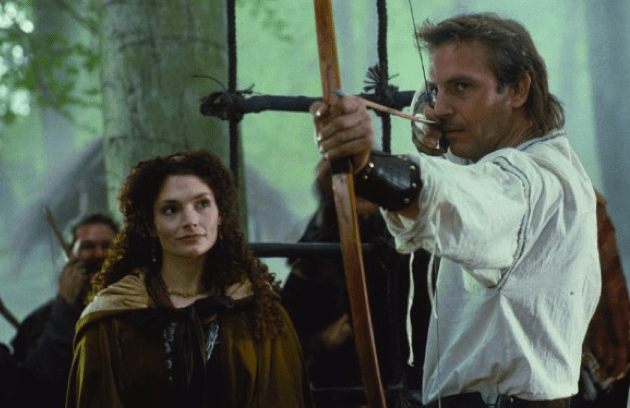

Kevin Costner in Robin Hood: Prince of Thieves.<a href="http://www.imdb.com/media/rm1932046336/tt0102798">IMDB</a>

Congress resolved the shutdown and debt ceiling crisis (for now) by agreeing to hash out a budget agreement by mid-December. Already, hopes are dim. Budget experts say that if any deal at all is worked out to replace the deep budget cuts that went into effect in March, the most likely outcome will be a short-term plan involving slightly less severe spending cuts—but with no new revenue, a big Democratic priority. Now, several prominent economists, along with a coalition of labor, health, and community groups are pushing progressive lawmakers to aim higher, calling for what they term a “Robin Hood tax” on the rich.

On Wednesday, economist Jeffrey Sachs briefed members of Congress on the Robin Hood tax, also known as a financial transaction tax, which would charge Wall Street investors a fraction of a penny on the dollar value of each trade they make. Given the mind-boggling number of trades that occur each day, the tax could rake in as much as $700 billion a year. That would increase federal revenues by about 24 percent.

“We are calling on Congress and the White House to refocus on a human needs budget, not just an endless cycle of more austerity and more cuts,” says Karen Higgins, RN, co-president of National Nurses United, one of the groups backing the tax. “We need the Robin Hood tax.”

Also joining the campaign are Robert Pollin, a leading expert on the financial transaction tax; Wally Turbeville, a fellow at the think tank Demos and a former Goldman Sachs investment banker; and Anni Podimata, the vice president of the European Parliament. (Eleven EU nations are already implementing the tax.) The Robin Hood tax campaign is backed by over 160 local and national organizations, including the National Nurses United, Friends of the Earth, and National People’s Action.

It seems unlikely that the gridlocked Congress will impose the tax anytime soon, but the groundwork is already in place: Rep. Keith Ellison (D-Minn.) has authored a bill seeking to establish it.