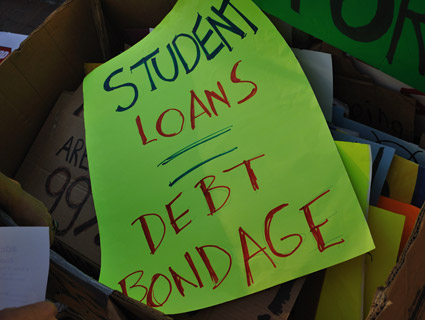

<a href="http://www.flickr.com/photos/nassernouri/5381199773/">Nasser Nouri</a>/Flickr; <a href="http://motherjones.com/photoessays/2011/11/occupy-oakland-shuts-down-port/west-oakland-march">Mark Murrmann</a>

![]() This story first appeared on the TomDispatch website.

This story first appeared on the TomDispatch website.

From Tunis to Tel Aviv, Madrid to Oakland, a new generation of youth activists is challenging the neoliberal state that has dominated the world ever since the Cold War ended. The massive popular protests that shook the globe this year have much in common, though most of the reporting on them in the mainstream media has obscured the similarities.

Whether in Egypt or the United States, young rebels are reacting to a single stunning worldwide development: the extreme concentration of wealth in a few hands thanks to neoliberal policies of deregulation and union busting. They have taken to the streets, parks, plazas, and squares to protest against the resulting corruption, the way politicians can be bought and sold, and the impunity of the white-collar criminals who have run riot in societies everywhere. They are objecting to high rates of unemployment, reduced social services, blighted futures, and above all the substitution of the market for all other values as the matrix of human ethics and life.

Pasha the Tiger

In the “glorious thirty years” after World War II, North America and Western Europe achieved remarkable rates of economic growth and relatively low levels of inequality for capitalist societies, while instituting a broad range of benefits for workers, students, and retirees. From roughly 1980 on, however, the neoliberal movement, rooted in the laissez-faire economic theories of Milton Friedman, launched what became a full-scale assault on workers’ power and an attempt, often remarkably successful, to eviscerate the social welfare state.

Neoliberals chanted the mantra that everyone would benefit if the public sector were privatized, businesses deregulated, and market mechanisms allowed to distribute wealth. But as economist David Harvey argues, from the beginning it was a doctrine that primarily benefited the wealthy, its adoption allowing the top 1 percent in any neoliberal society to capture a disproportionate share of whatever wealth was generated.

In the global South, countries that gained their independence from European colonialism after World War II tended to create large public sectors as part of the process of industrialization. Often, living standards improved as a result, but by the 1970s, such developing economies were generally experiencing a leveling-off of growth. This happened just as neoliberalism became ascendant in Washington, Paris, and London as well as in Bretton Woods institutions like the International Monetary Fund. This “Washington consensus” meant that the urge to impose privatization on stagnating, nepotistic postcolonial states would become the order of the day.

Egypt and Tunisia, to take two countries in the spotlight for sparking the Arab Spring, were successfully pressured in the 1990s to privatize their relatively large public sectors. Moving public resources into the private sector created an almost endless range of opportunities for staggering levels of corruption on the part of the ruling families of autocrats Zine El Abidine Ben Ali in Tunis and Hosni Mubarak in Cairo. International banks, central banks, and emerging local private banks aided and abetted their agenda.

It was not surprising then that one of the first targets of Tunisian crowds in the course of the revolution they made last January was the Zitouna bank, a branch of which they torched. Its owner? Sakher El Materi, a son-in-law of President Ben Ali and the notorious owner of Pasha, the well-fed pet tiger that prowled the grounds of one of his sumptuous mansions. Not even the way his outfit sought legitimacy by practicing “Islamic banking” could forestall popular rage. A 2006 State Department cable released by WikiLeaks observed, “One local financial expert blames the [Ben Ali] Family for chronic banking sector woes due to the great percentage of non-performing loans issued through crony connections, and has essentially paralyzed banking authorities from genuine recovery efforts.” That is, the banks were used by the regime to give away money to his cronies, with no expectation of repayment.

