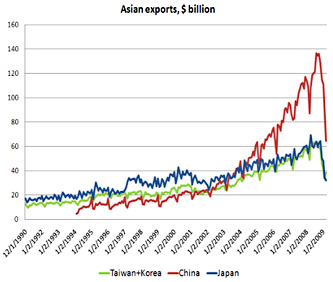

From Brad Setser, who notes that “much of the expansion of global trade over the last decade…rested on a weak foundation.” In particular, countries like China and Japan and Germany exported too much and countries like the United States and Great Britain consumed too much. Since this needs to change in the long term, you’d like to see the surplus countries running bigger stimulus programs than the deficit countries, but that’s not what’s happening:

From Brad Setser, who notes that “much of the expansion of global trade over the last decade…rested on a weak foundation.” In particular, countries like China and Japan and Germany exported too much and countries like the United States and Great Britain consumed too much. Since this needs to change in the long term, you’d like to see the surplus countries running bigger stimulus programs than the deficit countries, but that’s not what’s happening:

Big external deficit countries like the US and the UK are going to run fiscal deficits of between 8 and 10% of their GDPs, while the deficit in surplus countries like China and Germany remains between 3 and 4% of their GDPs.

….All in all, fiscal policy clearly is being used to support global growth, as it should be. The fall in exports globally in February leaves no doubt that there is an enormous shortfall of demand, relative to the world’s capacity to produce. But the global decomposition of the stimulus doesn’t suggest that it will do much to support “rebalancing.” The surplus counties generally aren’t leading the stimulus league tables.

Something more for Obama and Geithner to talk about at the upcoming G20 meeting.