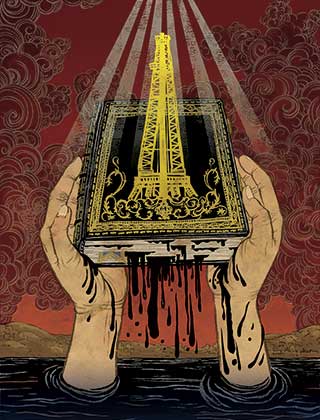

Illustration: Yuko Shimizu

When james cojanis heard the first rumblings of Armageddon, he was sitting in his San Jose home with the radio tuned to a popular Christian show called The Prophecy Club. Featured that day was a charismatic Texas oilman named Harold “Hayseed” Stephens. Speaking in the rousing cadence of a Southern preacher, he told listeners that “the greatest oil field on Earth is under the southwest corner of the Dead Sea”—and that his company, Ness Energy International, was about to tap into it. In doing so, he said, it would drain the oil fields of the Persian Gulf, prompt Arab countries to attack Israel, and at last touch off the great battle that would usher in the end of days.

As soon as the show was over, Cojanis got on the phone to find out how to invest in the venture. Days later the 70-year-old retiree received a form letter addressed, “Dear End Time Servant.” It claimed that the oil reserves at Ness’ planned drilling site ranged “from one billion to 40 billion barrels…putting this prospect in a class of the super giant oil fields of the world.” Without a second thought, Cojanis bought $120,000 worth of stock in Ness. “Faith is a gift God puts in your heart,” he explained when I visited him in October at his cluttered town house, piled with crumpled boxes of prophecy-themed newsletters and cassette tapes of old Christian radio shows. “And I didn’t have any doubt that Ness was a plan of God. He raised up Hayseed Stephens to find Israel’s oil.”

Eight years later, Ness has yet to sink so much as an initial borehole for a Dead Sea well. In fact, for most of its existence it has never even held exploration rights in Israel. Its U.S. headquarters, a barnlike storefront topped with an open Bible sprouting an oil well, was shuttered in 2006. Since then, its stock price has fallen from a high of nearly $5 to a mere 3 cents; Cojanis’ $120,000 investment is now worth $3,000. Not that he’s worried. “I’m glad the stock price is in the tank,” he says. “When they hit oil and the stock goes sky-high, that means Armageddon is around the corner.” At that point, he plans to use his gains to spread the word that the end times are here, preparing as many souls for heaven as possible.

It is widely believed among evangelical Christians (and some Orthodox Jews) that Scripture foretells a massive oil find in the Holy Land; prophecy buffs are especially captivated by a passage in Ezekiel that says Armageddon will be triggered by a band of nations—Russia, Iran, and a confederacy of Arab countries are most often named as the likely suspects—attacking Israel to “take a great spoil.” Their faith has spurred a sprawling, decades-long treasure hunt. At least 10 companies or individuals have searched for oil in Israel using biblical clues. So far, few of the more than 400 wells drilled there have turned up commercial quantities of oil and gas. But the willingness of ordinary churchgoers to invest their life savings has kept the ventures going—and made the business rich terrain for a bevy of false prophets, penny-stock hustlers, and con men.

a burly man who favored Wrangler jeans and fat belt buckles (one of which bore an oil derrick emerging from a Star of David), Hayseed Stephens grew up picking cotton and slopping hogs on a Texas sharecropping farm. For a brief stretch in the early 1960s, he played quarterback for the New York Titans (now the Jets) before returning to Texas to work the oil fields and, later, minister to the faithful from a church he opened in Willow Park, near Dallas.

In 1997 Stephens acquired a publicly traded shell company that he renamed Ness (“miracle” in Hebrew). With meager assets and no recent operating history, it was a business in name alone, but that didn’t stop Stephens from selling millions of dollars of stock in it. He got help from Stan Johnson, a one-time salesman turned doomsday prophet who founded the Prophecy Club, a Kansas-based ministry that airs television and radio programs on Christian stations across the country and holds traveling revival-style meetings. Johnson once told his followers that Stephens could be drilling within 60 days if he just collected enough money: “And when the well is drilled, when the oil comes in, 17 Bible prophecies will be fulfilled…We believe now is the time and Hayseed is the man.”

