. So Democrats sighed and went ahead and voted for it.

But wait. The federal government paid for staffers’ health insurance. Under Obamacare, they’d have to pay for it themselves. That’s a raw deal. So the federal government decided to take the money that had previously gone to health insurance and give it to staffers to offset the cost of insurance on the exchanges. Fair enough.

But now Republicans are up in arms again. Allegedly, this is because they’ve somehow decided that it’s unfair for staffers to get this money, so they want to take it away via the Vitter Amendment. After all, other people on Obamacare don’t get money from their employer to offset the cost of insurance.

Which is true. But that’s because other employers aren’t allowed to dump their employees onto Obamacare. Only Congress does that.

This is all mind-bogglingly stupid. Congressional staffers should never have been put on Obamacare in the first place. It only happened thanks to a craven political ploy from Republicans. Now they want to double down on their cravenness by taking away a chunk of their staffers’ compensation under the moronic pretense that they’re getting “special treatment.” They aren’t, of course. In fact, they got screwed by Grassley, and now they’re going to get doubly screwed by Vitter.

What’s more, this ploy is so craven and moronic that even Erick Erickson recognizes it for what it is. Go figure that. If this is the best Republicans can come up with, even Erickson thinks they should just give up and pass a clean CR. That’s how bad things have gotten.

POSTSCRIPT: Of course, passing a clean CR isn’t what Erickson wants. He wants the House to fight Fight FIGHT! Refuse to pass anything except a bill that fully repeals Obamacare, and if the government shuts down, then the government shuts down.

But if they’re not going to do that, the Vitter Amendment is just about the worst way imaginable to save face. Republicans think they’re being clever because they can complain about Congress giving itself “special privileges,” and they know that Fox News will dutifully repeat this no matter how dumb it is. But all they’re doing is screwing their own staff members because they know they can’t fight back. It’s truly odious behavior.

experiences. But that doesn’t mean everything

experiences. But that doesn’t mean everything

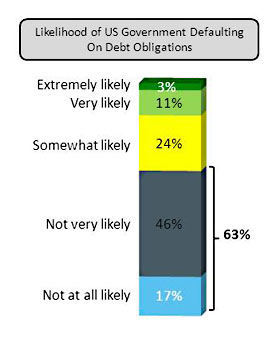

I’m not quite sure how seriously to take a poll by the National Center for the Middle Market, which focuses on companies with between $10 million and $1 billion in annual revenues, but I suppose it’s as good as any. Today,

I’m not quite sure how seriously to take a poll by the National Center for the Middle Market, which focuses on companies with between $10 million and $1 billion in annual revenues, but I suppose it’s as good as any. Today,