Everyone’s favorite method for “fixing” Social Security seems to be increasing the retirement age to 70. Can anyone explain why this has become such an article of faith?

Everyone’s favorite method for “fixing” Social Security seems to be increasing the retirement age to 70. Can anyone explain why this has become such an article of faith?

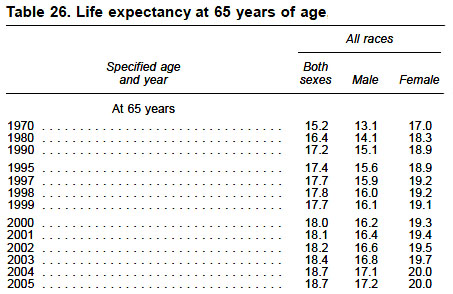

On the right, courtesy of the Department of Health and Human Services, is a chart showing the average life expectancy of Americans at age 65. In 1970 it stood at 15.2. Since the Social Security retirement age was also 65, this means the average number of years you could expect to receive benefits after retiring was 15.2 years.

By 2005 life expectancy had gone up to 18.7 years. But full retirement age had already been increased to 67 (that happened in 1983), so in order to keep the expected years of benefits constant at 15.2 years you’d only need to increase retirement age by another year and a half, to 68.5.

Now, I’m not in favor of that. Regardless of life expectancy, I think 67 is plenty old enough to retire. If a reasonable compromise package of reforms came along that included, say, a one-year increase in the retirement age to 68, I might reluctantly go along.

But where does the preoccupation with age 70 come from? That would represent a decrease in the expected number of years of retirement since 1970, during a period in which the United States has become nearly twice as wealthy. That doesn’t even begin to make sense. Sure, life expectancy may increase in the future, but if it does then we have the option of increasing the retirement age when it happens. For now, we should make policy based on current reality, and the current reality is that life expectancy at age 65 has increased only 3.5 years since 1970. There’s no reason the retirement age should increase five years in response.