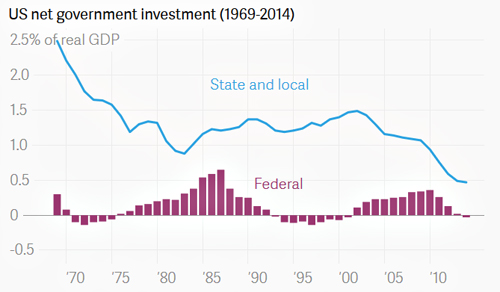

Tim Fernholz says that this chart shocked him:

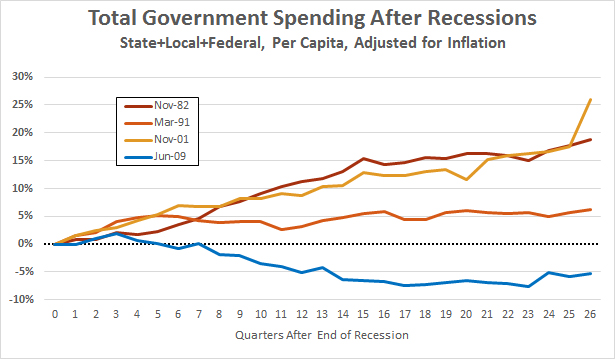

It’s pretty shocking, all right. We’re allowing our infrastructure to crumble because we’d rather keep taxes on millionaires low than spend the money it takes to keep our country in decent shape. But it’s even worse than that. This seems like a good time to update my chart showing total government spending after our four most recent recessions. Here it is:

It’s now 26 quarters since the official end of the Great Recession and total government spending is still below its 2009 level. This is entirely unlike previous recessions, in which we spent our way to recovery. After 26 quarters, Reagan was spending 19 percent more than in November 1982, when his recession ended. Clinton (and the Gingrich congress) were spending 6 percent more. Bush was spending a whopping 26 percent more.

But the Republican Congress has prevented the same thing from happening on Obama’s watch. We’re still spending 5 percent less than we were in June 2009, when the recession ended. Is it any wonder that our recovery has been so weak?