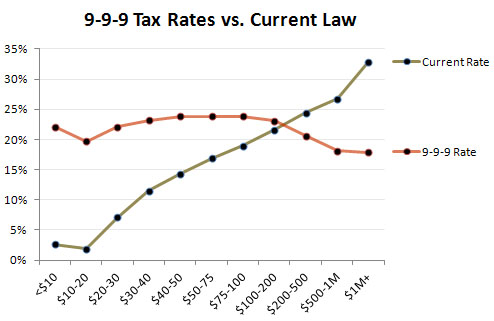

The Tax Policy Center has done yet another analysis of Herman Cain’s 9-9-9 plan, and guess what? Unless you’re really rich, your taxes will go up! If you earn, say, $50,000 per year, you currently pay about 14.3% of your income in federal taxes. Under Cain’s plan, you’ll pay 23.8%. Whee!

And if you make the big bucks? Well, millionaires currently pay about 32.9% of their income in federal taxes. Under Cain’s plan, they’ll pay 17.9%. Ka-ching!

I actually think the TPC analysis is probably kinder to Cain’s plan than it should be. But in any case, this is certainly the minimum damage that middle-class families can expect to see. So what do you think Cain’s response will be when he gets asked about this tonight? I’m putting my money on “They’re wrong.” Other possibilities are “It’s just a proposal, we can always tweak it,” and “I was just joking.”

UPDATE: Yep, Cain’s answer was “They’re wrong,” almost verbatim. Plus some more nonsense about apples and oranges.