Tunisian activists similarly directed their ire at foreign banks and lenders to which their country owes $14.4 billion. Tunisians are still railing and rallying against the repayment of all that money, some of which they believe was borrowed profligately by the corrupt former regime and then squandered quite privately.

Tunisians had their own 1 percent, a thin commercial elite, half of whom were related to or closely connected to President Ben Ali. As a group, they were accused by young activists of mafia-like, predatory practices, such as demanding pay-offs from legitimate businesses, and discouraging foreign investment by tying it to a stupendous system of bribes. The closed, top-heavy character of the Tunisian economic system was blamed for the bottom-heavy waves of suffering that followed: cost of living increases that hit people on fixed incomes or those like students and peddlers in the marginal economy especially hard.

It was no happenstance that the young man who immolated himself and so sparked the Tunisian rebellion was a hard-pressed vegetable peddler. It’s easy now to overlook what clearly ties the beginning of the Arab Spring to the European Summer and the present American Fall: the point of the Tunisian revolution was not just to gain political rights, but to sweep away that 1 percent, popularly imagined as a sort of dam against economic opportunity.

Tahrir Square, Zuccotti Park, Rothschild Avenue

The success of the Tunisian revolution in removing the octopus-like Ben Ali plutocracy inspired the dramatic events in Egypt, Libya, Yemen, Syria, and even Israel that are redrawing the political map of the Middle East. But the 2011 youth protest movement was hardly contained in the Middle East. Estonian-Canadian activist Kalle Lasn and his anti-consumerist colleagues at the Vancouver-based Adbusters Media Foundation were inspired by the success of the revolutionaries in Tahrir Square in deposing dictator Hosni Mubarak.

Their organization specializes in combatting advertising culture through spoofs and pranks. It was Adbusters magazine that sent out the call on Twitter in the summer of 2011 for a rally at Wall Street on September 17th, with the now-famous hash tag #OccupyWallStreet. A thousand protesters gathered on the designated date, commemorating the 2008 economic meltdown that had thrown millions of Americans out of their jobs and their homes. Some camped out in nearby Zuccotti Park, another unexpected global spark for protest.

The Occupy Wall Street movement has now spread throughout the United States, sometimes in the face of serious acts of repression, as in Oakland, California. It has followed in the spirit of the Arab and European movements in demanding an end to special privileges for the richest 1 percent, including their ability to more or less buy the US government for purposes of their choosing. What is often forgotten is that the Ben Alis, Mubaraks, and Qaddafis were not simply authoritarian tyrants. They were the 1 percent, and the guardians of the 1 percent, in their own societies—and loathed for exactly that.

The Occupy Wall Street movement has now spread throughout the United States, sometimes in the face of serious acts of repression, as in Oakland, California. It has followed in the spirit of the Arab and European movements in demanding an end to special privileges for the richest 1 percent, including their ability to more or less buy the US government for purposes of their choosing. What is often forgotten is that the Ben Alis, Mubaraks, and Qaddafis were not simply authoritarian tyrants. They were the 1 percent, and the guardians of the 1 percent, in their own societies—and loathed for exactly that.

Last April, around the time that Lasn began imagining Wall Street protests, progressive activists in Israel started planning their own movement. In July, sales clerk and aspiring filmmaker Daphne Leef found herself unable to cover a sudden rent increase on her Tel Aviv apartment. So she started a protest Facebook page similar to the ones that fueled the Arab Spring and moved into a tent on the posh Rothschild Avenue where she was soon joined by hundreds of other protesting Israelis. Week by week, the demonstrations grew, spreading to cities throughout the country and culminating on September 3rd in a massive rally, the largest in Israel’s history. Some 300,000 protesters came out in Tel Aviv, 50,000 in Jerusalem, and 40,000 in Haifa. Their demands included not just lower housing costs, but a rollback of neoliberal policies, less regressive taxes and more progressive, direct taxation, a halt to the privatization of the economy, and the funding of a system of inexpensive education and child care.

