<a href="http://www.shutterstock.com/pic-192807818/stock-photo-real-estate-agent-handing-over-the-house-keys-in-front-of-a-beautiful-new-home-and-for-sale-real.html?src=PkM_PvzfwdoKIkZ1rsnPuQ-1-24">Andy Dean Photography</a>/ShutterStock

This story first appeared on the TomDispatch website.

Security is a slippery idea these days—especially when it comes to homes and neighborhoods.

Perhaps the most controversial development in America’s housing “recovery” is the role played by large private equity firms. In recent years, they have bought up more than 200,000 mostly foreclosed houses nationwide and turned them into rental empires. In the finance and real estate worlds, this development has won praise for helping to raise home values and creating a new financial product known as a “rental-backed security.” Many economists and housing advocates, however, have blasted this new model as a way for Wall Street to capitalize on an economic crisis by essentially pushing families out of their homes, then turning around and renting those houses back to them.

Caught in the crosshairs are tens of thousands of families now living in these private equity-owned homes. For them, it’s not a question of economic debate, but of daily safety and stability. Among them are the Cedillos of Chandler, Arizona, a tight-knit family in which the men work in construction and the oil fields, while the strong-willed women balance their studies with work and children, and toddlers learn to dance as early as they learn to walk. Their story of a private equity firm, a missing pool fence, and the death of a two-year-old child raises troubling questions about how, as a nation, we define security in housing and why, in the midst of what’s regularly termed a “recovery,” many neighborhoods may actually be growing increasingly vulnerable.

A Buying Frenzy

In early August 2013, the Cedillo family threw a pool party at their house in Chandler. It was the sixth birthday of Brenda Cedillo’s son, Jesus, and the family gave him a Batman-themed celebration, complete with a piñata in the driveway and a rented waterslide for the small pool in the backyard. Brenda, her brother Bryan, and her sister Christine had signed a one-year lease on the two-story structure three weeks earlier, which made the party special. It was the first family celebration that could be held in a house.

“We’ve always lived in apartments, apartments, apartments,” said Christine.

The three of them were excited to find a place they could afford that was big enough for their children, Christine’s partner Javier, and their parents Olga and Jesus. Christine’s oldest daughter, two-year-old Zahara, was so close to Brenda’s son that the two called each other brother and sister.

The only worry during the party was the pool, carefully monitored by the adults. Being unfenced, it had been a source of stress since they moved in. Repeated requests to the management company overseeing the property that one be installed had resulted in nothing. The Cedillos had no idea that the house’s real owner was a private equity firm called Progress Residential LP. It had been founded in 2012 by Donald Mullen, a former Goldman Sachs partner, and Curt Schade, a former managing director at Bear Stearns, an investment bank that collapsed in 2008. Progress was financed by a $400 million credit line from Deutsche Bank.

The same month that the family rented the house at 1471 West Camino Court, Progress Residential purchased more homes in Maricopa Country than any other institutional buyer. Nationally, Blackstone, a private equity giant, has been the leading purchaser of single-family homes, spending upwards of $8 billion between 2012 and 2014 to purchase 43,000 homes in about a dozen cities. However, in May 2013, according to Michael Orr, director of the Center for Real Estate Theory and Practice at the W. P. Carey School of Business at Arizona State University, Progress Residential bought nearly 200 houses, surpassing Blackstone’s buying rate that month in the Phoenix area.

The condition and code compliance of these houses varies and is rarely known at the time of the purchase. Mike Anderson, who works for a bidding service contracted by Progress Residential and other private equity giants to buy houses at auctions, was sometimes asked to go out and look at the homes. But with the staggering buying rate—up to 15 houses a day at the peak—he couldn’t keep up. “There’d be too many, you couldn’t go out and look at them,” he said. “It’s just a gamble. You never know what you’ve got into.”

The House on West Camino Court

The two-story house that would soon become the Cedillo family’s home was in fine structural condition when the family signed the lease. It hadn’t sat vacant for long. Earlier that year, the former owner, Lloyd Carter, sold the house to avoid foreclosure after realizing that he owed $100,000 more on his mortgage than the house was worth. (“I didn’t even know who they sold it to,” Carter told me. “The title agency just sent the documents with the courier and met me at a Starbucks.”)

