President Donald Trump has vowed to dismantle the Affordable Care Act (ACA)?—?a move that could leave some 30 million Americans without health insurance. ACA literally sustains millions of lives?. Without the health insurance it provides, many people wouldn’t have access to medicine and procedures that they need to survive. When we asked people on Twitter and through healthcare advocacy organizations to share their stories of how ACA keeps them alive, we were overwhelmed with responses. We heard from people waiting for organ transplants, from cancer survivors, from people with debilitating mental illness, and more. They told us about the toll that disease has taken on their lives: Before the ACA, some were forced to skip treatments because of the price; others couldn’t get insurance at all because they were already sick. Here are a few of their stories.

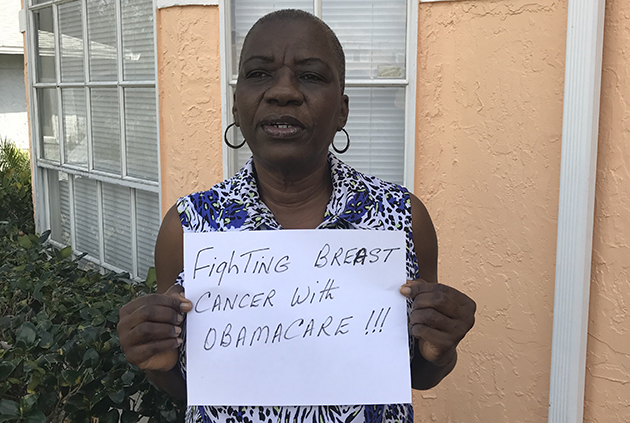

Claudette Williams, 58, Orlando, Florida: I lost my job in 2005. After that I decided to purchase a policy. I found them online. They had a gentleman come to my house, and we talked about my blood pressure medications. The insurance was almost twice what they had quoted me because of the medication, and also because of my condition. I eventually couldn’t afford it any more. I was uninsured, except for one year when I qualified for Medicaid. I ended up in the emergency room on a few occasions for heart trouble. I also developed diabetes. I couldn’t afford to have regular mammograms. In 2014 I signed up for Obamacare. I was diagnosed with breast cancer in September of last year. The lumpectomy alone was billed at $40,000. I have four more chemo sessions to go, and after that, I have to do radiation. Luckily my cancer is only a stage one, so my prognosis is pretty good. But it is really scary thinking about my insurance being taken away. This is a fight for my life.

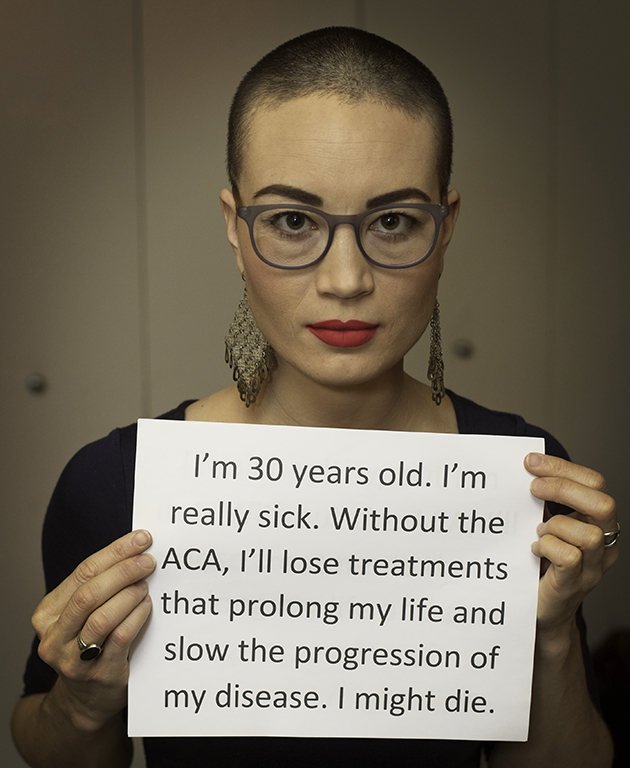

Charis Hill, 30, California: When I was 25, in 2012, I had a series of unexplained and undiagnosable respiratory challenges that felt like the flu or bronchitis or pneumonia. Doctors just couldn’t figure out what was wrong with me. My condition got worse and worse. I visited urgent care a few times. I thought I was having a heart attack once. They tried to blame it on anxiety.

Eventually reached out to my dad, who was estranged from me. I knew that he had a severe health condition. The first words out of his mouth were, it sounds like you have what I have, which is ankylosing spondylitis (AS). I knew that I would need health insurance to be treated. But if I were to get a diagnosis before getting health insurance, I would have the preexisting condition working against me. So I got the cheapest plan that existed. I wasn’t getting all the tests done or getting all the treatments. Then, ten months later, the ACA was implemented, and because of my income, I was eligible for a subsidy to purchase health insurance on the exchange in California. I got a better plan for less than I was paying before, which meant that I could access more treatment and not skip medication.