Many on the left in Israel are also deeply troubled by the political and economic power of right-wing settlers on the West Bank, but most decline to bring the Palestinian issue into the movement’s demands for fear of losing support among the middle class. For the same reason, the way the Israeli movement was inspired by Tahrir Square and the Egyptian revolution has been downplayed, although “Walk like an Egyptian” signs—a reference both to the Cairo demonstrations and the 1986 Bangles hit song—have been spotted on Rothschild Avenue.

Most of the Israeli activists in the coastal cities know that they are victims of the same neoliberal order that displaces the Palestinians, punishes them, and keeps them stateless. Indeed, the Palestinians, altogether lacking a state but at the complete mercy of various forms of international capital controlled by elites elsewhere, are the ultimate victims of the neoliberal order. But in order to avoid a split in the Israeli protest movement, a quiet agreement was reached to focus on economic discontents and so avoid the divisive issue of the much-despised West Bank settlements.

There has been little reporting in the Western press about a key source of Israeli unease, which was palpable to me when I visited the country in May. Even then, before the local protests had fully hit their stride, Israelis I met were complaining about the rise to power of an Israeli 1 percent. There are now 16 billionaires in the country, who control $45 billion in assets, and the current crop of 10,153 millionaires is 20 percent percent larger than it was in the previous fiscal year. In terms of its distribution of wealth, Israel is now among the most unequal of the countries in the Organization for Economic Cooperation and Development. Since the late 1980s, the average household income of families in the bottom fifth of the population has been declining at an annual rate of 1.1 percent. Over the same period, the average household income of families among the richest 20 percent went up at an annual rate of 2.4 percent.

While neoliberalism has produced more unequal societies throughout the world, nowhere else has the income of the poor declined quite so strikingly. The concentration of wealth in a few hands profoundly contradicts the founding principles of Israel’s Labor Zionism, and results from decades of right-wing Likud policies punishing the poor and middle classes and shifting wealth to the top of society.

The Indignant Ones

European youth were also inspired by the Tunisians and Egyptians—and by a similar flight of wealth. I was in Barcelona on May 27th, when the police attacked demonstrators camped out at the Plaça de Catalunya, provoking widespread consternation. The government of the region is currently led by the centrist Convergence and Union Party, a moderate proponent of Catalan nationalism. It is relatively popular locally, and so Catalans had not expected such heavy-handed police action to be ordered. The crackdown, however, underlined the very point of the protesters, that the neoliberal state, whatever its political makeup, is protecting the same set of wealthy miscreants.

Spain’s “indignados” (indignant ones) got their start in mid-May with huge protests at Madrid’s Puerta del Sol Plaza against the country’s persistent 21 percent unemployment rate (and double that among the young). Egyptian activists in Tahrir Square immediately sent a statement of warm support to those in the Spanish capital (as they would months later to New York’s demonstrators). Again following the same pattern, the Spanish movement does not restrict its objections to unemployment (and the lack of benefits attending the few new temporary or contract jobs that do arise). Its targets are the banks, bank bailouts, financial corruption, and cuts in education and other services.

Youth activists I met in Toledo and Madrid this summer denounced both of the country’s major parties and, indeed, the very consumer society that emphasized wealth accumulation over community and material acquisition over personal enrichment. In the past two months Spain’s young protesters have concentrated on demonstrating against cuts to education, with crowds of 70,000 to 90,000 coming out more than once in Madrid, and tens of thousands in other cities. For marches in support of the Occupy Wall Street movement, hundreds of thousands reportedly took to the streets of Madrid and Barcelona, among other cities.

