A new paper from a trio of Fed researchers suggests that our recent sluggish growth is mostly a result of demographic changes and technological slowdown. The retired share of the population has increased, which means the working share of the population has decreased. Since workers are the ones who produce goods and services, it makes sense that GDP growth will slow down in an economy with fewer adults of working age. Ditto for an economy in which technological progress is slackening.

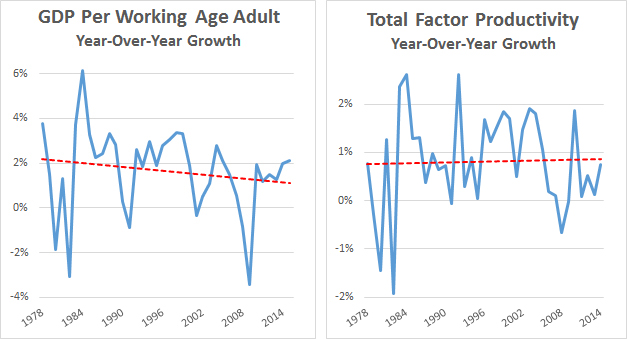

I’ve pointed out the same thing before in the case of Japan, and it makes sense. But how about in the US? The easiest way to see the rough shape of the river is to simply look at GDP per working-age adult. That eliminates most of the demographic issues. When you do this for the US, you get a trendline that still shows a decline in GDP growth: it’s down by about one percentage point since 1978.

You can also look at total factor productivity, which gives us an idea of the effect of technological change that’s independent of demographics. Over the past 60 years, it’s been pretty flat.

Both of these are volatile series, so take them with a grain of salt. That said, productivity hasn’t changed much, but GDP per working-age adult has steadily decreased anyway. This suggests that neither demographics nor technological progress really explains things. So what does?

NOTE: This bit of amateur economics was made possible by a grant from the Committee to Prevent Endless Blogging About Donald Trump. The author thanks them for their generosity.