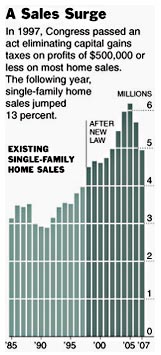

CAPITAL GAINS….Today, the New York Times reports that the housing bubble was partly fueled by tax changes in 1997 that eliminated capital gains taxes on home sales:

CAPITAL GAINS….Today, the New York Times reports that the housing bubble was partly fueled by tax changes in 1997 that eliminated capital gains taxes on home sales:

The different tax treatments gave people a new incentive to plow ever more money into real estate, and they did so….By itself, the change in the tax law did not cause the housing bubble, economists say. Several other factors — a relaxation of lending standards, a failure by regulators to intervene, a sharp decline in interest rates and a collective belief that house prices could never fall — probably played larger roles.

But many economists say that the law had a noticeable impact, allowing home sales to become tax-free windfalls. A recent study of the provision by an economist at the Federal Reserve suggests that the number of homes sold was almost 17 percent higher over the last decade than it would have been without the law.

Of course, that’s not the only thing the 1997 law did. It also reduced the general capital gains rate from 28% to 20% just as the dotcom boom was taking off, helping turn that into a monstrous bubble too. Nice work, Washington!