Federal Reserve Vice Chairman Stanley Fischer comments on inflation and monetary policy:

The Federal Reserve’s No. 2 official said there is “good reason” to think sluggish U.S. inflation will firm and move back toward the U.S. central bank’s 2% annual target, touching on a significant assessment facing the Fed ahead of its September policy meeting.

….When the time comes to raise rates, Mr. Fischer said, “we will most likely need to proceed cautiously” and with inflation low, “we can probably remove accommodation at a gradual pace. Yet, because monetary policy influences real activity with a substantial lag, we should not wait until inflation is back to 2% to begin tightening.”

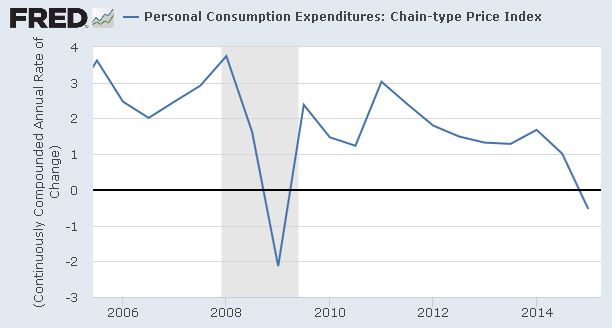

A lot of people think the big problem with Fischer’s statement is the first bolded sentence. There’s been “good reason” to think inflation will increase for a long time. And yet it hasn’t. Why are we supposed to believe that this year’s good reason is any better than previous ones?

That’s fair enough. But I think the real problem is in the second bolded sentence: Fischer is intent on tightening monetary policy well before inflation shows any sign of hitting 2 percent. This illustrates a serious asymmetry in the Fed’s decisionmaking. If inflation goes below the 2 percent target, they’re willing to wait things out. But if it shows even the slightest sign of maybe, someday going a few basis points above the 2 percent target, then it’s time to tighten. The net result of this is that inflation won’t average 2 percent. It will swing between 1 and 2 percent, maybe averaging 1.5 percent or so.

That’s a bad thing, and it’s especially bad if, like me, you think our inflation target should be more like 3-4 percent anyway. But that’s the way it is.