Jeb Bush said a peculiar thing last night:

What we ought to do is raise the capital requirements so banks aren’t too big to fail. Dodd-Frank has actually done the opposite, totally the opposite, where banks now have higher concentration of risk in assets and the capital requirements aren’t high enough. If we were serious about it, we would raise the capital requirements and lessen the load on the community banks and other financial institutions.

The is peculiar for two reasons. First, it’s unlikely that most viewers had the slightest idea what he was talking about. Second, he has things exactly backward. In fact, Dodd-Frank mandates higher and safer capital levels, and it does so largely because of a Republican amendment to the act.

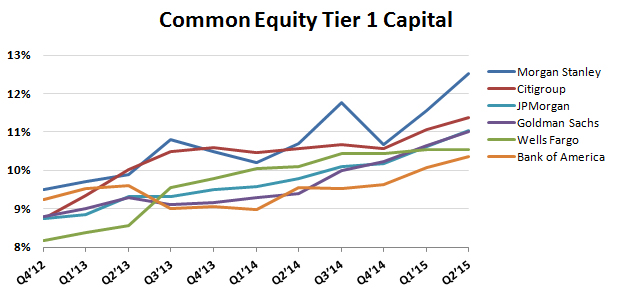

Basically, Dodd-Frank instructed the Fed to issue new capital rules, which it did in 2013. These rules took into account both the new Basel III requirements as well as Dodd-Frank’s changes, and specifically mandated higher capital requirements for big banks than for smaller community banks. In 2015, the Fed went even further, creating capital surcharges for the nation’s largest banks. Here’s the result:

Not all of this increase in capital is a consequence of Dodd-Frank, but much of it is. And certainly it’s completely untrue that Dodd-Frank has done “totally the opposite.” I wonder what Bush was thinking? This is hardly a big conservative hot button. In fact, most people have never heard of bank capital and have no idea what it means, which means there’s hardly any point in making up stuff about it. And if the only goal was to criticize Dodd-Frank, there are far better ways to do it.

If Bush had wanted to argue that Dodd-Frank didn’t go far enough, and we needed even higher capital requirements for big banks, I would have cheered him on. But that’s not what he said. Very strange.