In a campaign season in which the Democratic candidates agree with each other on 95 percent of their policy proposals, Social Security stands out as an issue with a small but stark difference.

Here’s the nut of the issue. Currently, Americans pays a Social Security tax on the first $97,500 of their income. If you make $60,000 a year, you pay tax on 100 percent of what you make. If you make $1 million a year, you pay tax on 9.75 percent of what you make. Barack Obama proposes lifting that $97,500 cap (which rises to $102,000 next year), while Hillary Clinton suggests it would raise taxes by too much.

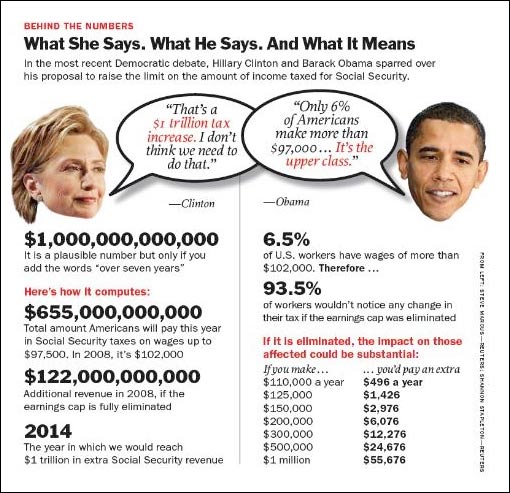

Over on the Time blog Swampland, I found this incredibly helpful chart. I’ve stolen it because it breaks down the numbers exceptionally well. As a thank you, show Swampland some love.

Clinton is right about the rise in taxes: in some instances it is substantial. But only the rich will feel it.