What’s holding back a stronger economic recovery? For the millionth time: it’s not regulatory uncertainty or lack of financing or inability to find good workers or fear of healthcare reform. It’s lack of  customers. Mike Konczal points us to the conclusions of Atif Mian and Amir Sufi of the Federal Reserve Bank of San Francisco:

customers. Mike Konczal points us to the conclusions of Atif Mian and Amir Sufi of the Federal Reserve Bank of San Francisco:

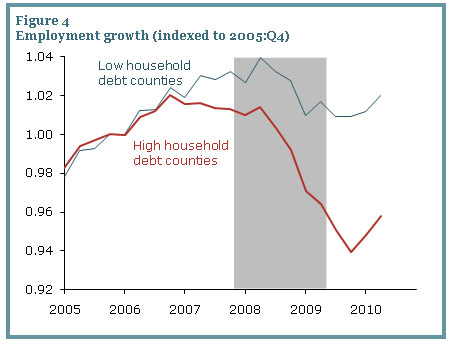

Overall, the county evidence strongly suggests that credit demand is weak because of an overleveraged household sector. This view is supported by survey evidence that the main worry of businesses is sales, not financing. The October 2010 National Federation of Independent Business survey (Dunkelberg and Wade 2010) shows that almost no small businesses viewed credit availability as their primary problem. In fact, the NFIB has reported that weak sales were the top problem facing small businesses throughout the recession. Weak consumer demand also helps explain the enormous cash balances currently held by U.S. corporations (see Lahart 2010). These results have important policy implications. If the main problems facing businesses relate to depressed consumer demand due to a household sector weighed down by debt, investment tax subsidies and lower interest rates may have a limited effect on business investment and employment growth.

An effective regime for foreclosure relief would have done wonders for economic recovery, but it would have hurt the interests of the financial sector, which fought furiously to kill it in early 2009. And they won. Not because they were right, but because they had the raw muscle to get their way and middle-class homeowners didn’t. That was good for banks, not so good for the rest of us.

Any explanation of the financial crisis and its aftermath that relies exclusively on economic analysis, without taking full account of the raw political power behind the economics, is doomed to failure. Economists would do well to rediscover this simple and timeless truism.