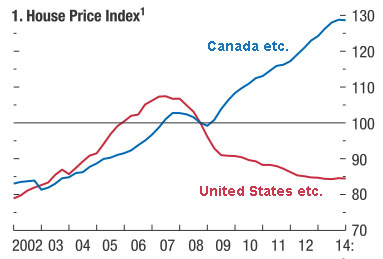

Nick Timiraos points to an interesting IMF chart today. It breaks the world into two sorts of countries. The first, which includes the US, UK, Spain, and others, saw a big housing bubble during the aughts and a big housing bust during the Great Recession. The second, which includes  Canada, Germany, and others, had only a modest runup in housing prices during the aughts and a correspondingly small decline during the Great Recession.

Canada, Germany, and others, had only a modest runup in housing prices during the aughts and a correspondingly small decline during the Great Recession.

So what’s happening now? Well, countries that already had a housing bubble continue to struggle. Housing prices today are more than 20 percent below their 2007 peak. And the other countries? Well, they’re having their own housing bubble now, with prices nearly 30 percent higher than their previous peak.

Is this a problem? Maybe. With the exception of China, the IMF reckons that housing prices in the rebounding economies are still only modestly overvalued. Still, it sure looks as though there was a big pot of money chasing returns in one set of countries in the aughts, contributing significantly to the housing bubble. Now, with those countries no longer looking very attractive, the pot of money has moved on. More sensible controls on mortgages are supposedly what saved these other countries from the mid-aughts bubble, but I wonder if that’s enough now that lots of money is apparently sloshing its way in their direction? Stay tuned.