Both Paul Krugman and Tyler Cowen recommend a new paper from Hyun Song Shin called “Global Banking Glut and Loan Risk Premium.” If both of those guys say a paper is important, then it’s probably pretty important. So I took a look. I’ll confess up front that I had a hard time plowing through it, which means my summary might be off base a bit here and there, but here we go anyway. Roughly speaking, Shin says the following things:

- Credit expands when banks lever up their balance sheets by piling up lots of debt.

- Thanks to Basel II, European banks levered up even more than U.S. banks.

- Some of this was intra-European debt, but lots of it was U.S. debt denominated in dollars. In

total, European banks had about $5 trillion in claims on U.S. counterparties in the peak year of 2007, much of it via purchase of private label subprime securitizations.

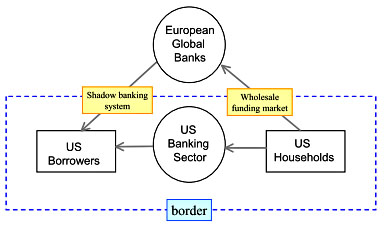

total, European banks had about $5 trillion in claims on U.S. counterparties in the peak year of 2007, much of it via purchase of private label subprime securitizations. - In other words, the European segment of the shadow banking system was indirectly providing about $5 trillion in credit to U.S. borrowers. This was about as much as U.S. banks provided directly.

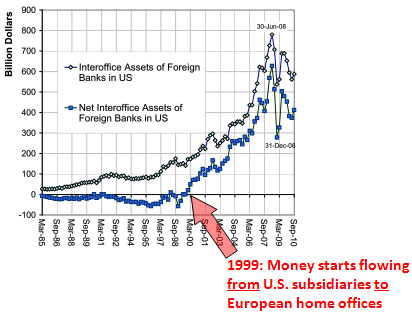

- The mechanism for this indirect flow was simple. Starting in 1999, U.S. money began flowing in large quantities to the U.S. subsidiaries of European banks, then across the Atlantic to their home offices in Europe, and from there back to borrowers in the U.S.

-

Conclusion: the

European banking sector provides about as much credit to the U.S. as the American banking sector does. So when the European banking sector deleverages, as it must, it will have a very substantial effect on credit conditions in the U.S. In Shin’s bland phrasing, “The European crisis carries the hallmarks of a classic ‘twin crisis’ that combines a banking crisis with an asset market decline that ampli?es banking distress….The global ?ow of funds perspective suggests that the European crisis of 2011 and the associated deleveraging of the European global banks will have far reaching implications not only for the eurozone, but also for credit supply conditions in the United States and capital ?ows to the emerging economies.”

European banking sector provides about as much credit to the U.S. as the American banking sector does. So when the European banking sector deleverages, as it must, it will have a very substantial effect on credit conditions in the U.S. In Shin’s bland phrasing, “The European crisis carries the hallmarks of a classic ‘twin crisis’ that combines a banking crisis with an asset market decline that ampli?es banking distress….The global ?ow of funds perspective suggests that the European crisis of 2011 and the associated deleveraging of the European global banks will have far reaching implications not only for the eurozone, but also for credit supply conditions in the United States and capital ?ows to the emerging economies.”

Translated, this means that as sovereign debt woes get worse, bank woes get worse too. And as bank woes get worse, sovereign debt woes get worse. The result is a vicious circle that produces a big credit contraction, and since European banks have become so important as funding sources to the U.S., it means a big credit contraction in the U.S as well.

Tyler’s comment: “If true we are doomed.” On a separate note, Shin also points out that after the euro was introduced in 2000, cross-border claims within Europe skyrocketed. Unfortunately, banks themselves mostly stayed pretty local:

The introduction of the euro meant that “money” (i.e. bank liabilities) was free-?owing across borders in the eurozone, but the asset side remained stubbornly local and immobile. It is this contrast between the free-?owing liabilities but localized assets of European banks’ balance sheets that has been a key contributing factor in the European crisis.

In other words, wholesale funding flowed easily to wherever it would get the best return, but banks mostly kept their loan books local. This produced big property bubbles in Ireland and Spain and big current account imbalances across the entire continent. There’s no easy way for this to unwind, and unfortunately, even the moderately difficult ways appear to be out of bounds to the eurozone’s policymakers. If we really are doomed, it’s partly because of bad policymaking during the aughts, but it’s also because of disastrous policymaking right now. I wish I thought that Shin was wrong about this, but I suspect he’s not.