The global reach and connectedness of these movements has yet to be fully appreciated. The Madrid education protesters, for example, cited for inspiration Chilean students who, through persistent, innovative, and large-scale demonstrations this summer and fall, have forced that country’s neoliberal government, headed by the increasingly unpopular billionaire president Sebastián Piñera, to inject $1.6 billion in new money into education. Neither the crowds of youth in Madrid nor those in Santiago are likely to be mollified, however, by new dorms and laboratories. Chilean students have already moved on from insisting on an end to an ever more expensive class-based education system to demands that the country’s lucrative copper mines be nationalized so as to generate revenues for investment in education. In every instance, the underlying goal of specific protests by the youthful reformists is the neoliberal order itself.

The word “union” was little uttered in American television news coverage of the revolutions in Tunisia and Egypt, even though factory workers and sympathy strikes of all sorts played a key role in them. The right-wing press in the US actually went out of its way to contrast Egyptian demonstrations against Mubarak with the Wisconsin rallies of government workers against Governor Scott Walker’s measure to cripple the bargaining power of their unions.

The Egyptians, Commentary typically wrote, were risking their lives, while Wisconsin’s union activists were taking the day off from cushy jobs to parade around with placards, immune from being fired for joining the rallies. The implication: the Egyptian revolution was against tyranny, whereas already spoiled American workers were demanding further coddling.

The American right has never been interested in recognizing this reality: that forbidding unions and strikes is a form of tyranny. In fact, it wasn’t just progressive bloggers who saw a connection between Tahrir Square and Madison. The head of the newly formed independent union federation in Egypt dispatched an explicit expression of solidarity to the Wisconsin workers, centering on worker’s rights.

At least, Commentary did us one favor: it clarified why the story has been told as it has in most of the American media. If the revolutions in Tunisia, Egypt, and Libya were merely about individualistic political rights—about the holding of elections and the guarantee of due process—then they could be depicted as largely irrelevant to politics in the United States and Europe, where such norms already prevailed.

If, however, they centered on economic rights (as they certainly did), then clearly the discontents of North African youth when it came to plutocracy, corruption, the curbing of workers’ rights, and persistent unemployment deeply resembled those of their American counterparts.

The global protests of 2011 have been cast in the American media largely as an “Arab Spring” challenging local dictatorships— as though Spain, Chile, and Israel do not exist. The constant speculation by pundits and television news anchors in the US about whether “Islam” would benefit from the Arab Spring functioned as an Orientalist way of marking events in North Africa as alien and vaguely menacing, but also as not germane to the day to day concerns of working Americans. The inhabitants of Zuccotti Park in lower Manhattan clearly feel differently.

Facebook Flash Mobs

If we focus on economic trends, then the neoliberal state looks eerily similar, whether it is a democracy or a dictatorship, whether the government is nominally right of center or left of center. As a package, deregulation, the privatization of public resources and firms, corruption and forms of insider trading, and interference in the ability of workers to organize or engage in collective bargaining have allowed the top 1 percent in Israel, just as in Tunisia or the United States, to capture the lion’s share of profits from the growth of the last decades.

Observers were puzzled by the huge crowds that turned out in both Tunis and Tel Aviv in 2011, especially given that economic growth in those countries had been running at a seemingly healthy 5 percent per annum. “Growth,” defined generally and without regard to its distribution, is the answer to a neoliberal question. The question of the 99 percent percent, however, is: Who is getting the increased wealth? In both of those countries, as in the United States and other neoliberal lands, the answer is: disproportionately the 1 percent.

If you were wondering why outraged young people around the globe are chanting such similar slogans and using such similar tactics (including Facebook “flash mobs”), it is because they have seen more clearly than their elders through the neoliberal shell game.

Juan Cole is the Richard P. Mitchell Professor of History and the director of the Center for South Asian Studies at the University of Michigan. His latest book, Engaging the Muslim World, is just out in a revised paperback edition from Palgrave Macmillan. He runs the Informed Comment website. To stay on top of important articles like these, sign up to receive the latest updates from TomDispatch.com here.