There were a number of small rehab issues: a cockroach infestation, oil that had spilled in the driveway, and a sloppy paint job. Christine recorded some of these problems and others on a walk-through inspection, but she wasn’t overly troubled. “All I was looking for was a place big enough for us to be together,” she said. Until then, she had been living in her parents’ apartment in Tempe with Zahara and her younger daughter Elysiah.

The one serious problem was the lack of that pool fence. Before the family moved in, Christine asked the Golba Group, the property management company hired by Progress to lease and maintain many of its houses, to install one. As she recalls, Lacey, the property agent, left for a moment and when she returned “said they weren’t going to put it up.” Christine offered to cover the cost and was informed that the family could install their own barrier, but only if it didn’t affect any of the landscaping and wasn’t fixed to any permanent structures, which to Christine sounded impossible.

The next week, the family moved in, increasingly nervous about the fenceless backyard, especially since they were unsure what steps they could legally take as renters. Christine’s father began collecting wood to build a barrier on the patio and the family agreed on a safety plan: both front and back doors were to remain locked at all times, and multiple adults had to supervise the children if they were outside. Christine says she called the company another time to ask for a fence, again offering to cover the cost.

Golba claims it has no record of these requests. Lacey (who declined to share her last name) said she doesn’t remember the Cedillos, no less whether they requested a fence. “If you knew the amount of properties we had,” she told me by phone. “It was over a year ago.”

The Private Equity Business Model

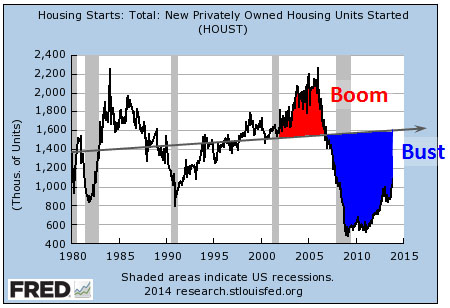

Global private equity firms have not been, historically, in the business of dealing with pool fences and the other hassles of maintaining single-family houses. But following the housing market collapse, the idea of buying a ton of these foreclosed properties suddenly made sense, at least to investors. Such private-equity purchases were to make money in three ways: buying cheap and waiting for the houses to gain value as the market bounced back; renting them out and collecting monthly rental payments; and promoting a financial product known as “rental-backed securities,” similar to the infamous mortgage-backed securities that triggered the housing meltdown of 2007-2008. Even though the buying of the private equity firms has finally slowed, economists (including those at the Federal Reserve) have expressed concern about the possibility that someday those rental-backed securities could even destabilize—translation: crash—the broader market.

Since Wall Street was overwhelmingly responsible for the original collapse of the housing market, many have characterized these new purchases as a land grab. In many ways, Progress CEO Donald Mullen is the poster-child for this argument. An investment banker who enjoyed a brief flurry of fame after losing a bidding war to Alec Baldwin at an art auction, he was the leader of a team at Goldman Sachs that orchestrated an infamous bet against the housing market. Known as “the big short,” it allowed that company to make “some serious money” when the economy melted down, according to Mullen’s own emails. (They were released by the Senate Permanent Subcommittee on Investigations in 2010.) As Kevin Roose of New York magazine has written, “A guy whose most famous trade was a successful bet on the full-scale implosion of the housing market is now swooping in to pick up the pieces on the other end.”

Since Wall Street was overwhelmingly responsible for the original collapse of the housing market, many have characterized these new purchases as a land grab. In many ways, Progress CEO Donald Mullen is the poster-child for this argument. An investment banker who enjoyed a brief flurry of fame after losing a bidding war to Alec Baldwin at an art auction, he was the leader of a team at Goldman Sachs that orchestrated an infamous bet against the housing market. Known as “the big short,” it allowed that company to make “some serious money” when the economy melted down, according to Mullen’s own emails. (They were released by the Senate Permanent Subcommittee on Investigations in 2010.) As Kevin Roose of New York magazine has written, “A guy whose most famous trade was a successful bet on the full-scale implosion of the housing market is now swooping in to pick up the pieces on the other end.”

