Here is President Obama, in the course of defending his economic performance:

If we can’t puncture some of the mythology around austerity, politics or tax cuts or the mythology that’s been built up around the Reagan revolution, where somehow people genuinely think that he slashed government and slashed the deficit and that the recovery was because of all these massive tax cuts, as opposed to a shift in interest-rate policy — if we can’t describe that effectively, then we’re doomed to keep on making more and more mistakes.

This train has long since left the station, and Republicans are dead set on making sure it never returns. But that doesn’t mean Obama is wrong. He’s not.  Even conservative James Pethokoukis acknowledges this:

Even conservative James Pethokoukis acknowledges this:

A recent Brookings literature review noted that Martin Feldstein and Doug Elmendorf found in a 1989 analysis “that the 1981 tax cuts had virtually no net impact on economic growth.” They find that the strength of the recovery over the 1980s could be ascribed to monetary policy. In particular, they find no evidence that the tax cuts in 1981 stimulated labor supply.

Feldstein was Reagan’s chairman of the CEA, so he’s hardly some liberal shill trying to take down Reagan’s legacy. As I noted a few years ago, there were five main drivers of the 80s boom. In order of importance, they were:

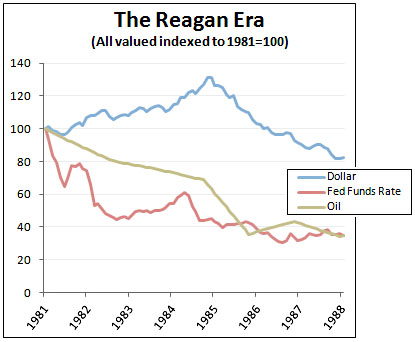

- Paul Volcker easing up on interest rates/monetary aggregates in 1982

- The steep drop in oil prices after 1981

- Reagan’s devaluation of the dollar

- Reagan’s deficit spending

- Reagan’s tax cuts

Conservatives will never admit any of this, but there’s no reason the rest of us have to go along with their fairy tale about Reaganomics. Taxes matter, but they simply don’t matter nearly as much as they claim, and it’s long past time for the mainstream press to acknowledge all this. It’s hardly controversial anywhere outside the Fox News bubble.