Besides scriptural backing, Stephens claimed to have geological proof for his theory. In late 2002 he told Prophecy Club listeners that “experts from Israel and around the world” had studied his planned drilling site and concluded that “18 to 50 billion barrels of oil” were hidden beneath the surface, reserves worth up to a trillion dollars. “You cannot find such good odds in Vegas, Atlantic City, or anywhere else in the world, even if you are nothing but a gambler.”

Among those swayed was Michael, a 53-year-old Kansas farmer who asked that his last name not be used. In 1999, he invested half a million dollars in Ness, learning only later that the shares he bought couldn’t be resold—a claim echoed in lawsuits filed by other Ness stockholders. He was forced to watch from the sidelines as the share price climbed from the 45 cents he paid at one point to around $5, then sank back to around a quarter. At the peak, his stock would have been worth $11 million. “I thought God was in the project,” he says. “It turns out it was a trap laid for me by the enemy, Satan.”

Over the past 10 years, Ness has issued 180 million shares and collected almost $10 million from investors. What most of them didn’t know—and still don’t today—is that behind the fire and brimstone lurked a standard penny-stock play known as the pump-and-dump scheme, which entails buying a publicly traded shell company, inflating the stock price with misleading claims, then selling off shares at a huge profit and leaving investors holding the bag.

Key Ness executives had a history of such cons. The company’s original chief financial officer, Ivan Webb, moonlighted as president of a firm called Broadband Wireless, where, according to sec investigators, he and convicted con man Donald Knight cheated stockholders out of at least $5 million. Ness’ founding ceo, Stanley Swanson, headed an outfit called Safescript Pharmacies, which had its registration revoked by the sec for artificially inflating its stock value through a fraudulent accounting scheme. A few other Ness insiders had ties to Safescript, including Webb, who served as a consultant. In 2000, Ness purchased $1 million in Safescript stock—shares that became nearly worthless within months.

Stephens played a similar game with Ness’ stock—driving up prices with apocryphal claims, then selling shares, ultimately clearing at least $3.5 million. But in this case, pump and dump was just part of the swindle.

one of Stephens’ darkest secrets is buried in Israel’s oil register, a battered leather binder held together with red electrical tape whose crumpled pages hold exploration permits dating back several decades. During a visit last summer to the offices of the Ministry of National Infrastructures in Jerusalem, I combed through the book with the help of deputy oil commissioner Avraham Honigstein, an unassuming geologist who speaks in a precise monotone. It took nearly an hour, but we eventually unraveled an elaborate shell game designed to give the illusion that Ness held drilling licenses. In fact, the rights were held by a private company called Hesed—a firm owned by Hayseed Stephens. What’s more, Ness and Hesed had an operating agreement saying that Ness was to perform all the work on the proposed Israeli drilling sites while Hesed would receive all the potential profits. In other words, had either company struck oil, Ness investors wouldn’t have seen a penny.

In the end, the terms didn’t matter much, since Stephens never even laid the groundwork for a Dead Sea well. “He didn’t do the geological work because he didn’t want to spend the money,” Moshe Goldberg, Israel’s former oil commissioner, told me. He called the claims that Stephens sold “lies” and “nonsense.”

In April 2003, Stephens sold Hesed and another firm he owned to Ness for around $4 million—at least four times what they were worth, according to sec documents. Stockholders were led to believe that Hesed’s value lay in proprietary geological and seismic data collected on the sites where it had held licenses in Israel; in fact the only geological work Hesed had ever done was to reinterpret an existing seismic study.