A Child’s Death

Unlike her cousin Jesus, two-year-old Zahara was afraid of the pool. She was much more likely to be found dancing in front of the television, or eating vegetables, which were—to her family’s surprise—her favorite food. She loved ketchup, and once disgusted her aunt Brenda by dipping her entire hand into the ketchup bowl at a restaurant and licking the condiment off her fingers. Describing herself as someone who “loves firsts,” Christine saved everything about her daughter’s life from her positive pregnancy test to the certificate she received for volunteering at Zahara’s Early Head Start program.

Tod Stewart, Christine Cedillo’s lawyer, remembers being shocked by the number of keepsakes the family had collected over Zahara’s short life. “I asked her for some pictures of Zahara,” Stewart told me, “and Christine sent me 1,200 photos.”

About a week before Zahara’s death, Christine reached out to her daughter’s Head Start teacher to inquire about swimming lessons. The girl still showed an extreme aversion to the pool, but Christine wanted to be careful. That birthday party weekend was, according to family members, the moment when her fear of the water must have evaporated, because that following Wednesday, while Christine was at work and Zahara was at home recovering from a fever with her grandmother Olga, the toddler crawled out through a doggie door and found her way into the pool.

“I literally went into shock,” says Christine after she got a call from Olga at the Subway outlet where she and Brenda worked. “I took off my apron and sped off to the hospital.”

Multiple Violations

As far as legal liability goes, Arizona pool laws are not very complicated.

If a property is out of compliance with city or state codes, the responsibility for possible injuries or death, such as a drowning, falls on the owner of the property—especially when the injured party is a minor. Reviewing photos of the West Camino house taken by the police and investigators, Doug Dieker, a personal injury lawyer in Scottsdale, explained that the place was clearly “in violation of city code.”

If an interior fence around a pool is lacking, city code requires one of three precautions: the doors with pool access need to be self-latching and self-closing; there needs to be a power cover for the pool; or there needs to be audible alarms on all the doors. None of these three things existed at the house at the time of the drowning, according to both photo evidence and testimony from the family.

Dieker, who has worked on a similar wrongful death case in which a 16-month-old child drowned in a pool in neighboring Glendale after crawling through a doggie door, explained, “Anytime you rent to a family with small children, the duty under Arizona law is that the landlord needs to take the precautions of a reasonably prudent person.”

As he reviewed the photos, he added, “The outside fence is in violation of city code, also.”

Not “Traditionally Correct” Practices

When Christine arrived at the hospital, Zahara was hooked up to a breathing tube and her stomach was dramatically inflated. Javier, who works in construction, was out of town on a job. Christine called to tell him to come home, now. The doctors informed her that even if they could get Zahara to breathe again, she would have suffered serious brain damage. Christine said she just wanted her daughter alive, so the doctors continued trying to resuscitate her.

“They were pressing and pressing on her and I said, ‘Just leave her alone,'” was how Christine described her daughter’s final moments. “We said a prayer and the priest blessed her body and I just fell on the floor and started crying.”

The family returned from the hospital and began a nine-day mourning period, but Christine didn’t stay idle for long. Brenda remembers that her sister almost immediately began attending to the preparations for her daughter’s funeral. In the process, as Christine tells it, she called Golba to let the company know what had happened. Rather than receive condolences, she was told to submit a police report.

Christine began researching the city building codes and laws on the subject, only to find herself shuttled from one agency to the next. “On the City of Chandler website, I looked up code enforcement,” she recalled. “I called a couple of times. It was very confusing; when I called code, they said to call [the Department of] Buildings. And when I called Buildings, they told me to call code.”

Finally she went down to the code office and told one of the inspectors how her daughter had died. She wanted to know if there was a violation at the house and, if so, how to report it. The inspector took her number and scheduled a time to come inspect the house. Instead, he called back that afternoon and left a voicemail suggesting that Christine call the Department of Buildings. When she recounted the exchange with Golba and the frustration with the city to the funeral director at Zahara’s service, Christine was advised to find herself a lawyer.

