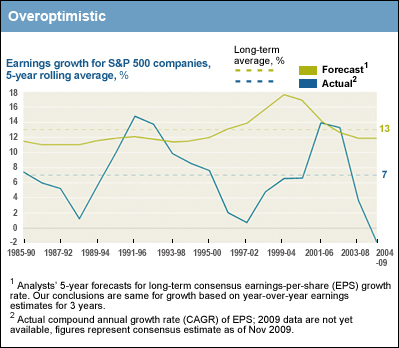

Via Paul Kedrosky, here’s a McKinsey chart comparing projections of corporate earnings by Wall Street analyst with the actual results. As you can see, the analysts relentlessly overestimate earnings.

Via Paul Kedrosky, here’s a McKinsey chart comparing projections of corporate earnings by Wall Street analyst with the actual results. As you can see, the analysts relentlessly overestimate earnings.

Actually, what I find most interesting about this chart isn’t the overestimation — though that’s fascinating — but the remarkable steadiness of their earnings projections. For 25 years, with the exception of a few years starting in the late 90s, through good times and bad, consensus earnings for the S&P 500 have been right around 12-13%. No matter what’s going on in the broader economy, Wall Street always thinks earning will be at least 12% or higher. Coincidentally, I’m sure, this is also the direction of error most likely to get their clients to churn stocks.

Anyway, it’s nice work if you can get it. If any Wall Street firm wants to hire me, I’ll be happy to project 13% earnings forever and then make up good stories to justify it. I think I’d be good at it. And my services probably come cheaper than the analysts they’re using now. Any takers?