Ryan Cooper suggests that we don’t really know if the Fed can significantly raise inflation:

let’s see a central bank actually try and fail first https://t.co/8fI8wIl5j6

— ryan cooper (@ryanlcooper) September 22, 2016

@ryanlcooper What do you think they should do?

— Kevin Drum (@kdrum) September 22, 2016

@kdrum say “we’re going $100bn in new QE, to double every month until we hit 2% inflation”

— ryan cooper (@ryanlcooper) September 22, 2016

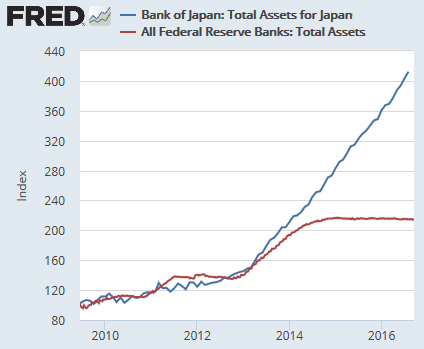

Here’s the thing: this is pretty much what the Bank of Japan has been doing for the past few years. The chart on the right shows QE in Japan compared to the US over the past six years (indexed to 100 at the end of the Great Recession).  The BOJ balance sheet has more than quadrupled since then, and the inflation rate in Japan is….

The BOJ balance sheet has more than quadrupled since then, and the inflation rate in Japan is….

-0.4 percent.

Since this hasn’t worked—and since doubling the Fed’s balance sheet in 2013 has produced declining inflation—it seems likely the Fed would have to increase its balance sheet by, say, 8x, to have any chance of producing substantially higher inflation. In dollars, that means $28 trillion in additional asset purchases. They would run out of treasuries to buy long before they hit that mark and would start gobbling up every corporate and MBS bond in sight. That’s really not a tenable suggestion.

This is all just back-of-the-envelope stuff, not meant to be taken too literally. For one thing, we’re starting off with a higher inflation rate than Japan did. Still, this gives you a rough idea of what the Fed is up against. In theory, they can do endless helicopter drops until they get the inflation they want. In practice, it’s a lot less clear they truly have a plausible path to 3 or 4 percent inflation.