Illustration by Zohar Lazar

It was the Excel error heard round the world.

In January 2010, as the global economy was slowly beginning to claw its way out of the depths of the Great Recession, the Harvard economists Carmen Reinhart and Ken Rogoff published a short paper with a grim message: Too much debt kills economic growth. They had compiled a comprehensive database of debt episodes throughout the 20th century, and their data told an unmistakable story: Time and again, countries that rack up high debt levels have gone on to suffer years—sometimes decades—of stagnation.

As economics studies go, it was nothing short of a bombshell. As its conclusions were invoked from Washington to Brussels, tackling the recession suddenly became less important than tackling deficits. For the next three years, stimulus was out, austerity was in, and the protests of critics were all but buried amid the headlong rush to slash spending.

But then, on April 15 of this year, a trio of researchers at the University of Massachusetts published a paper that took a fresh look at Reinhart and Rogoff’s study. It turned out there was a problem: R&R had presented data from a list of 20 countries that filled lines 30 through 49 on a spreadsheet. But the formula that calculated the results relied on lines 30 through 44. Oops.

On its own, the spreadsheet error had only a modest effect on the paper’s conclusions, but the UMass team had other, weightier criticisms that taken together called R&R’s conclusions into serious question. Still, under ordinary circumstances the whole thing would have been little more than a dry academic debate.

But these were far from ordinary circumstances. Like a well-aimed snowball that sets off an avalanche, the UMass paper changed everything.

To fully understand the R&R affair, let’s return to that moment in January 2010. Technically, the Great Recession had ended several months earlier. But the economic reality of working Americans remained bleak. The unemployment rate continued to hover near 10 percent. A broader measure that includes discouraged job seekers and those forced to accept part-time work was near 17 percent. GDP was growing again after a disastrous 2009, but at an anemic rate of about 2 percent a year. Wage growth, adjusted for inflation, was actually negative: Salaries were shrinking, and still no one was getting work.

The problem, from an economist’s perspective, was a simple one: The housing bubble had burst, and banks were stuck with enormous losses on their housing-related securities. They desperately needed to sell assets to remain solvent, but when everyone wants to sell all at once, and nobody wants to buy, the result is a death spiral: Falling prices require ever more asset sales, which in turn produce ever steeper price drops and further asset sales. This vicious cycle eventually transformed an ordinary recession into something far more threatening—a banking crisis recession.

Ironically, it was none other than Reinhart and Rogoff who had warned us of this in their magisterial—and sardonically titled—study of financial crises throughout history, This Time Is Different. They found that while government action might rescue broken financial systems fairly quickly (in this latest case via bank bailouts and emergency cash injections by the Federal Reserve), the wider recessions brought on by financial crises typically last a very long time. Five years is hardly unusual.

This wasn’t a counsel of despair. If anything, This Time Is Different should have been taken as a well-timed warning to respond to this recession even more forcefully than usual. What was needed was for the federal government to apply the same urgency to rescuing the economy that it had to rescuing the banks.

No Stimulus For You

In every recent recession, rising government spending provided a backstop to the recovery except this one.

Our general economic problem, after all, was similar to the banking system’s. Everyone suddenly needed to pay down all that debt they had taken on so exuberantly during the bubble. In other words, everyone wanted to save, and no one wanted to borrow or spend. This is a recipe for deep and long-lasting disaster, famously described by John Maynard Keynes as the paradox of thrift: Although it’s normally a virtue for individuals to save money, it brings the economy to a grinding halt when everyone stops spending at once. Factories are shuttered, workers are laid off, and unemployment skyrockets. The only way to avoid the worst is if someone steps in with massive amounts of spending to keep the economy afloat until everyone’s bills are paid down and normal life resumes.

The federal government is the only logical candidate for this rescue operation, and with recovery still perilously weak in 2010, the obvious response would have been a second dose of stimulus spending. But the political world was already moving in the opposite direction. Republicans had voted against President Obama’s first stimulus bill almost unanimously, and there was little reason to think they’d be any more receptive to a second round. Nor was it just Republicans. By the fall of 2009, with the economy still on life support, the Wall Street Journal was already reporting that there was internal disagreement within the White House about whether to push for more stimulus or to begin a pivot toward addressing the country’s mounting deficits. In the end, for reasons both political and ideological, Obama decided that he needed to demonstrate that he took the deficit seriously, and in his 2010 State of the Union address he did just that. “Families across the country are tightening their belts,” he said, and the federal government should do the same. To that end, he announced a three-year spending freeze and the formation of a bipartisan committee to address the long-term deficit.

