President Obama has proposed that we enact some version of the “Buffett Rule,” which would ensure that millionaires pay at least the same tax rate as middle class workers. But do millionaires really pay lower rates than truck drivers in the first place? The AP fact checks Obama’s claim and finds it wanting:

On average, the wealthiest people in America pay a lot more taxes than the middle class or the poor, according to private and government data….This year, households making more than $1 million will pay an average of 29.1 percent of their income in federal taxes….In 2009, taxpayers who made $1 million or more paid on average 24.4 percent of their income in federal income taxes, according to the IRS.

Hmmm. There’s an awful lot of averages there. But you need to be pretty careful with that stuff. The average household income in Redmond, Washington, is $66,000, but that doesn’t mean Bill Gates is pinching pennies to save up a down payment for his next car.

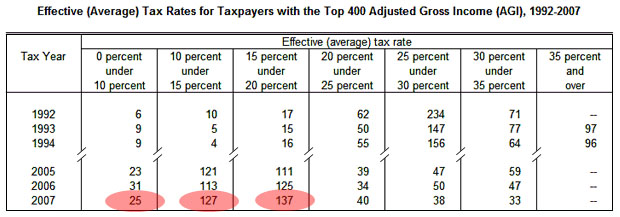

The whole piece is pretty ridiculous. Obama’s point isn’t that millionaires pay lower tax rates than truck drivers. It’s that some millionaires pay lower tax rates than truck drivers — and as a simple matter of fairness and equity they shouldn’t. Take a look at the table below, extracted from the Tax Policy Center. It doesn’t just show the tax rates of mere millionaires, it shows the tax rates of the top 400 super-duper millionaires. Back in 1992, only 33 of them paid less than 20% of their income in federal taxes. Today, 289 of them do. That’s just not right.

On Fox News, they brush this off with a yawn. “It’s because most of their income comes from capital gains,” they repeat tirelessly, as if that was sufficient explanation all by itself. But why? Surely even trust fund babies ought to pay some kind of minimum tax rate no matter where their income comes from. Is a 20% tax floor on the income of the rich really so outrageous?