Via Jonah Goldberg, AEI’s Mark Perry reaches deep into his bag of greatest hits and hauls out the chart on the right:

Via Jonah Goldberg, AEI’s Mark Perry reaches deep into his bag of greatest hits and hauls out the chart on the right:

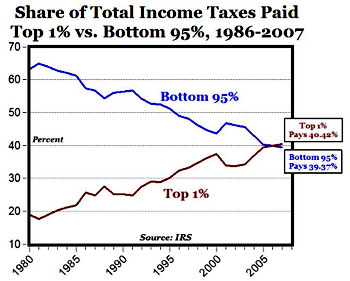

As the chart below shows (data here), the top 1 percent of taxpayers paid 40.42 percent of all income taxes collected in 2007 ($451 billion), the highest share in modern history for that group….One could even argue that the Bush tax cuts of 2001 and 2003 were actually huge “tax cuts for the poor and middle class” because they helped to increase the number of “non-payers” by more than 14 million Americans between 2000 and 2007. Secondly, the tax burden on “the rich” — the top 1 percent of taxpayers — reached a record high in 2007 of more than 40 percent, and was higher after the Bush tax cuts than before.

It’s true that the share of income tax paid by the rich went up between 1980 and today. But that’s because the share of income earned by the rich went up during that period. In fact, it more than doubled. And since income taxes are a percentage of income, you’d pretty much expect that if your share of income more than doubled, then your share of income tax would also more than double.

But for the top 1% it didn’t. It just doubled. In other words, it went up a little bit more slowly than their actual increase in income. Why? Because tax rates on the rich have decreased steadily under Republican presidents since 1980.

Griping about taxes is every American’s birthright. But if your share of the income pie increases by 135% over thirty years while everyone else stagnates, you’re a pretty lucky ducky. Surely the least you can do is not complain that your share of the tax bill went up by only 100%?