Who do credit card companies make the most money from? Answer: the poor, by far, because they rack up the highest fees and the highest interest expense. Card issuers also make some money on the rich, because they buy a lot of stuff. This generates interchange fees (usually 2-3 percent of the amount charged) that exceed the cost the reward points they dole out to attract these customers.

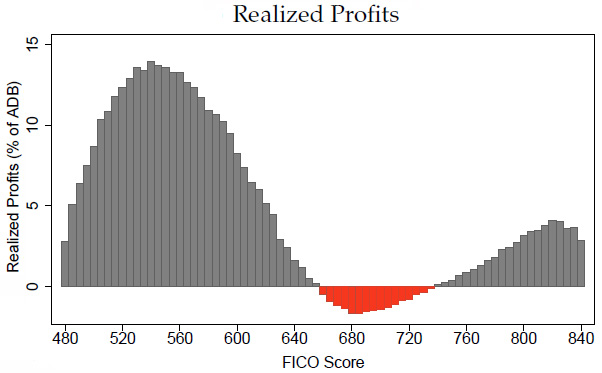

It’s the customers in the middle who cost them. They don’t buy enough stuff to generate lots interchange fees, but they aren’t poor enough to get themselves stuck with lots of late fees and interest charges. The chart below shows this. Folks with FICO scores between 660 and 730 (representing about a third of all customers) are net losses for credit card companies.

This comes from a paper written last year about the effect of the CARD Act, a law passed in 2009 that modestly regulated the credit card industry. The authors’ conclusion: “The CARD Act successfully reduced borrowing costs, in particular for borrowers with the lowest FICO scores. We find no evidence for offsetting increases in other costs or a decline in credit volume.” All in all, the CARD Act saved consumers—mostly lower-income consumers—about $12 billion per year. For much more, see today’s Harold Pollack interview with one of the authors here.