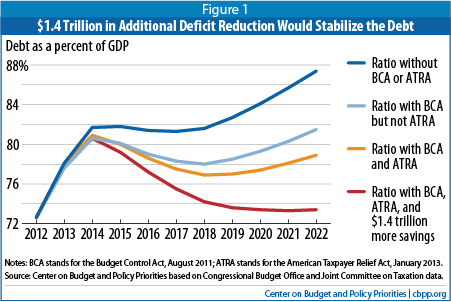

The Center on Budget and Policy Priorities has taken a look at projected future deficits and concludes that we need an additional $1.4 trillion in savings in order to  stabilize the debt/GDP ratio at 73 percent by 2022. The chart on the right tells the story.

stabilize the debt/GDP ratio at 73 percent by 2022. The chart on the right tells the story.

What’s really so striking about this is what they say after diving a little further into the numbers. If we split this equally between spending cuts and tax increases, we need about $600 billion of each. (The rest comes from interest savings.) That’s $60 billion per year. Or, if we did things rationally, it would come to zero dollars this year, increasing to perhaps $100 billion in 2022. For all the hue and cry from both sides, this is really not a huge amount of money. And if we did it, it would amount to total deficit reduction of nearly $4 trillion over the past couple of years.

This isn’t necessarily what I’d do if I were your benevolent overlord. But it’s hardly the end of the world as a baseline plan for now. After all, we can always change it in a few years if we don’t like how things are turning out.