The Beltway establishment may have applauded Obama’s pivot to the deficit, but much of the economic community saw it as nothing short of a debacle. Sure, there were still a few economists who believed that even in a deep recession government spending merely crowded out private spending and thus did no good, but they were a distinct minority. Most economists acknowledged that deficit spending was appropriate at a time like this. Paul Krugman fumed that Obama was cravenly trying to score political points by doing a “deficit peacock-strut” that would be destructive in the wake of the financial crisis. Mark Zandi, a centrist economist who has advised leaders of both parties, used more judicious language, but likewise warned that spending cuts might “cost the economy significantly in the longer run.”

Triumph of the Deficit Hawks

Annual federal spending deficit (in billions)

It was at this point, with the political world still wavering between stimulus and austerity, that Reinhart and Rogoff waded in with their explosive paper, “Growth in a Time of Debt.” It was couched in the usual sober language of academic economists, but its takeaway was simple: Contrary to conventional economic wisdom—but in keeping with the arguments of tea party Republicans and austerity enthusiasts worldwide—deficit spending actually might hurt rather than help economies recovering from a recession. After an exhaustive review of government debt levels throughout history, they concluded that there was a hard threshold beyond which government debt got so high, it could actually tank the economy. When debt was between 0 and 90 percent of GDP, there was no problem. But when debt exceeded 90 percent of GDP, economic growth was cut in half.

Their paper couldn’t have been timelier if it had been issued as a traffic alert during rush hour. The month it was published, US debt—fueled by two years of recession-starved tax receipts, increased outlays on the unemployed, and an $800 billion stimulus bill—ticked over from 89 percent to 91 percent. Obviously, we were doomed.

The R&R paper, Krugman said, “may have had more immediate influence on public debate than any previous paper in the history of economics.” It’s not that they were the first economists ever to warn of the dangers of deficit spending. There had always been plenty of those. But Reinhart and Rogoff really seemed to deliver the goods. It was no longer a matter of whether deficit spending was helpful in principle—an argument that had been going on for decades and showed little prospect of ever being resolved. Even if it was, they seemed to say, it just didn’t matter. In this particular recession, we were already past the 90 percent danger point where further debt would have disastrous future consequences.

And with that, the trajectory of the next three years was set: It would be austerity as far as the eye could see. Reinhart and Rogoff’s conclusions were featured in newspapers around the world. They were cited by columnists. They testified before Congress. The head of the European Union’s commission on economic policy used their findings to justify sharp spending cuts designed to reduce government debt in Greece, Italy, and Spain.

American deficit hawks were singing the same song. Future VP nominee Paul Ryan warned that a debt level above 90 percent “intensifies the risk of a debt-fueled economic crisis.” Republicans eagerly jumped on the Ryan bandwagon, and frightened Democrats went along. “We’re past the danger zone,” Sen. Kent Conrad (D-N.D.), head of the Senate Budget Committee, said at the time.

The result was predictable: spending cuts and more spending cuts. First came budget deals in 2010 and 2011 that reduced the deficit by $760 billion. Then, in August 2011, Obama struck an agreement with Republicans to resolve the debt ceiling crisis, which produced about $1.1 trillion in spending cuts along with the promise of more from a congressional supercommittee. At the end of 2012, the fiscal-cliff showdown resulted in $850 billion in tax increases and spending cuts. Finally, in March, sequestration cuts (cued up when the supercommittee failed to produce a deal) kicked in, to the tune of another $1.2 trillion. Taken as a whole, these measures have cut the deficit by $3.9 trillion over the next 10 years. And that doesn’t even count the expiration of desperately needed stimulus measures like the payroll tax holiday and extended unemployment benefits.

This was unprecedented, as the chart above shows. After every other recent recession, government spending has continued rising steadily throughout the recovery, providing a backstop that prevented the economy from sliding backward. It happened under Ronald Reagan after the recession of 1981, under George H.W. Bush after the recession of 1990, and under George W. Bush after the recession of 2001. But this time, even though the 2008 recession was deeper than any of those previous ones, it didn’t.

Because most state budgets are required by law to be balanced, it’s normally the job of the federal government to keep spending on an upward path during a recovery. But with federal outlays squeezed by all the budget deals, total government spending peaked in the second quarter of 2010 and then started falling, falling, and falling some more. Today, government spending at all levels—state, local, and federal combined—has declined 7 percent since the publication of Reinhart and Rogoff’s paper.

