Austin Frakt draws my attention today to a new article about the administrative costs of Medicare. Exciting stuff! Long story short, Kip Sullivan of the Minnesota chapter of Physicians for a National Health Program wants everyone to understand just what’s involved in figuring out the true administrative costs of Medicare. The cost of collecting payroll taxes is one frequently overlooked element, for example. More interestingly, though, there’s a large and growing gap between the overhead calculations of the Medicare Trustees and those of the National Health Expenditure Accounts. Why is that?

According to Sullivan, the Treasury’s calculation of administrative costs does not include those incurred by Medicare Advantage and private, Part D (drug) plans….The trustees’ and NHEA measures were fairly close until the 1980s. Then they diverged as enrollment grew in Medicare Advantage and its predecessor programs. In 2006, Part D drug plans became available and the two types of administrative costs diverged further still. As traditional Medicare’s administrative costs went down, those of private plans grew.

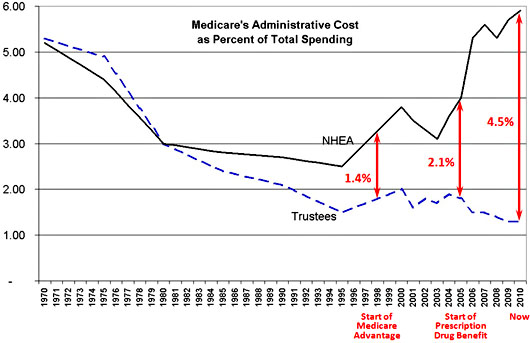

The chart below shows what happened. When Medicare was run traditionally, overhead was fairly low and getting lower (dashed blue line). Then private plans were introduced and total overhead costs started to flatten (black line). By 1997, total overhead was about 1.4 percentage points higher than traditional Medicare alone. In that year, Medicare Advantage was introduced, and by 2005 the gap had widened to 2.1 percentage points. Then privately run prescription drug plans were introduced, and now the gap is 4.5 percentage points.

In the case of prescription drugs, it’s possible that higher overhead is justified by the lower overall program costs we get from having a lot of competing plans. In the case of Medicare Advantage, it’s just pure waste. We have higher overhead and higher overall costs, with very little benefit to show for it. As Sullivan says, this should “long ago have triggered inquiries within Congress and the US health policy community as to whether the higher administrative costs associated with the growing privatization of Medicare are justified.”