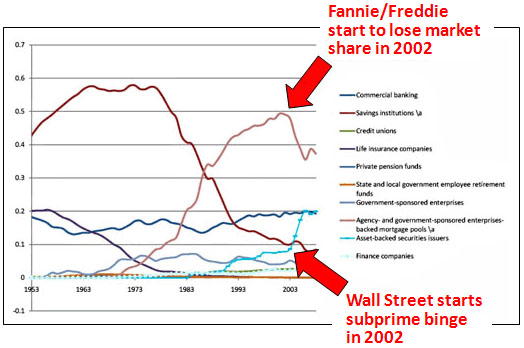

Conservatives have been arguing for years that Fannie Mae and Freddie Mac were the real culprits behind the housing bubble. Unfortunately, their case has always been one that a five-year-old could see through. The data makes it plain that Fannie and Freddie didn’t lead the charge into risky mortgage loan securitization. The private sector did. In 2002, just when the housing bubble was starting to heat up, Fannie’s market share plummeted  while the market share of the private sector shot up. That continued for several years until finally, around 2005, Fannie and Freddie got back in.

while the market share of the private sector shot up. That continued for several years until finally, around 2005, Fannie and Freddie got back in.

That was a big error. Still, it’s pretty obvious that unless Fannie and Freddie had access to a time machine, it was the private sector the drove things along in the first place. The conservative argument doesn’t survive even the barest scrutiny.

But wait! That just means conservatives need a more sophisticated argument. And who better to play the role of water carrier than Alan Greenspan? In his latest book, The Map and the Territory, he admits that a housing bubble probably would have developed even without Fannie and Freddie. However, by buying up subprime securitizations, Fannie and Freddie encouraged the private sector to produce ever more of them, and that in turn made bank balance sheets too highly leveraged to withstand the crash.

This is unquestionably more sophisticated than the original argument. But not by much. The problem is that although Fannie and Freddie might indeed have prompted the creation of excess mortgage securitization, they also sopped up a tremendous amount of it, thus removing it from the private banking system and making their balance sheets stronger. Brad DeLong illustrates this using a few simple charts, and concludes:

Thus Fannie Mae’s intervention (a) fueled the housing bubble but (b) did not cause the financial crisis–rather, it (c) reduced the chances of financial crisis by diminishing the exposure of undercapitalized private-sector banks to subprime risk.

This isn’t rocket science: this is supply and demand.

Greenspan, after his brief road-to-Damascus moment in 2008, has been busy ever since figuring out ways to continue believing everything he believed in the first place. This is a typical example: If it weren’t for the government, he says, the private sector would have managed things just fine after all. The free market is never wrong.

But it ain’t so. Fannie and Freddie may have added fuel to the fire, but the financial crisis was first and foremost a problem with private financial markets, which knew precisely the value of maintaining astronomical leverage ratios. What the government did wrong—and this very much includes Alan Greenspan, who was keenly aware of the problem of high leverage but did nothing to rein it in—was to regulate the financial system so lightly that it could get away with operating on razor-thin capital levels for years.

Greenspan has claimed for several years that he’s finally gotten the message on this. Last night on Jon Stewart’s show, he endorsed the idea of doubling capital requirements to 20 percent or more. Somehow, though, he’s still never managed to accept any of the blame for ignoring this during the time when he actually had the influence to do something about it.

POSTSCRIPT: More generally, it’s remarkable how bipartisan the belief in very high capital requirements is these days. And yet, somehow, there’s zero chance of ever implementing them. Funny that.