No matter what it does, the Bank of Japan just can’t seem to generate any inflation. The BOJ meets on Friday to decide on its next move, and Prime Minister Shinzo Abe upped the ante yesterday by announcing a large spending increase  prior to the meeting. He hopes to get the BOJ to coordinate more monetary easing with his stimulus package, something that might finally push inflation up.

prior to the meeting. He hopes to get the BOJ to coordinate more monetary easing with his stimulus package, something that might finally push inflation up.

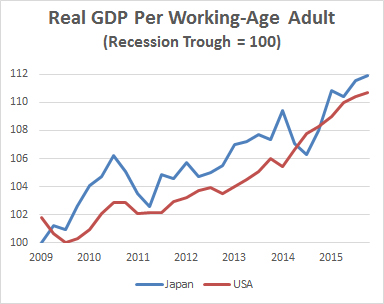

So what’s going on, anyway? Obviously I don’t know, but the whole thing is peculiar because Japan’s economy has actually done reasonably well since the Great Recession. As the chart on the right shows, real GDP per working-age adult has grown about as much as it has in the United States.

Why have I carefully shown GDP growth this way? Because Japan’s population is shrinking: over the past two decades, the number of working-age adults has declined from 86 million to 78 million. This means that GDP will shrink too. But that’s pretty meaningless. Obviously a lower population means a lower GDP. What you want to know is how much economic activity you generate per person.

So if economic growth is OK, why the inflation problem? Perhaps it’s inevitable when a population shrinks and ages. If retired workers are too cautious to increase their spending, then stimulus is working against a huge headwind—and one that gets bigger every year as the population ages even more.

But it’s not as if everyone doesn’t know this already, and even so nobody can figure out quite what Japan needs to do to avoid a deflationary spiral. Maybe helicopter money will be next?