The deal was Stephens’ last. He died the following month, struck down by a heart attack while praying with a neighbor outside of his Texas home.

the history of biblical oil prospecting is filled with quixotic quests and colorful characters, starting with Weslie Hancock, a wealthy California man who in the 1960s dreamed that Jesus told him he would find black gold in the Holy Land. He sunk his entire fortune into two dry holes. In the 1980s, Andy Sorelle, a World War II fighter pilot and petroleum engineer, collected as much as $25 million from churchgoers who believed they were buying an interest in his well; he bored down to 21,500 feet, deeper than anyone had ever drilled in Israel, before hitting a thick slab of limestone that showed traces of oil. Across the Bible Belt, the faithful braced for a gusher. On The 700 Club, Pat Robertson reported that Sorelle was about to tap “the largest oil field ever discovered,” a development that could “revolutionize the fulfillment of biblical prophecy.” But the euphoria evaporated when some testing equipment got jammed in the hole and Sorelle couldn’t conjure the miracle he needed to get it out. That’s when Goldberg started receiving letters from churchgoers who had sunk their entire savings into the well. “I felt so bad for them,” he recalls. “They were people who had scraped together their dollars, and when the hard times came, they had nothing. “

Other wildcatters followed, including Bernard Coffindaffer, a West Virginia businessman who searched for oil using scriptural clues and a vial of his own blood. In 1999 a penny-stock firm named Covenant Energy began promoting a bogus oil-exploration project on the spot where Sorelle had drilled, selling $70,000 worth of stock to investors before Delaware Securities Division investigators discovered that corporate officers were pocketing most of the money. The firm’s founders were convicted of fraud and conspiracy in 2003.

today, two companies are searching for oil in Israel based on biblical passages. One of them, Givot Olam, is run by an Orthodox Jewish geophysicist named Tovia Luskin. Luskin’s firm has drilled three wells using a blend of science and Scripture. All have shown traces of oil and gas, though none have turned up commercial quantities.

The other firm, Dallas-based Zion Oil & Gas, was founded by an evangelical Christian named John Brown. I met him last July in the Club Lounge of Tel Aviv’s David Intercontinental Hotel. A mild-mannered 68-year-old with a slight Texas twang and a deep tan, he was wearing denim shorts and reclining in a pink armchair, overlooking the turquoise waters of the Mediterranean.

Twenty-seven years ago, Brown was a tool-company executive with a $200,000 salary and a comfortable house in the Detroit suburbs. He was also a zealous new believer who credited the Lord with delivering him from a stubborn alcohol addiction. Eager to share the good news, he doled out “Jesus Loves You!” wallet cards and once sent a memo warning coworkers to “choose JESUS CHRIST as your Personal Savior” or face “eternal damnation.” Some people were put off by his newfound fervor, including his wife, who packed up their four kids and divorced him.

It was around this time that Brown heard a sermon from maverick preacher Jim Spillman, who unfurled ancient tribal maps and quoted Deuteronomy 33, which tells how Moses scaled Mount Nebo, looked out on the Holy Land, and described the blessings awaiting the 12 sons of Jacob. Among them were “treasures hid in the sand” and “precious things” deep beneath the earth.

Brown later traveled to Israel, where he says the Lord spoke to him and told him he was the “stranger” that the Book of Kings predicts will be sent to fortify Israel in the final days. “I knew in my heart what to do,” he recalls. “I knew God was going to put me in the oil business.”

Brown was so convinced that in 1985 he quit his job and moved to Houston, where he tried to drum up support for an Israeli drilling venture. But investors weren’t eager to back a greenhorn on a mission from God, especially in the midst of an industry slump. So Brown waited and prayed and lived off his savings. By 1996, utterly broke, he ended up scrubbing toilets at a Baptist church for $4 an hour before moving back to Michigan, where he slept in his brother’s basement. “Talk about one whipped dog: I was it,” he says.

It took him two years to get back on his feet, but he never lost sight of his dream and finally founded Zion in 2000 with the help of Philip Mandelker, an oil-industry attorney who was also deeply involved with Ness. Early investors pitched in enough money to complete one drilling project near the land Brown believes once belonged to Asher, the Israelite Moses predicted would “dip his foot in oil.” Last spring, the company held its initial public offering on the American Stock Exchange, raising more than $12 million.

Unlike Ness, Zion is a legitimate wildcatting venture, with respected geologists on its board of directors. Still, some of its activities are questionable. The firm was first brought to wide attention by Hal Lindsey, host of the prophecy-focused TV show The Hal Lindsey Report and coauthor of the best-selling The Late Great Planet Earth. Lindsey has bet very publicly on Brown’s company, telling his viewers in March 2007 that “Zion Oil right now is on the verge of discovering oil,” a sign that “we are really on the very threshold of Lord Jesus’ return.” Around the same time, he touted the company in his column on the popular conservative website WorldNetDaily, saying, “Zion Oil has sunk eight exploratory wells, all of which have shown signs of oil and gas” (it has, in fact, sunk just one), and suggesting Israel’s oil “could rival that of Saudi Arabia.”

