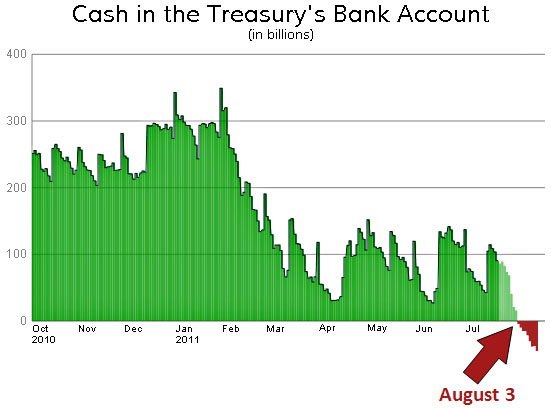

This is from Chris Wilson of Slate, and it shows the cash position of the U.S. Treasury over the past year. Long story short, Treasury periodically sells some bonds to raise cash and its cash position goes up. Then it spends that money, sells some more bonds, etc. But starting on May 16, when we reached the debt ceiling and Congress did nothing about it, no more bonds could be sold. For the past couple of months Treasury has been playing games to stay in business, mostly by raiding other accounts or suspending payment of securities that could be held off temporarily. But that’s done, and now we’re headed inexorably to zero. On August 3rd we go into the red and we stop paying a whole lot of bills.

Which bills? Well, the tea partiers never say. But if you’re expecting a check from the U.S. government after next Tuesday, you might want to make a contingency plan.