The Wall Street Journal reports:

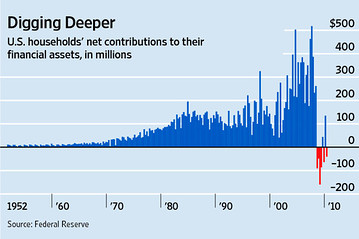

Over the two years ending September 2010, Americans withdrew a net $311 billion — or about 1.4% of their disposable income — from their savings and investment accounts, according to the Federal Reserve. That’s a sharp divergence from the previous 57 years, during which they never made a net quarterly withdrawal. Rather, they added an average of 12% of disposable income to their holdings of financial assets — including bank accounts, money-market funds, stocks, bonds and other investments — each year.

There were no net withdrawals during the 2001 recession. Nor the 1991 recession or the 1981 recession. Nor during the oil shock recessions of the 70s. Not during any recessions until now. It’s just another way in which the the 2008-09 recession has been the most damaging to household finances since World War II.