Along the way, there were plenty of Cassandras who warned that austerity was strangling the recovery in its cradle. They pointed to history: When FDR cut spending too soon in 1937, it famously throttled recovery from the Great Depression. They pointed to economic data: By 2010, we knew that the 2008 recession had been far worse than we thought during Obama’s first month in office, when the initial round of stimulus was passed. They pointed to Europe: Austerity there had crippled the recovery and kept unemployment at stratospheric levels in Greece, Portugal, Spain, and other countries. And they pointed to Ben Bernanke, the Republican-appointed Fed chairman (and Great Depression scholar) who all but begged Congress not to sabotage the recovery with foolish spending cuts.

But nobody was listening. Until April 15. That was when the dam broke.

By itself, the Excel error in the R&R paper was more symbolic than anything else. But by demonstrating that maybe its math shouldn’t be taken as gospel after all, it gave new urgency to broader questions about the 90 percent rule. The day after the UMass study was published, economist Dean Baker of the labor-funded Center for Economic and Policy Research pointed out that although Reinhart and Rogoff showed countries growing more slowly when debt passed 90 percent, it was a very gradual slowdown, not some kind of cliff. What’s more, the paper’s data showed growth slowing down even more sharply when debt increased from 0 to 30 percent. No economist in the world believed that a debt level of only 30 percent had a serious impact on growth. But if the R&R data produced one nonsensical conclusion, could any of their other conclusions be trusted?

And even if their data were right, there had long been a more fundamental question about their analysis. Maybe it wasn’t high debt that caused slow growth in the first place; maybe it was the reverse. Sure enough, UMass economist Arindrajit Dube ran some tests on the R&R data and concluded that it showed strong signs of “reverse causality”: Low growth predicted high debt levels, not the other way around. Miles Kimball and Yichuan Wang of the University of Michigan took an even deeper dive, and their conclusion was similar: High debt levels didn’t seem to have an independent effect on growth rates. “Done carefully,” they wrote, “debt is not damning. Debt is just debt.”

None of this means that countries can simply pile on as much debt as they want. Kimball and Wang, for example, warned that “unless the borrowed money is spent in ways that foster economic growth in a big way, paying it back or paying interest on it forever will mean future pain in the form of higher taxes or lower spending.” In other words, if borrowed money is spent wisely—for example, on roads or electric grids—then it will promote future growth, which makes paying down the debt manageable. If it’s not, high debt might indeed cause future pain.

But that’s a mere caveat. Within reason, what these new studies tell us is that increased national debt simply isn’t likely to cause growth to slow down. In fact, it might be just the opposite. Increasing the debt in a situation like the one we face now might, by spurring a faster recovery, produce lower debt in the long run.

And that’s not all. A prolonged weak economy obviously causes pain in the present—people out of work, wages stagnant, houses foreclosed—but it can also cause permanent damage in the future. Like a cancer that metastasizes when left untreated, unemployment can turn into a vicious cycle for millions of people when it drags on for more than a year or two; because they’ve been out of work for so long, nobody wants to hire them and they end up out of the labor force for good. This is one way in which cyclical unemployment—the normal kind that goes away when an economy recovers—can turn into permanent, structural unemployment.

In some cases it can be even worse. Thanks to massive austerity forced on Spain by the European Union, the unemployment rate there stands at 27 percent. That’s higher than what the United States suffered even in the depths of the Great Recession. Nearly 10 percent of the country has been without work for more than two years. And among the young, the unemployment rate is 57 percent.

Let that sink in for a minute. More than half of the young people in Spain are out of work. The figures are just as bad in Greece, and only modestly less catastrophic in Ireland, Italy, and Portugal. Countries have succumbed to armed revolution—and dragged the world into crisis—for less.

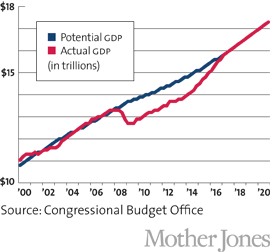

So what has austerity cost us in the United States? The full price is hard to calculate, but the Congressional Budget Office figures that sequestration alone has cut GDP growth by about 0.8 percentage points. Since sequestration accounts for less than half of total belt-tightening over the past couple of years, a rough guess suggests that our austerity binge has cut economic growth by something like 2 percentage points—about half the total growth we might normally expect following a recession. Ironically, this means that we have indeed suffered the halving of economic growth that Reinhart and Rogoff estimated we’d get from running up the national debt above 90 percent. But we got it from not running up the debt.

