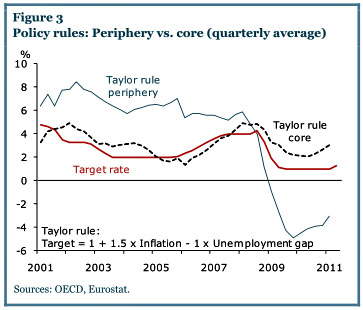

Via Ryan Avent, Fernanda Nechio of the San Francisco Fed has produced a chart that demonstrates Europe’s monetary problems in a nutshell. It shows the interest rate  target of the European Central Bank (red line) compared to the rate suggested by a simple application of the Taylor rule. But instead of looking at the euro area as a whole, he breaks it into a set of core countries (Germany, France, and a few others) and peripheral countries (Portugal, Ireland, Greece, and Spain).

target of the European Central Bank (red line) compared to the rate suggested by a simple application of the Taylor rule. But instead of looking at the euro area as a whole, he breaks it into a set of core countries (Germany, France, and a few others) and peripheral countries (Portugal, Ireland, Greece, and Spain).

This makes Europe’s problem clear: it’s a lousy currency area. Between 2001 and 2006, ECB policy was OK for the core economies but way too permissive for the peripheral economies, which eventually spiraled out of control. Then, ever since 2009, ECB policy has been far too restrictive for the periphery. Roughly speaking, the ECB has run monetary policy all along so that it’s fairly reasonable for the big, central economies of Germany and France but monstrously inappropriate for the smaller economies on the periphery. The result has been catastrophic.

There’s a bit of evidence — take it with a grain of salt — that the ECB is perfectly happy with this state of affairs and hopes to use the current crisis to force closer fiscal union on the euro area’s governments. But given the ECB’s obvious bias in favor of Europe’s core economies, Ryan says, “If the ECB is unsuccessful in winning such progress from core governments, however, we shouldn’t be surprised if peripheral economies find euro-zone policy intolerable and — eventually — drop out of the system entirely.” We’ll see.