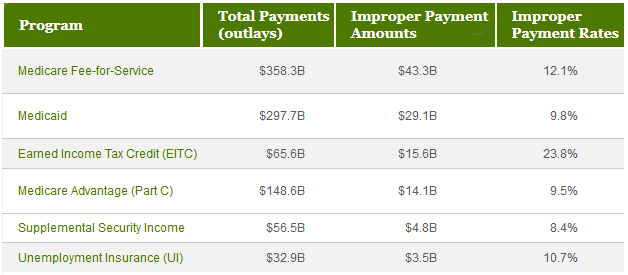

Here’s an interesting thing. I was browsing over at The Corner and came across a post from Veronique de Rugy, who was unhappy about the federal government’s rate of improper payments, which totaled $137 billion last year. That’s fair enough. Here are the six worst programs:

This is the kind of thing that liberals should care about too—in fact, we should care about it more than conservatives if we want people to trust government to handle their tax dollars competently. Still, it got me curious. What exactly does this mean? $137 billion in waste and fraud last year? As it turns out, no. Here’s one interesting methodological tidbit:

Another prevalent misunderstanding is that all improper payments are a loss to the government, but that is not always the case. For example, although most of the $137 billion in improper payments was caused by overpayments (payments that are higher than they should have been), a significant chunk of that total amount was caused by underpayments (payments that are lower than they should have been). The difference between these two amounts (that is, overpayments minus underpayments) equals the net amount of payments that improperly went out the door.

Huh. So if the feds overpay Joe $10 and underpay Jane $10, that counts as $20 in improper payments. This is a reasonable thing to track, since we’d like all the payments to be correct, but it doesn’t give us much insight into how much money we’re losing to improper payments. My guess based on a bit of googling is that underpayments are a smallish part of the whole number, but for some reason there’s no official tally of this. Roughly speaking, though, you can probably shave 10-20 percent off the top and get pretty close.

What else? There’s this:

Also, many of the overpayments are payments that may have been proper, but were labeled improper due to a lack of documentation confirming payment accuracy. We believe that if agencies had this documentation, it would show that many of these overpayments were actually proper and the amount of improper payments actually lost by the government would be even lower than the estimated net loss discussed above.

An entire payment is labeled improper if complete documentation is not available. This appears to account for somewhere in the neighborhood of 50-60 percent of all improper payments. Most likely, though, once the documentation is in place, the vast majority of these payments turn out to be correct.

Put this all together, and the net value of genuinely improper payments is probably about $50 billion or so. Still high, but not quite as outrageous as it seems at first glance.

Something about this whole exercise seems kind of weird to me, though. We’re only a few months into 2016 and we already have numbers for FY2015. That’s fast work—too fast to be anything but a preliminary cut at flagging payments that might be incorrect. But how many of them really are incorrect? Nobody knows. For that, you’d have to wait a year or two and then re-analyze all the payments in the sample.

I’d be a whole lot more interested in that. $137 billion makes for a fine, scary headline—especially when the headline leaves the vague impression that this is all due to fraud and waste—but why don’t we ever get a follow-up number that tells us how much the feds ended up paying improperly once all the documentation is rounded up and the final audits are done? Wouldn’t that be a better number to care about?