The chart above illustrates what austerity has done to the economy. Normally, recessions show up as tiny downward blips from the growth trend of “potential” GDP—the size of the economy when it’s operating at full capacity. These blips are quickly erased as the economy returns to its long-term trend. But this time around, our rebound has been agonizingly slow. The CBO now estimates that we won’t return to full capacity until about 2017.

This difference between actual GDP and potential GDP is called the “output gap,” a bloodless term that represents a great deal of real-world pain. If we had spent more in order to close the output gap faster, it would have meant more jobs—perhaps as many as 3 million more—higher wages, healthier retirement accounts, and, ironically, a shrinking deficit thanks to higher tax revenues and lower spending on food stamps, Medicaid, and other programs for the poor.

Our obsession with austerity has hurt us in other ways, too. Interest rates, for example, have been at historic lows for the past four years. Until recently, in fact, real interest rates were actually negative, which means the federal government could have spent money and then paid back less than it borrowed in the first place. This was a once-in-a-generation opportunity to repair our decaying infrastructure at bargain rates: roads, bridges, airports, rail lines, local transit, electrical grids, gas pipelines, internet backbones, and much more.

And doing so would have been a twofer: These are all projects that employ workers now and contribute to higher economic growth in the future. We’re still going to have to perform all this maintenance eventually, but we’ve missed our chance to do it on the cheap.

And that’s not the worst of it. David Stuckler and Sanjay Basu, of Oxford University and Stanford, respectively, have studied austerity episodes both in the past and in other countries, and their conclusion is grim: “Recessions can hurt, but austerity kills.” During the Great Depression, they found, states that implemented New Deal programs most quickly saw significant declines in infectious diseases, child mortality, and suicides. Their findings were similar for the periods following the fall of communism, the Asian financial crisis of 1998, and the current recession. In every case, austerity programs were literally life-threatening for the poor and unemployed.

The obvious question at this point is: Why? It’s not as if we needed the skills of Nostradamus to predict the consequences of austerity. It’s pretty much textbook economics. Surely Reinhart and Rogoff aren’t entirely to blame for Washington’s perplexing decision to ignore Econ 101 and instead commit America to a self-defeating war on the deficit?

Of course not. Their paper was, after all, just another paper. It could only have the impact it did if it told people something they wanted to hear in the first place. But again: Why?

This transports us from the realm of academic economics into the realm of political speculation. But we can certainly speculate. Among Republicans, one obvious explanation is that austerity provides a handy excuse for cutting social spending that they’ve never approved of in the first place. (And—though no one will admit this in polite company—they probably found it pretty easy to talk themselves into opposing anything that might have given President Obama a growing economy to campaign on in 2012.)

What else? John Maynard Keynes thought of the economy as a simple machine: When a car has trouble starting, we don’t lecture it, we just fix the car. Likewise for the economy. But plenty of people find this unsatisfying. They think of economics as a morality tale: We’ve been on a binge, and now we need to pay the piper.

Other people rely on folk wisdom: Households have to tighten their belts when times are bad, so the government should too. Even Obama fell into that trap during his pivot to the deficit in 2010. But this is one of the most destructive bits of economic folklore ever to enter common circulation. The truth is exactly the opposite; the proper role of the federal government is to be countercyclical. When households and businesses are all cutting back at once, Congress needs to be the spender of last resort to keep the economy from falling even further into recession.

Adding even more momentum to these misconceptions is simple self-interest, since plenty of people have something to gain from austerity. Chief among them are creditors like banks and pension funds, which tend to be single-mindedly hostile to the risk of deficit-fueled inflation eating away at the value of their earnings, even if it means tolerating an extended recession. The finance industry also tends to like the political focus on austerity because it diverts attention from the market excesses that caused the banking crisis in the first place.

In other words, Reinhart and Rogoff were pushing on an open door. There were lots of powerful actors—Pete Peterson, Grover Norquist, the Washington Post editorial page—ready to leap at the chance to pretend that their pursuit of austerity was motivated not by politics or self-interest, but merely by a virtuous desire for economic growth. The 90 percent paper provided them that cover.

So have we learned our lesson from all this? Of course not. No further stimulus is even remotely on the table, either in the United States or in Europe, and Republicans are already promising another debt ceiling crisis unless Obama agrees to yet more spending cuts. The inmates took over the asylum three years ago, and they show no sign of leaving.

Austerity is working out fine for the 1 percent: Their jobs are safe, their investments are growing, and their taxes are low. But the rest of us are paying a high price in the form of slow growth, high unemployment, and stagnant wages for years to come. All things considered, we’ve been remarkably tolerant of our fate. The folks who run the world might do well to ponder how long that’s going to last.