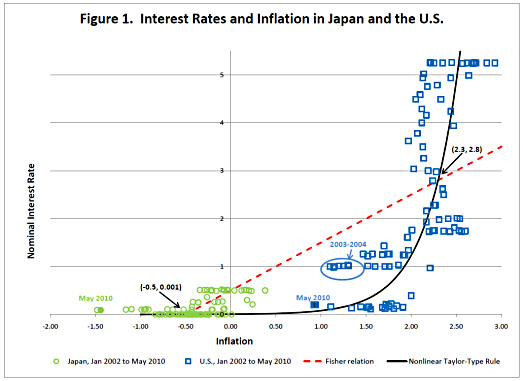

This chart comes from Seven Faces of ?”The Peril,” ?a paper by St. Louis Fed president James Bullard. Bullard has generally been considered an inflation hawk, but in this paper he describes a technical problem with inflation targeting. Most central banks follow something called the Taylor Rule, in which interest rates are raised when inflation gets too high and lowered when things cool off. But Bullard notes that a standard model of the Taylor Rule has two points where it’s in equilibrium — in the chart below it’s where the red line meets the black curve. The one on the right is fine: it corresponds to an interest rate of about 2.8% and inflation of 2.3%. This is roughly where the U.S. has been until recently. But the one on the left is trouble: it corresponds to an interest rate of zero and deflation of about -.5%. This is where Japan has been.

Bullard’s conclusion is simple and direct:

The U.S. economy is susceptible to negative shocks which may dampen infl?ation expectations. This could possibly push the economy into an unintended, low nominal interest rate steady state [i.e., deflation]. Escape from such an outcome is problematic. Of course, we can hope that we do not encounter such shocks, and that further recovery turns out to be robust? but hope is not a strategy. The U.S. is closer to a Japanese-style outcome today than at any time in recent history.

….To avoid this outcome for the U.S., policymakers can react differently to negative shocks going forward. Under current policy in the U.S., the reaction to a negative shock is perceived to be a promise to [keep interest rates] low for longer, which may be counterproductive because it may encourage a permanent, low nominal interest rate outcome. A better policy response to a negative shock is to expand the quantitative easing program through the purchase of Treasury securities.

The problem we have right now is that if you grind through the usual arithmetic of the Taylor rule, what pops out of the formula is a negative interest rate. But interest rates can’t be negative. So for all practical purposes, monetary policy right now is quite tight even with interest rates at zero. What Bullard suggests is that if the economy suffers any further shocks, the Fed needs to respond even though it can’t lower interest rates any further. And the way to do that is to fire up the printing presses.