I have infusions of a drug every eight weeks. I have to go to an infusion center for 2.5 hours. There’s no generic. There’s no way to get those treatments unless I have insurance. They slow down the progression of my disease. I also take anti-inflammatory medications orally. AS is a severe inflammatory condition. It primarily affects the spine. It causes a lot of pain and fatigue from the body trying to fight that inflammation. I’m permanently disabled. I was a college athlete, and now I’m not even able to run. I use a wheelchair sometimes. As hard as I fight to be healthy, I’m never going to be healthy, and I’m always going to have to rely on the medical system to keep me alive.

John Weiler, 27, Oakland, California: I got HIV when I was 19. When I was in college, I was on my parents health insurance, so when I started meds when I was 21, I took it for granted that I was going to have insurance that would cover it, because it was so easy. When I went to grad school, I naively accepted a position without asking any questions about how the insurance was structured. When you do a science PhD, it’s typical for the school to pay your tuition, pay your health insurance premium, and give you a stipend. In my program, the stipend is about $30,000 a year. So when I enrolled and started to look at my insurance situation, I realized the policy offered to students provided up to $10,000 worth of prescription coverage per academic year, and that was it. But in 2013, the student government got together and petitioned the university to change across the UC system. The students basically said, ‘We don’t care if our insurance premiums are higher, we don’t want these things that the ACA offers to not be part of the insurance plan for the school.’

I was on a med cocktail called Complera, and that one was $22,000 a year. HIV meds are super expensive. I switched to a different medication since then, called Stribild, and I don’t know exactly what it is this year, but if I remember correctly, that one was closer to $27,000 a year.

I’m about to graduate and find a job, and, let’s say worst case scenario, first Congressional session they manage to totally gut the ACA and revert to how things were before. If that were to happen and I were to get a job, it would be totally legal for an employer to be like, ‘Hey, yeah, we’re not covering this.’ I’d be looking at close to $35,000 a year in medical expenses just for maintenance, let alone if I got sick.

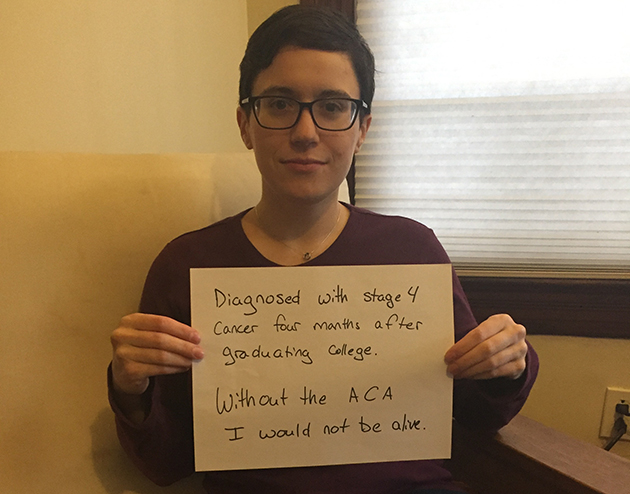

Ruth Linehan, 26, Portland, Oregon: I graduated college in May 2012. I was 22. About a month later, I started an internship as a software developer at a Portland startup. Thanks to ACA I was on my parents’ insurance. After four months I was offered a full time job, but the insurance didn’t start until 6 weeks after my first day as an employee. On my first day I was diagnosed with Burkitt’s Lymphoma. I looked like I was 7 months pregnant. I started chemo the day after I was hospitalized. This is an incredibly fast-growing cancer. I was in the hospital for seven weeks. I received about four rounds of chemo. After four months I was declared in remission. I continue to be in remission. The hospital bills were about half a million dollars. I only had to pay about $10,000 because I was on my parents’ insurance.

If I lose my job and the cancer comes back, what am I going to do? I worry about illness down the road. I’ve had cancer at a very young age and a lot of very harsh chemo. I worry that I won’t be able to get affordable insurance, or get insurance at all.

Larry Sterlingshires, 35, Tennessee: I have a condition called hidradenitis surruptiva—look it up, do not look at pictures, because it’s not a good time—it’s a chronic skin condition that’s ultimately debilitating. As it progresses, it causes tissue degradation on the skin layer that doesn’t heal, like normal wounds do. Sometimes it creates lesions that don’t heal for a year and half. It’s debilitating because it’s painful—the tissue underneath is exposed without that protective layer, so it bleeds regularly. You have to keep everything patched and bandaged, and it easily gets infected. But because of the ACA, I can have medication that can’t completely undo the symptoms, but it seems to have halted its progression, and even promoted some healing. Complications related to the tissue damage and infections can be fatal.

