What’s the effect of rising energy prices on the economy? Stuart Staniford looks at historical data and says that before 1970 the answer is: nothing. There’s no effect at all. But since 1970,  the effect is profound: every single recession since then has been preceded by a runup in energy prices.

the effect is profound: every single recession since then has been preceded by a runup in energy prices.

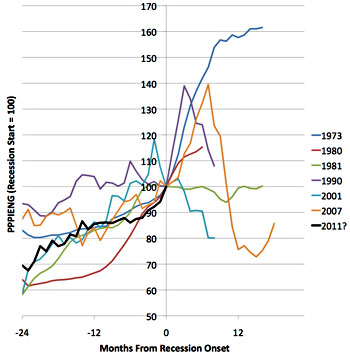

And what does that runup look like? Well, it looks an awful lot like the runup we’ve exprienced over the past 24 months. That’s the heavy black line in the chart on the right. Does that mean we’re inevitably headed for another recession? Nope. But since I was being economically optimistic yesterday, I’m going to revert to my true nature today and be economically pessimistic. “I doubt energy prices can go a whole lot higher without triggering another recession,” says Stuart, “so it depends on whether the world can scrape up a few more mbd of oil to keep growth going without prices rising too much more.” Or, alternatively, perhaps a mild slowdown will cool off energy prices without triggering anything more serious.

Still, this is worth watching carefully. There are half a dozen economic shocks that could tip a fragile recovery back into recession, and for my money, an oil shock is the most likely of them.