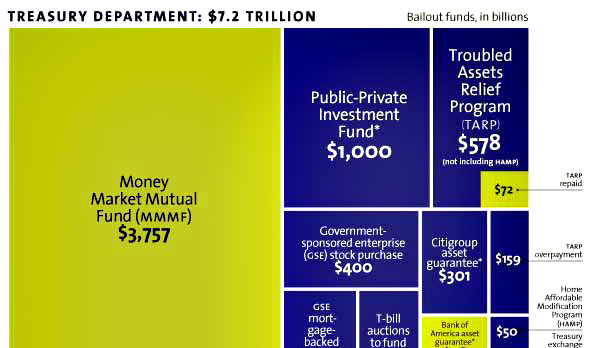

This comes from Nomi Prins, and it’s part of the package of bailout stories in the new issue of the magazine (available at newsstands now!). Click to see the whole chart, which adds up programs from both the Treasury and the Fed. The eventual cost to taxpayers of these programs will be less than $14 trillion, of course, but make no mistake: the value to the banking industry was the whole enchilada. And despite the much ballyhooed repayment of a fraction of the TARP funds, they’re still using most of it.

Mag Promo

Bold. Brave. Beautiful.

Award-winning photojournalism.

Stunning video. Fearless conversations.

Looking for news you can trust?

Subscribe to the Mother Jones Daily to have our top stories delivered directly to your inbox.

Close

Thank you for subscribing!

By signing up, you agree to our privacy policy and terms of use, and to receive messages from Mother Jones and our partners.