The medications I’m on right now, in addition to just my normal medications for diabetes and hypertension, will help me survive longer. This lets me afford something called Claravis, and another medication called Humira. Humira runs approximately $7300 a month, and the Claravis is about $4000 a month. Those basically keep me functional without being completely disabled. That’s no exaggeration. If you check the disability schedule, it’s so painful and considered debilitating enough that you can qualify for full disability with it. The Affordable Care Act covers all of that medication in full. I come from poverty, I’m just now getting used to having insurance for the first time in my adult life, and now that seems like it might evaporate.

Debbie Lynn Smith, 59, Las Vegas, Nevada: I was a TV writer and producer. In 2000 I was diagnosed with bronchiolitis obliterans. It’s also called popcorn lung. I got it from buttered popcorn. When you work in TV, you work 15 hour days. They provide snacks and things. Microwave popcorn is one of the things they give you. I ate a lot of it. It just so happened that I was susceptible to this disease.

I was in remission for 16 years, but I was living with 50 percent of my lung capacity. I couldn’t do TV anymore, couldn’t put in those long hours. I really had a hard time working and being reliable because I would get sick. So I couldn’t get insurance through work. I had insurance through the high-risk California program and I was paying $2,000 a month for that. My husband was on it, too, he had prostate cancer. We moved to Nevada. When the ACA came around we were ecstatic. We were both out of work at the time, so we went on ACA.

This year, in April, my disease came out of remission. I am now down to 30 percent of my lung capacity and waiting for a lung transplant. So you can imagine the fear I have—being so close to getting a transplant—that they might repeal the ACA right away, and I will no longer have access to insurance, and I won’t be able to get my transplant. I am extremely stressed. I was so stressed before the election that I could not take anything else. I was working for Hillary and I ended up in the hospital.

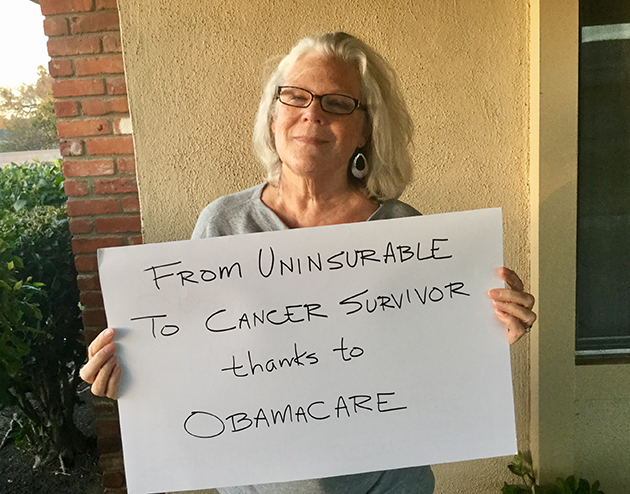

Michele Munro, 64, Southern California: I was first diagnosed with breast cancer in 1997. I was 44. I was a single mom with two boys. I had Kaiser insurance. It wasn’t a bad cancer, and we caught it early. Then seven years later I was diagnosed with a different type of breast cancer. That was 2004. I also had a hip replacement. The Kaiser premium doubled, so I went without insurance for the first time in years. I was working as a freelancer, and insurers told me I was uninsurable. In 2011, ACA started to kick in. It was not allowing insurance companies to consider preexisting conditions. I applied and was accepted into Aetna. The first thing I did was go for a mammogram, and, sure enough, I had a triple–negative tumor. Very aggressive. It was small and early, so we caught it just in time. I had a double mastectomy and chemotherapy and breast reconstruction, all covered through ACA. I went into the hospital seven times total for infections. The billing was $900,000. Aetna settled and paid out $180,000.

I’m feeling really good right now because December was the fifth anniversary of being cancer-free. I exercise a lot. I’m doing everything I can on my end. But there is only so much you can do. I’m scared for myself, and also for my children. My parents had to claim bankruptcy for health insurance reasons. They were not covered for a medical emergency.

Suzanna Moore, 29, Fairfield, Iowa: When I was a baby, I had a stroke. I recovered well, but I would always have issues afterward. Throughout my childhood, it always a concern if I would have proper health care. I grew up in a pretty poor family in New England. With Obamacare, I went to an orthopedist for the first time in forever and got a prescription for orthotics to alleviate chronic pain in my knees and ankles on one side, because my right side was affected more from the stroke than my left side. The pain built up for a while, but basically throughout my twenties, I was never able to get it addressed, because I was living on my own in Tennessee and was unable to focus any money toward my personal health care.

I also had a meniscus tear during that time. Had I had surgery on that on my own, it would have been like $15,000 or more. With Obamacare, we still had to prioritize, but we didn’t go in debt over it.

My husband has a rare condition called achalasia, which means the muscles in his throat stopped working the way they were supposed to, so he had trouble swallowing and eating. He had to force food down his esophagus with air and water. After a while, it got so painful that he was eating less and he was losing weight rapidly. It was hindering his quality of life, and, left untreated, it could contribute to throat cancer. So he had to have surgery about eight months after I had my knee surgery. We were able to afford all of it. We wouldn’t have been able to do that without Obamacare.