In a phone interview, Scott Golba, cofounder of the Golba Group, claimed that issues like drownings or code violations are not common at the investor-owned homes his company has managed. (Pool drownings in Maricopa County, it should be noted, are remarkably common; 10 children have drowned there so far in 2014, according to Children’s Safety First.)

Golba did, however, suggest that Progress’s need to achieve a high rate of returns for its investors had brought a financial pressure previously unheard of to the single-family rental market. “Institutional owners want to know, ‘How much money did I make on every single square foot? How much money did I have to put in capital wise, and how much money did I make on that capital?’… It’s all about spreadsheets when it comes to institutional owners.”

For Progress and other institutional investors, so far the returns on their single-family rental homes haven’t always proved to be a happily-ever-after story. Last summer, another private equity firm, American Homes 4 Rent, fired a number of its employees after posting losses. In February, data showed that the rents Blackstone was collecting from 3,207 houses that together made up the collateral for the first-ever “rental-backed security” had declined by 7.6%. “Single-family landlords have struggled to turn a profit while acquiring homes faster than they can fill them with tenants,” Bloomberg News reported last August.

Scott Golba explained that sometimes this gap between anticipated profits and actual ones led companies like Progress to skirt the rules to increase returns. “Initially they have to sell to their stockholders a certain dollar amount, and if it doesn’t come to that, when everything’s said and done, if they can’t make that much money out of the home, they have to explain that to their stockholders or the bank they lend to.”

“On the negative side,” he continued, “they’ll try to raise the rents or do something that isn’t traditionally correct to save money—or I should say, to make more money out of the property.”

The Fence

In the spring, while Christine and Javier were still coping with their grief, the Cedillos moved out. “We’ve got to learn to live without her for the rest of our lives,” Christine told me.

Zahara’s death affected other family members as well. Olga remained heartbroken, while Brenda felt the stress of keeping the family together, even as she held down a full-time job, finished her junior year of college, and cared for Jesus, who grew increasingly withdrawn and angry at school. At the cemetery, Christine remembers the six-year-old exclaiming, “It’s just so stupid! Why couldn’t they just put up a fence?”

In fact, more than three months after the drowning, Progress did finally approve and pay for the installation of a fence at the house. But even that didn’t go according to plan because the fence was initially installed next door, at 1461 West Camino Court. (That home’s owner, Michael Hoard, remembers returning home to find an unexpected barrier in his backyard. “I got back Saturday, went outside, and there was a pool fence that I hadn’t asked to be installed. Two or three days later, I got back from work and it was gone.”)

Christine and Jesus are now preparing to file a wrongful death suit against Progress. So far, they’ve refused to put down a dollar amount on the compensation they would accept. Instead, they want to see local laws enacted that would require institutional investors like Progress to have their houses inspected to ensure that they are in compliance with local ordinances. “I just want this not to happen to someone else,” said Christine. Employees from Progress’s Scottsdale office did not return repeated requests for comment.

Rob Call, a graduate student in the department of Urban Planning at MIT, has researched institutional investor homes in Atlanta. What he’s found is that the sort of vulnerability experienced by the Cedillos is a distinguishing feature of the wave of private-equity ownership. “I see it as a business model that is anti-community control.” He sees the logic behind the private equity push into the rental market—essentially using housing as a “wealth extraction tool” from communities—as similar to the one lenders and mortgage companies employed in the years leading up to the 2007-2008 crash.

“If Wall Street is involved and willing to dump $20 billion into something, it’s because they think they can, and they plan on making a bunch of money on it,” he says. “Last time they got involved in housing, that’s exactly what they did. And then everything came crashing down.”

In the meantime, the Cedillos tend to a grave instead of a child, sad proof of what might be called “rental-backed insecurity” in a new American housing world.

TomDispatch regular Laura Gottesdiener is a journalist and the author of A Dream Foreclosed: Black America and the Fight for a Place to Call Home. She is an editor for Waging Nonviolence and has written for Playboy, Al Jazeera America, RollingStone.com, Ms., the Huffington Post, and other publications. To stay on top of important articles like these, sign up to receive the latest updates from TomDispatch.com here.