McDonald’s is getting a lot of flak for producing a “Practical Money Skills” budget journal in association with Visa. But this mockery is seriously misplaced. Let’s review the tape:

- Producing a simple monthly planning guide for low-income families is a good thing to do. Lots of low-income families have essentially no planning skills at all and need something extremely basic to help them out. If you think the McDonald’s brochure is so simplistic as to be “condescending,” you really, really need to get out more.

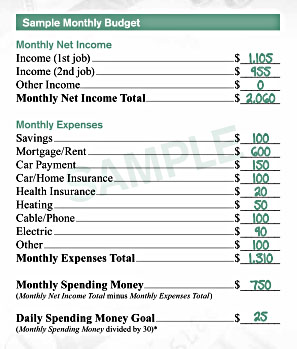

- The basic advice in the guide is this: Figure out your monthly take-home pay. Then list all your monthly expenses and subtract them from your income. Take what’s left over and divide by 30. This is how much you have for daily expenses like food, clothing, entertainment, etc. Then use their spending journal to keep track of your actual daily expenses so you can see where your money is going. This is a perfectly sensible approach.

The sample budget on the right has come in for the bulk of the criticism, but it doesn’t deserve it. The fact that it has spaces for two incomes doesn’t mean they assume you’re working 80 hours a week. It means they’re using an example in which two people in the family have jobs.

The sample budget on the right has come in for the bulk of the criticism, but it doesn’t deserve it. The fact that it has spaces for two incomes doesn’t mean they assume you’re working 80 hours a week. It means they’re using an example in which two people in the family have jobs.- The dollar amounts in the sample budget are generally fairly reasonable. Tim Lee has a rundown here of which ones make sense and which ones don’t. (Nickel summary: Childcare is notably missing, and the health insurance figure is laughably low.)

- But you know what? Lots of people live on an income of $25,000. According to the census, this is the income of roughly a fifth of American families. And since this guide is aimed at low-income families, it makes sense to use sample figures that add up to $25,000. I mean, what should they have done? Assumed that everyone makes $50,000? Assumed that no one making $25,000 should receive realistic financial planning advice? Or what?

- What’s more, the family in the example probably qualifies for both SNAP and EITC. That would increase their monthly income by a few hundred dollars.

I get that people think McDonald’s is trying to put a happy face on the minimum wage jobs they offer. Maybe they are. But good advice is good advice no matter where it comes from, and the McDonald’s guide offers an extremely conventional collection of good financial advice, the same kind offered by nonprofits everywhere. There’s no reason to rake them over the coals for providing it.

In the meantime, if we want McDonald’s workers to make more money, we need to keep fighting for a higher minimum wage, a more generous EITC, and better national healthcare. Practically speaking, that’s the most likely path toward improving the lives of the working poor.