Suzy Khimm notes today that student loan delinquency rates are continuing to rise:

Suzy Khimm notes today that student loan delinquency rates are continuing to rise:

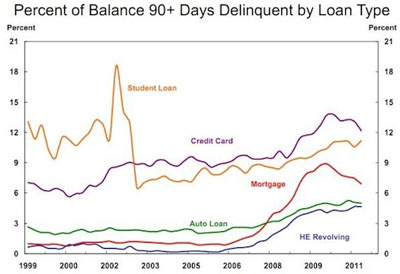

As USA Today notes, outstanding student loans have now hit a record high of more than $1 trillion, and “Americans now owe more on student loans than on credit cards,” according to the new data. Since the peak of the crisis in 2009, they’ve become increasingly able to pay off their credit cards and mortgages. But the student loan debt crisis has continued mostly unabated.

There’s something a little odd here, though. The big spike in 2002 is almost certainly an artifact, possibly due to a change in the interest rate structure of student loans that was scheduled to take effect in 2003 but then repealed in 2002. So ignore that. But take a look at a couple of other things:

- Even now, the 90-day delinquency rate is lower than it was during the boom years of the late 90s.

- The other categories of loans all started showing suddenly higher delinquency rates starting in 2007-08, a sign of financial distress. But ever since the 2002-03 spike, student loan delinquency rates (as well as default rates) have been rising steadily. Whatever’s happening, it’s not really due to the recession. Just eyeballing the numbers, it doesn’t look like the growth in delinquency rates changed at all after 2008. It just kept growing at its usual rate.

So what’s going on? Well, credit card delinquencies are probably declining because banks have cut off a lot of credit. Mortgage delinquencies are probably falling because homes are being foreclosed. HELOCs and auto loan delinquencies haven’t fallen at all, just like student loans.

I’d like to see the cost of college remain reasonable, especially the cost of public universities, and I think the growth in student loan debt is probably a bad thing overall. I want to motivate more kids to go to college, not put in place incentives not to. Still, the delinquency problem for student loans doesn’t really appear any worse than for any other kind of loan, and compared to the 90s it’s actually better. It’s possible that the 2002-03 spike has misled us by artificially pushing delinquency rates temporarily below their natural level. If it weren’t for that, student loan delinquency rates might have looked pretty flat over the past decade. More analysis, please.