It’s fairly easy to examine tax returns and figure out the share of personal income taxes paid by various groups. But what about the corporate income tax. Who pays that?

One way or another, people ultimately end up paying corporate taxes. Corporate shareholders pay much of it in the form of lower profits and dividends, but not all. So who else? Bruce Bartlett summarizes some new reasearch on this:

Companies may try to raise prices to compensate for the corporate income tax, thus shifting some of the burden onto consumers.

Most economists don’t believe that much, if any, of the corporate tax is shifted onto consumers this way, because corporations face competition from noncorporate businesses, such as sole proprietorships and partnerships, and from businesses based in countries with higher or lower corporate taxes. Competition sets prices for goods and services without regard to the corporate tax rate.

While economists still believe that the bulk of corporate income taxes is paid by the owners of capital, in recent years they have come to believe that workers ultimately pay much of the tax in the form of lower wages. This results from lower capital investment due to a higher cost of capital, which reduces productivity and hence wages, and because capital investment moves to other countries where corporate income taxes are lower.

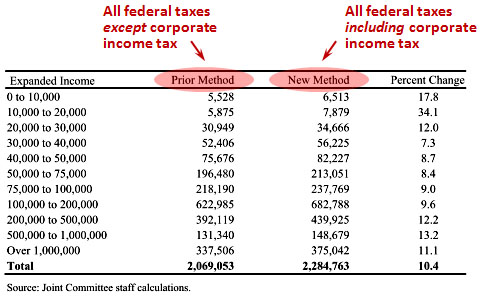

So when you take all this into account, what’s the distribution of corporate income taxes? The Joint Committee on Taxation took a crack at estimating this and came up with the following table:

The numbers in this table represent the total amount of taxes paid by various income groups, in millions. The lowest income group, for example, pays an aggregate of $5.5 billion if you don’t count corporate taxes, and $6.5 billion if you do. Thus, corporate taxes increase their federal tax burden by 17.8 percent. Other groups see similar kinds of increases.

Bartlett suggests that this might make a bipartisan deal on corporate taxes more likely. “Politically, it is now easier to show that a cut in the corporate tax rate will have benefits that are broadly shared.” That might be true if these estimates are confirmed by other groups. But it would still depend a lot on what kind of tax replaced the lost revenue.