What Lindsey neglected to mention was that he and his relatives own millions of dollars of stock in the company. In 2002, John Brown gave Lindsey a gift of 50,000 shares, worth $337,500 at today’s price. Ralph Devore, Lindsey’s cousin and a director of his ministries, controls nearly 725,000 shares, worth about $4.9 million. Devore was also a founding member of Zion’s board and was at one point hired to promote the company.

Brown insists his motives for the gift were pure. “It was simply in my heart to give shares to people who loved Israel,” he says. But Lindsey’s support has clearly paid off for the company. After he told television viewers that Zion was “on the verge” of an oil find, the trading volume of the company’s stock leaped from 11,100 a day to 122,000 and the price climbed from $7.64 to $9.25 a share, a 21 percent increase. (Lindsey did not respond to requests for comment.)

In truth, Zion was never close to striking oil; at its very first stockholders’ meeting this past June, the firm announced plans to temporarily abandon its only well due to technical problems. Afterward, John Brown climbed to the podium and arranged himself between an American flag and an Israeli one. Flipping his Bible open to the Book of Kings, he began reading a passage about the prophet Elijah, who heard “the sound of abundance” when Israel was in the midst of a crippling drought. No one else could hear the sound, but Elijah prayed and waited, and within hours “the heavens was black with clouds.”

When he finished reading, Brown looked up and told his investors that he, too, heard “the sound of abundance.” Zion is now laying plans for its next well.

at ness, meanwhile, the saga continues with a new cast of characters. The main player these days is Hayseed’s son, Shannon “Sha” Stephens, who took the reins of the company after his father’s death. Sha inherited his father’s bulky build and cowboy style, not to mention his taste for life on the margins of the oil business. Before taking over at Ness in May 2003, he was president of Warrior Resources, a struggling oil and gas company, where he faced allegations that he spent the company’s money on personal expenses and transferred its assets into his own name, according to a lawsuit filed in an Oklahoma District Court. (Sha did not respond to calls seeking comment.)

His first move at Ness was to announce a bold new business plan called the “New Outlook,” which involved expanding the company’s U.S. drilling operations to raise funds for its Israel venture. Shortly afterward, he sold Ness a handful of Texas oil and gas leases for $11.5 million. Most of them, the company later announced, “were lost due to lack of production.”

Like his father, Sha used The Prophecy Club to spread deceptive claims about Ness’ prospects, once telling listeners that the company had enough acreage in Texas for tens of thousands of wells, each bringing in $5,000 a day. With each misleading claim, the stock climbed, and insiders dumped millions of shares. Having milked the venture dry, Sha started folding up the company’s operations in 2006, eventually selling its Texas headquarters that December. In July, Ness was wiped from the corporate register in Washington state, where it was incorporated. Yet even with the company seemingly in its death throes, in September Stephens and crew appointed a British businessman named Anthony Allenby as the new ceo—a move that drove up the stock 350 percent and triggered clauses that board members and executives had added to their contracts a couple of years before, giving themselves large cash payouts in the event of leadership changes. Stephens is in line to receive at least $750,000.

Allenby departed within a month, leaving the company $30 million in the red, with no staff, no offices, and no clear claims to any drilling rights. (During his tenure he declined Mother Jones‘ interview requests, but warned of a “media attack by the enemy” on Ness’ blog. “I see this as part of the Lord’s work to ‘purify’ this Company,” he wrote, “and perhaps even the whole ‘Christian oil business’ in preparation for what He is about to do.”)

And still, devoted stockholders cling to hope. Some have even offered to band together to pay Sha’s salary out of their own pockets if he returns to Ness’ helm. James Cojanis, the San Jose retiree who bought $120,000 of the firm’s stock, says he is thinking of investing another $100,000, a third of his savings. “One of these days the oil is going to come,” he says. “And when it does, Ness’ stock is going through the roof. I have no doubt that it will happen in God’s perfect timing.”